Societal Responsibility

Human Rights

Commercial Bank’s employment practices reflect the standards enshrined in the Universal Declaration of Human Rights proclaimed by the United Nations, as well as the Conventions of the International Labour Organisation. These include:

- Freedom of association and the right to collective bargaining.

- The elimination of all forms of compulsory labour.

- The effective abolition of child labour.

- The elimination of sexual harassment in the workplace.

- The elimination of discrimination with respect to employment.

The Bank has pledged to uphold the 10 principles of UN Global Compact when formulating policies and procedures. We are committed to safeguarding human rights and to preserving appropriate values and practices in our operations. We follow widely accepted best practices governing aspects of human rights, including minimum working age, working hours, health and safety in the workplace, and collective bargaining principles. The Bank does not condone or support any form of forced or compulsory labour, child labour, discrimination or sexual harassment.

Our Human Resources Department, business line heads, departmental heads and branch managers are all held responsible for upholding human rights at all times. They are expected to be vigilant and report promptly on any breach or violation affecting any dimension of human rights. Moreover, the Bank’s Whistleblower Charter mandates staff members to shed light on potential human rights issues. Any breach or violation is subject to a formal inquiry, which can lead to corrective or disciplinary action as required – including, where warranted, the dismissal of any staff member(s) found guilty of such violations.

Our Inspection Department conducts periodic verifications to ensure that aspects of human rights are being properly handled and managed by the Human Resources Department in line with established policies. When necessary, the Inspection Department determines whether the grievance-handling procedure has been appropriately applied in an unbiased manner, in line with procedures set out in the Bank’s official guidelines.

There were no incidents of human rights violations reported during 2014.

Societal Responsibility

For Commercial Bank, the scope of corporate responsibility extends to many areas of society. We make every effort to ensure that our enterprise and partners in our supply chain conduct business in a manner that avoids moral hazards, corruption and anti-competitive behaviour.

We recognise our duty to serve underprivileged people, who are often neglected by the financial industry because they are perceived to be high-risk borrowers. We are able to serve such customers with a deep understanding of the communities where they live and work, thanks to our widespread branch network. And with the guidance of our Development Credit Department, we are able to offer agricultural, industrial and housing loan products at reasonable interest rates. As with all of the Bank’s lending, our repayment plans are designed to match such customers’ unique cash flow constraints, requiring minimal collateral and offering longer repayment periods.

Communities benefit in two ways from our commitment to serving disadvantaged customers. First, by offering direct financing to small-scale cultivators, farmers and low-income earners for their working capital and housing needs, we help them prosper and contribute more to the local economy. And when we provide financing to small and medium-scale entrepreneurs, their success creates jobs in the surrounding region.

Moreover, we extend our support even further by providing entrepreneurial customers with industry-specific technical expertise, along with help in managing their finances. We are committed to increasing Commercial Bank’s microfinancing operations, as we believe there are tremendous opportunities in this untapped market. The Bank’s 12 dedicated agricultural and microfinancing units are a testament to our belief in its future potential.

Agriculture and Microfinance Sector – Capacity-Building Programmes

Our Development Credit Department, in collaboration with various regulatory authorities and entities, implemented nine capacity-building programmes in 2014, targeting agricultural customers –cultivators, farmers, producers and traders – in various parts of the country. Our goal was to introduce these customers to new technologies, the latest scientific cultivation methods, improved productivity measures and various forms of risk-mitigation insurance – and, of course, to showcase our lending products in these sectors while helping to boost financial literacy.

| Programme | Target Group | Number of Participants |

| Introduction to the Bank’s lending products for the agriculture sector | Members of Traders Association – Warakapola | 30 |

| Awareness programme for tea small-holders | Green leaves suppliers – Ratnapura | 41 |

| Awareness programme for grape cultivation | Grapes cultivators – Manipay, Jaffna | 44 |

| Awareness programme for vegetable cultivation | Vegetable cultivators – Maskeliya | 38 |

| Awareness programme for seaweed cultivation | Seaweed cultivators – Jaffna | 88 |

| Awareness programme for coconut cultivation | Members of the Coconut Producers Cooperative Society – Marawila | 48 |

| Cinnamon oil processing | Cinnamon oil processing businessmen – Baddegama | 30 |

| Tea cultivation and microfinance product promotion | Tea small-holders and suppliers – Akuressa | 40 |

| Dairy farming | Commercial scale dairy farmers – Tissamaharama | 23 |

Operations with Negative Impacts

The Bank closely monitors funding requests for projects that have potential negative impacts, such as wind power generation projects that could require resettlement of local communities. We only provide funding when a borrower can show that necessary clearances have been obtained from the appropriate authorities.

Loan proposals identified in our primary investigations as having possible negative impacts on either society or the environment are routed through the Social and Environmental Management System (SEMS) Co-ordinator. Any disbursement of loans is subject to conditions imposed by the SEMS screening process. The Bank also carries out reviews even after a loan is granted in order to ensure that the borrower fulfills all agreed commitments.

CSR Trust Fund Initiatives

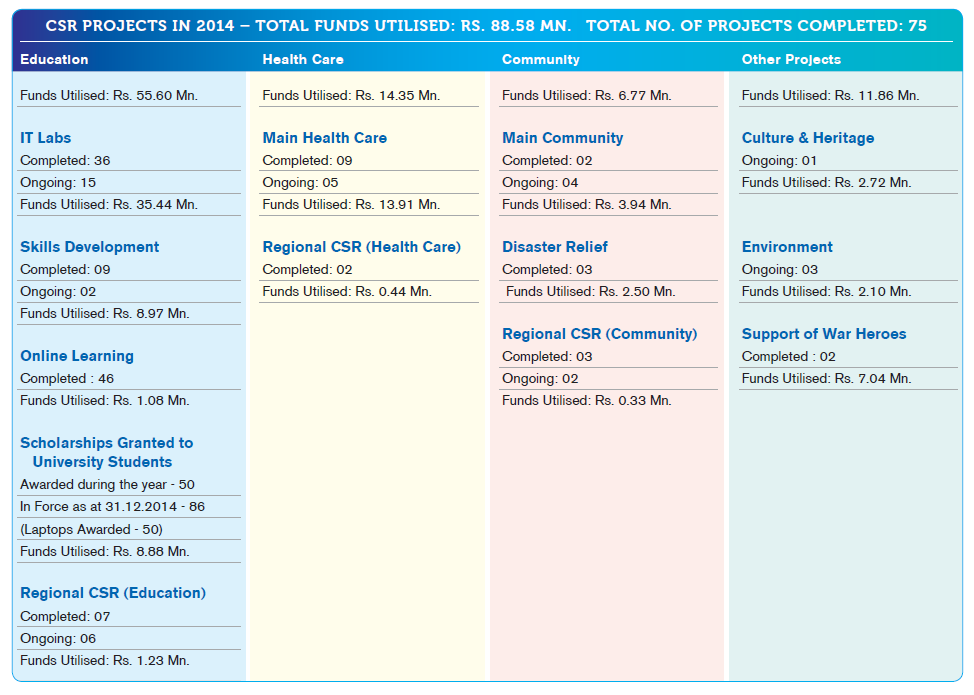

Establish in 2004, the CSR Trust Fund receives its allocation of funds from the Bank annually, an amount up to 1% of the post-tax profits of the Bank constitutes the CSR Trust’s Fund allocation. The Bank provided Rs. 52.5 Mn. from its previous year’s post-tax profits to the CSR Trust in 2014. The Bank’s CSR initiatives are focused on six key areas, namely, education, health care, culture & heritage, rehabilitation of war heroes, regional social initiatives, disaster relief and environment. Our main focus has been on the advancement of education of children in the country as we believe that the future of our Nation is determined by the children of today. Apart from education many other notable projects were also undertaken during the year. The CSR Trust has invested Rs. 88.58 Mn. for its 75 CSR initiatives carried out during the year 2014.

Method of Identification of Projects and Selection Process

Generally, projects are selected for their significance to the community and for their ability to deliver sustainable long term benefits to direct recipients and to the country at large. Our staff members from the island-wide branch network are voluntarily involved in identifying project proposals from their localities.

These include IT labs to government schools, essential medical equipment to government hospitals, disaster relief measures and regional CSR initiatives. In addition, the CSR Trust continuously engages in identifying sustainable projects having a national importance through various sources from the society. All such proposals are evaluated by the CSR Coordinator and her team for conformity with the laid down guidelines of the CSR Trust. The shortlisted proposals are tabled at the monthly meeting of the Board of Trustees for their evaluation and ratification. Approved projects are implemented with the voluntary participation of staff at respective branches and in support service divisions of the Bank including IT, Procurement, Logistics, Premises and Marketing.

Brief Account of the Projects Undertaken:

Education

The Bank’s main focus areas within the realm of education has been the promotion of IT skills amongst children, strengthening English language education in the country and providing scholarships and laptops for deserving undergraduates, with a view to improve their employability.

IT Education

With the aim of empowering a higher IT literacy rate in the country the Bank continued its efforts in providing fully-equipped IT labs to government schools and non-fee levying institutions across the country. Our assistance includes providing brand new computer equipment with warranty and licensed software (inclusive of UPS units for each computer and a printer for each IT lab), furniture (computer tables and chairs) and expenditure for renovation of IT labs. During the year, 36 IT labs were established and a total of Rs. 35.44 Mn. was spent on this project. Overall, the Bank has setup 158 IT labs investing Rs. 109.83 Mn. by the end of 2014, benefiting more than 115,000 students in different communities of the country covering many rural areas as well.

Phase II of this ongoing project was started in September 2013 by introducing a web based online learning programme to schools equipped with IT labs donated by the Bank, to facilitate both students and teachers to use the Internet in their learning and teaching more effectively. In this regard the Bank entered into a strategic partnership with the University of Colombo for designing a web interface on selected lessons in mathematics and science by a group of 3rd year undergraduates from the Science Faculty. This move met the aspirations of both institutions as the undergraduates are assessed in their community skills by the University under a ‘Service Learning’ project done voluntarily with a corporate entity. The components of the online learning project were designed based on the national school curriculum integrating free educational websites such as the world renowned Khan Academy. University students have so far conducted online learning sessions in 66 schools having IT labs donated by the Bank, of which 46 were conducted in 2014.

Furthermore, two strategic partnerships were entered into with Microsoft Sri Lanka and Cisco Systems Inc. during the ensuing period to add further value to our effort. Information and Communication Technology (ICT) is an important tool in education for increasing productivity. Specialised businesses and industries, including the banking sector and the BPO industry strategically uses ICT as an enabling technology. We are looking at offering ICT education to school children via our IT labs to give them required knowledge and skills in computing and communication devices, software that operates them, applications that run on them and systems that are built with them. Two pilot projects were carried out for teachers to give them required qualifications in order to train their students at respective schools. A group of 12 teachers selected from 6 schools have successfully followed a certificate course in CISCO IT Essentials - Instructor at the CISCO Networking Centre - University of Moratuwa. Five schools have already commenced the CISCO IT Essentials course for the students of grade 9 and above using the IT labs provided by the Bank. Around 130 students are presently following this course. The other group of teachers from 10 schools has followed a certificate course in Microsoft Office & Free Tools at the Gateway Institute Colombo. These teachers are also entrusted to offer relevant training modules to students at their respective schools.

Online learning session at Bandagiriya Maha Vidiyalaya, Hambantota

English Education

The Sri Lankan youth must have a good knowledge of English in order to take on and outsmart the global competition. Having identified this need the CSR Trust has offered English language training programmes for students and teachers since 2012. The Bank started sponsoring the British Council’s ‘Road Show’, a one day workshop designed for English teachers in 2013. The Teacher Training Programme was considered more sustainable as the teachers could immediately apply new methods and ideas they learnt from the training in their school lessons to enhance the English Language skills of students. We have successfully conducted our second programme with the British Council in May 2014 at the Kingswood College Kandy for a group of 200 teachers, chosen from 153 schools from the Kandy District. Overall, more than 300 English teachers have been trained to date under this initiative. The CSR Trust has spent Rs. 0.87 Mn. on this project.

Teacher training programme conducted by the British Council at the Kingswood College, Kandy

Scholarships to Undergraduates

The CSR Trust awarded another 50 undergraduates selected from seven state universities with scholarships and laptops under the ‘Sarasaviyata Nawa Saviyak’ community initiative. This was the seventh undergraduates scholarships presentation made by the Bank under the above programme.

Selection of scholarships recipients are done with the assistance of the University Grants Commission (UGC). Being ineligible for ‘Mahapola’ or any other scholarship programme, number of attempts made at the GCE A/L examination, number of school-going children in the family, parental income and distance between the university and the student’s home are some of the factors that are taken into consideration in identifying recipients.

The Bank has awarded 300 scholarships to date. In addition, 125 laptops have been gifted to scholarship recipients since 2012. With the latest batch of 50, 86 undergraduates will continue to receive the scholarship grant as the rest has already completed their degree. The bursary is remitted to the recipients’ bank accounts on quarterly basis upon obtaining confirmation from the Registrars of the respective universities regarding their attendance and other relevant details. The CSR Trust has spent Rs. 8.88 Mn. on this project.

Scholarship and laptop awarding ceremony for selected undergraduates under the ‘Sarasaviyata Nawa Saviyak’ community initiative

Laptop Computers for Visually Handicapped Undergraduates

Responding to a request made by the ‘Centre for Sight’ unit of the Ophthalmology Department of Teaching Hospital Kandy, the CSR Trust supported 20 visually handicapped undergraduates from Ruhuna, Peradeniya, Colombo, Sri Jayawardenepura, Kelaniya and Jaffna Universities by providing laptop computers enabling them to pursue their tertiary education. Selection of these students was done by the specialist doctors who work in the centre. According to the doctors, these students can use the laptops to take down notes and study reading materials with enlarged texts and installation of specialised software. They can also learn and use other accessibility options available in computers to enhance their knowledge in the field of IT. The CSR Trust has spent Rs. 1.88 Mn. on this project.

Health care

CSR Trust continued to invest in community health care projects to enhance medical facilities at Government Hospitals. Our assistance under this sector includes providing essential medical and other equipment required for multiple usage and renovation of hospital premises. During the year Rs.13.91 Mn. worth of essential medical equipment were provided to nine Government Hospitals. The largest investment made under this was the donation of a Colour Doppler Ultra Sound Scanner to the General Hospital (Teaching) Karapitiya for the benefit of kidney patients in and around the Southern Province. Without a scanning machine these patients had to travel to Colombo for necessary testing. Amount invested on this was Rs. 3.9 Mn. Other major donations include; two Incubators to the Neonatal Intensive Care Unit of Teaching Hospital, Peradeniya, a Hysteroscope to the Castle Street (Teaching) Hospital for Women, a Neonatal Life Saving Machine to the District General Hospital, Negombo and an Auto Refractometer to the Eye Unit of the Ashraff Memorial Hospital, Kalmunai. Essential medical and other equipment also donated to Base Hospital, Mirigama, Rehabilitation Hospital, Digana, Divisional Hospital, Karaveddy and Base Hospital, Thambuttegama.

Culture and Heritage

Preservation of our valuable historical and cultural heritage is one of the main objectives of the Bank’s CSR Trust. In response to a request made by the Basnayake Nilame of Sabaragamu Maha Saman Devalaya, Ratnapura, the CSR Trust commenced the renovation of the flight of steps to Sri Pada (Adam’s Peak) from ‘Gangula Thenna’ to ‘Seetha Gangula’ in May 2014. This is the second occasion that the Bank has undertaken restoration of the pathway of Sri Pada. Pathway between ‘Seetha Gangula’ and ‘Thenna’ was reconstructed by the Bank in 2008.

Sri Pada is revered as a holy site by several religions and annually thousands of pilgrims climb the steps up this holy mountain to worship. It is of particular significance to the Buddhists due to the belief that the foot print of Lord Buddha is imprinted on top of the mountain.

The renovation work is carried out under the supervision of the engineers of our Premises Department. The Civil Security Department (CSD) attached to the Sri Pada provides labour at a concessionary rate. Our Maskeliya Branch volunteered to coordinate this project by liaising with the suppliers to arrange building materials as and when required by the CSD. Approximately 80% of the work is now completed and the balance work is to be completed before March 2015. Estimated expenditure of the project is around Rs.10.4 Mn. The CSR Trust has spent Rs. 2.66 Mn. thus far on this project.

Regional CSR

Regional level CSR initiatives include development of local infrastructure, assistance to children and the aged and those needing medical attention and responding to essential common needs of the community. Identification of projects is done through our branch network with the voluntary engagement of our employees.

Assistance provided under this sphere includes construction of a separate scanning room and installation of an air-conditioner for the Dengue Treatment Unit at the District General Hospital Negombo, construction of a playing area for differently-abled children, renovation of rest room facilities at a home for elders, donation of 3 photocopy machines to government schools, donation of a water purifier for a cluster of residents in Kebithigollewa and donation of books to a school library. The CSR Trust has allocated Rs. 2.14 Mn. for projects undertaken during the year.

Disaster Relief

The CSR Trust donated 90 units of 1,000 litre water storage tanks and dry rations to the people of Kaduruwela, Ampara, Anuradhapura, Dambulla, Kekirawa and Nikaweratiya and deployed 10,000 litre water bowsers for 30 days in the Mullaitivu District, in a project to help families survive the severe drought affecting these areas.

The CSR Trust also assisted people affected by floods in some of the worst hit areas of the country such as Horana, Bandaragama, Elpitiya, Kalutara, Matugama and Anuradhapura with timely distribution of emergency relief. Packs of dry rations were distributed with the assistance of local authorities to families affected by the floods in some of these areas. Clothes were provided to needy people while children who lost their school requirements were provided with exercise books, stationery, mathematical instruments, school bags and water bottles.

Relief was also provided to the Koslanda landslide victims with the assistance of the Haldulmmulla Government Agent. Packs of dry rations and clothes were distributed for the displaced.

Our branches operating in and around the affected areas were voluntarily involved in distribution of the disaster relief. The CSR Trust has spent Rs. 2.50 Mn. for the relief measures undertaken during the year.

Environment

Coral Replanting Project

The joint environmental conservation project undertaken by the CSR Trust to replant coral in the Hikkaduwa Marine National Park, in partnership with the Department of Wildlife Conservation, has progressed into the phase II of the project. This initiative involves in replanting of corals in an extent of 1,000 square feet in the Walduwa area of the marine park, using techniques perfected in the Philippines. The original coral in this protected area was damaged in 1998 due to the warming of the ocean due to the ‘El Niño’ southern oscillation and the tsunami in 2004. Under the second phase, the process was to attach live corals to the sunken plaques containing dead corals. However, this had to be stalled temporarily as the scientists were predicting an ‘El Niño’ attack in 2014, according to an article published in the Time Magazine. Another reason being, that some of the cement plaques that were set down on the sea bed have got dislocated due to sand filling. As a precautionary measure it was decided to move cement plaques to the shallow waters of the Marine Park. Live corals subsequently collected from Roomassala area have been replanted thus commencing phase II of the project. As a shallow stretch has been chosen, better monitoring of the growth of the corals as well as protecting the corals from any disturbances from the boats carrying tourists to view the coral reef is ensured. Arrangements are under way to spread the replantation to a further 300 square metres, using wire mesh casings to induce quicker propagation and prevent sand filling.

By supporting the re-growth of corals in Hikkaduwa the Bank will indirectly sustain a positive impact on improving tourism in the area. Tourism was and is the main livelihood of the general public of Hikkaduwa. The arrival of tourists will provide the locals with job opportunities and entrepreneurship to promote the cultural activities and sell their products. Improved livelihood impacts the Bank’s business positively. Estimated expenditure of the project is around Rs. 0.76 Mn. The CSR Trust has spent Rs. 0.46 Mn. so far on this project.

A scene from the ongoing coral re-planting project commenced by the Bank in 2013 in Hikkaduwa

Greening Project at National Hospital of Sri Lanka (NHSL)

The National Hospital of Sri Lanka (NHSL), formerly known as the General Hospital, Colombo, was established in 1864. To commemorate the 150th Anniversary, the hospital authorities initiated a project to create a patient friendly tranquil environment, in keeping with their Mission statement. The Bank, accepting the invitation from this premier healthcare institution of the country, undertook to develop and landscape 44,000 sq.ft of the hospital precincts.

The NHSL occupies 32 acres in the heart of Colombo and is the largest teaching hospital in Sri Lanka and the final referral centre in the country. Consisting of 3500 beds, 75 wards, 35 Operating Theaters and 12 Intensive Care Units the NHSL serves over 10,000 outpatients daily.

According to a study carried out by a five member cabinet Sub-Committee, 60% of the air pollution in the city of Colombo is due to the greater dependence on fossil fuel as a source of energy. In the use of fossil fuels carbon dioxide (CO2) is produced and increase in atmospheric carbon dioxide can cause major adverse effects.

The project includes planting of CO2 -absorbent trees in specified plots of land belonging to the hospital to minimise carbon dioxide emissions in its immediate environs which will also facilitate the mental well-being of patients as well. In addition to existing trees in the garden, more mango and jack trees are to be planted. The existing ponds have been cleaned and repaired along with the benches. Lush lawns will be produced to enhance the aesthetic and environmental values of the property to facelitate the mental well-being of patients. The contractor entrusted with the work will also maintain the landscaped areas for a period of five years. The monitoring of the project is being done under the supervision of the Engineers of our Premises Department. Estimated value of the project is Rs. 5.0 Mn. The CSR Trust has spent Rs. 1.90 Mn. so far on this on going project.

Community Development

Melinchimunai Project

Melinchimunai is a village located in the Kayts Island, which consists of 225 families whose sole livelihood is fishing. They were facing with a severe scarcity of drinking water for many years due to non-availability of a natural water resource. Each family had to manage with a daily ration of 5-10 litres of drinking water distributed through the bowsers of the local Provincial Council which was hardly sufficient for drinking. The CSR Trust donated a Massey Ferguson 4-wheel tractor with a 4,000 - litre water bowser to ease the suffering of more than 400 inhabitants of the village. The Parish Priest of the ‘Christ the King Church’ who tirelessly engages in community services for the benefit of these villagers, along with the Melinchimunai Development Society, have taken the responsibility of distributing water to these families from 02 deep wells located about 12 Km from the Church. For this purpose a tractor which had been repossessed by the Bank due to non-repayment of a lease was purchased at a reasonable cost.

Besides helping the village to minimise its water problem, the Bank also organised awareness programmes to introduce a micro finance project on seaweed and sea cucumber farming for export to encourage the fishing communities of the islands of Jaffna to develop an alternate source of income. This programme was attended by a large number of fishermen from the islands of Kayts, Mandathivu, Punkuduthivu, Nagadeepa, Delft and Analaithivu. The project was jointly coordinated by the Development Credit Department of the Commercial Bank and the staff of the Bank’s Velanai branch. The CSR Trust has invested Rs. 1.3 Mn. for both these projects.

A resident of Melinchimunai village drawing water from the bowser donated by the Bank

Rehabilitation of War Heroes

Abhimansala 3

We are in debt to our war heroes for safeguarding our country. As part of our ongoing efforts to support the war heroes, the CSR Trust provided patronage for the construction of a fully-furnished Villa at ‘Abhimansala 3’ – the Life Long Care Centre for disabled war heroes in Pangolla, Kurunegala, which was ceremonially declared open by the former President in April 2014.

The villa, which is one of eight such villas at the centre, comprises of two bedrooms, a living room cum TV lounge and bathrooms custom designed and equipped for the use of disabled military personnel. It can accommodate four occupants at a time.

In all, ‘Abhimansala 3’ will accommodate 52 disabled war heroes, 32 of them in eight villas donated by corporate entities including Commercial Bank, and 20 in a hospital within the complex. The centre also has a therapy swimming pool and other facilities including a gym and an Ayurveda therapy centre and several cottages for visiting families of resident war heroes. Abhimansala projects are managed by the Brave Heart Foundation which is affiliated to the Army Branch of the Seva Vanitha Foundation. Total investment of the project is Rs. 6.0 Mn.

A picture of ‘Abhimansala 3’ donated by the Bank

Two Houses for War Heroes

Responding to a request made by the Civil Security Department (CSD) financial assistance was provided to build two homes for deserving members of CSD. During the civil war few years back, it was the soldiers of the CSD who protected the border villages from terrorist attacks. Most of these soldiers are from poor rural families and do not have a house of their own. Further, the CSD unit attached to Sri Pada is currently providing labour at a very concessionary rate for the ongoing CSR Project at Sri Pada. The CSR Trust has contributed Rs. 1.0 Mn. for this project.

Fighting Against Corruption Through Audits

The Bank has strict internal controls in place aiming to eliminate any form of corruption across the organisation. Our efforts in this regard are implemented by the Inspection Department, which carries out onsite and online investigations of the Bank’s operations in both Sri Lanka and Bangladesh. While majority of the audits of branches and departments in Sri Lanka are carried out by our Inspection Department, the Bank also engages its External Auditors in meeting the Bank’s Annual Audit Plan. Audits of Bangladesh operations are carried out by a team of Auditors in Bangladesh with the assistance of visiting teams from Sri Lanka. We adopt a risk-based approach through which the scope and frequency of audits for each branch or department is established. The following table provides a summary of investigations in 2014.

| Location | Onsite | Online |

| Sri Lanka | ||

| - Branches | 191 | 192 |

| - Departments and Divisions | 40 | 5 |

| Bangladesh | 33 | 16 |

In 2014, there were three reported incidents of corruption involving financial losses. All were internal fraudulent acts involving unauthorised fund transfers. Subsequent investigation of these incidents revealed that the frauds were abetted by non-adherence to existing controls, as opposed to problems with the controls themselves. As a result, appropriate disciplinary actions were imposed on staff members who were directly and indirectly involved with the incidents.

Money Laundering

The Bank has an ongoing programme that actively works to prevent money laundering and any activity that facilitates the financing of terrorism and other unlawful criminal activities. Our Anti-Money Laundering (AML) Unit, headed by the AML Compliance Officer (a senior Bank official), centrally monitors transactions to detect suspicious activities. Any alerts are reported to the Financial Intelligence Unit (FIU) of the Central Bank of Sri Lanka. The programme also requires every Bank business unit to bring any questionable transactions to the attention of the AML Compliance Officer.

We constantly train staff on AML issues, providing regular updates on the Bank’s internal controls and corrective procedures – both through specifically targeted training programmes and as part of the general induction sessions conducted by our Staff Development Centre.

Supply Chain

The Bank works with a wide variety of firms, organisations and individuals in support of our business activities. We view our suppliers and service providers as important stakeholders who are vital to our success.

| Suppliers and Service Providers |

| Utility service providers |

| Energy (electricity and fuels) |

| Telecommunication (data connections) |

| Material suppliers |

| Providers of various materials, including paper, IT-related supplies and other stationery items |

| Premises providers |

| Individual building owners |

| Firms renting office space |

| Supermarket chains |

| Contractors |

| Building |

| Interior decoration and partitioning |

| Wiring and plumbing |

| Travel and transportation |

| Courier services (domestic and international) |

| Cash transporters |

| Goods transporters |

| Car rental companies |

| Air travel, including support services such as ticketing agencies |

| Human resources |

| Suppliers of outsourced employees |

| Maintenance |

| IT equipment/software maintenance companies |

| Office equipment maintenance companies |

| Janitorial services |

| Staff welfare |

| Water suppliers |

| Food and beverage providers |

| Trainers and consultants |

| Assets suppliers |

| Vehicle suppliers |

| IT equipment/software vendors |

| Waste management |

| Waster paper management agents/companies |

| Waste food management agents/companies |

| Used furniture and equipment management agents/companies |

| Communication |

| Media |

| General post |

| Telecommunication (voice connections) |

| Services |

| Insurance companies |

| Lawyers and law firms |

| Auditors |

| Valuers |

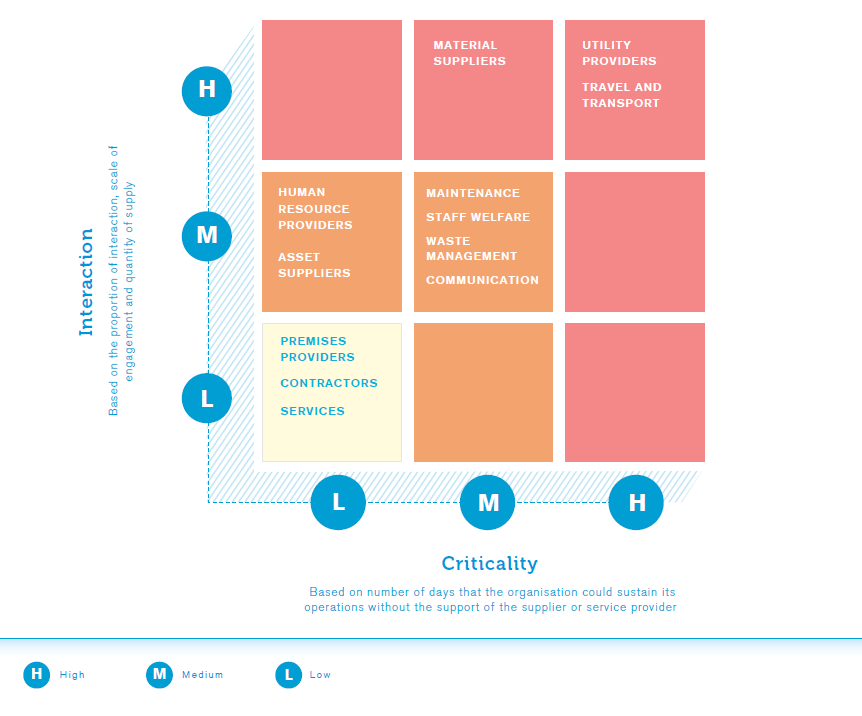

Our engagements may be routine or ad hoc, large-scale or small-scale, critical or non-critical to the normal course of business – but all create important links in the supply chain that ultimately delivers value to our stakeholders.

These engagements present challenges with regard to sustainability -some specific to certain types of suppliers and others common to all outside partners. The business activities of some suppliers are more vital than others to the Bank’s operations. The following chart summarises material aspects by supplier type:

| Type of Supplier | Material Aspect |

| Contractors | Health and Safety |

| Travel and Transport | Emissions |

| Human Resources | Labour Practices |

| Human Rights | |

| Maintenance | Effluents and Waste |

| Waste Management | Effluents and Waste |

We believe in partnering with suppliers that deliver the best value proposition to the Bank. Our procurement practices look beyond monetary value to gauge ethical behaviour and sustainable practices as equally important in forging a successful partnership.

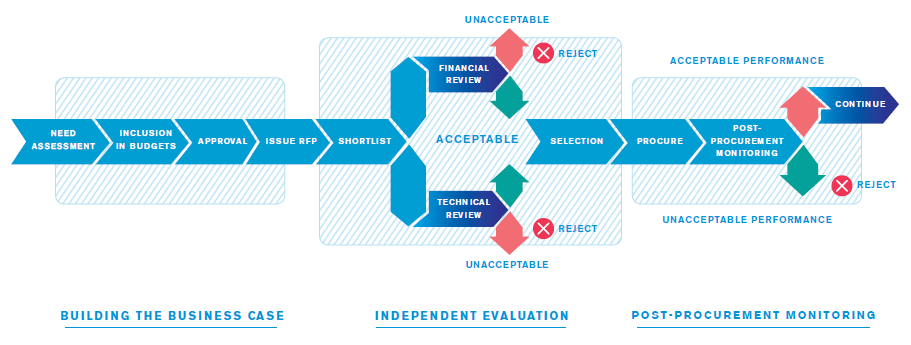

Supplier Assessment

The Bank has established a process to promote sustainable practices within our supply chain. In addition to a financial evaluation, our standard procurement procedures include an independent technical review. This assesses a prospective supplier’s technical know-how, after-sales service, experience in the field and compliance with environmental regulations and standards, as well as accepted labour and social practices.

Requests for Proposal (RFPs) issued to potential suppliers include the following compliance and responsibility requirements:

- Compliance with environmental standards

- Compliance with the RoHS (Restriction of Hazardous Substances) Directive

- Energy Star Rating

- Adherence to software piracy regulations (Intellectual Property Act No. 36 of 2003 and the Computer Crimes Act No. 24 of 2007)

- Adherence to the 10th Principle of the United Nations Global Compact.

- Adoption of health and safety standards (for suppliers with workers at risk of injury or disease)

Non-adherence to these requirements results in disqualification from the RFP process and may lead to the vendor’s removal from the list of registered suppliers.

Much of the Bank’s procurement is done locally. In 2014, the proportion of our spending on local suppliers was 99%. Although many of the software solutions we purchase are developed by global players, we also give local IT service providers opportunities to work with us on smaller projects. These engagements help Sri Lankan firms enhance their marketability in the IT industry while also opening the door to more immediate business prospects.

Ensuring Well-Being of Our Outsourced Staff

Commercial Bank outsources non-critical functions to reputable agencies that meet the Bank’s selection criteria. A rigorously documented screening process is in place to enable the Bank to scrutinise organisations that supply outsourced workers. Aspects such as compliance with applicable labour laws, including those covering minimum pay, whether they are paid on due dates and provided with salary slips with adequate details, working hours, leaves, payment of statutory levies, child labour are looked into in this screening. In addition, a screening process vets suppliers before contracts are offered to ensure they are not involved in corrupt activities such as money laundering.

The Bank’s Human Resources Department continuously monitors labour practices and procedures to ensure protection of human rights. We ensure that half-yearly Employees’ Provident Fund and Employees’ Trust Fund return statements are submitted to us for scrutiny. As well, our Security Department confirms that outsourced security officers are paid the statutory minimum wage by their employers. Further, the Internal Audit Department of the Bank undertakes periodic reviews to ensure that relevant procedures related to the foregoing areas are followed.