Operational Review By Division

Personal Banking

| Key Performance Indicators(*) | Actual 2014 Rs. Mn. |

Budget 2014 Rs. Mn. |

Actual 2013 Rs. Mn. |

Achievement (Actual Over Budget) % |

| Deposits as at December 31, | 407,509.3 | 382,063.0 | 342,540.4 | 106.7 |

| Advances as at December 31, | 221,187.8 | 224,636.5 | 192,835.4 | 98.5 |

| Profit before Tax, | 7,382.6 | 7,187.0 | 7,147.0 | 102.7 |

| Cost to Income Ratio (%) | 48.2 | 53.1 | 48.6 | |

| NPA Ratio as at December 31, (%) | 6.8 | 7.0 | 7.6 |

(*) Based on Management Accounts

Bank’s Personal Banking Division is responsible for delivering a complete range of services to both individual customers and small and medium sized enterprises (SMEs), ensuring the timely and accessible support they require to meet their financial goals.

The cornerstone of the Bank’s national delivery network remains the physical branch; we continue to make substantial investments in expanding and updating our retail presence. At the same time, we continue to invest in the future, assisting customers discover, for example, the convenience of eBanking by eRemittance.

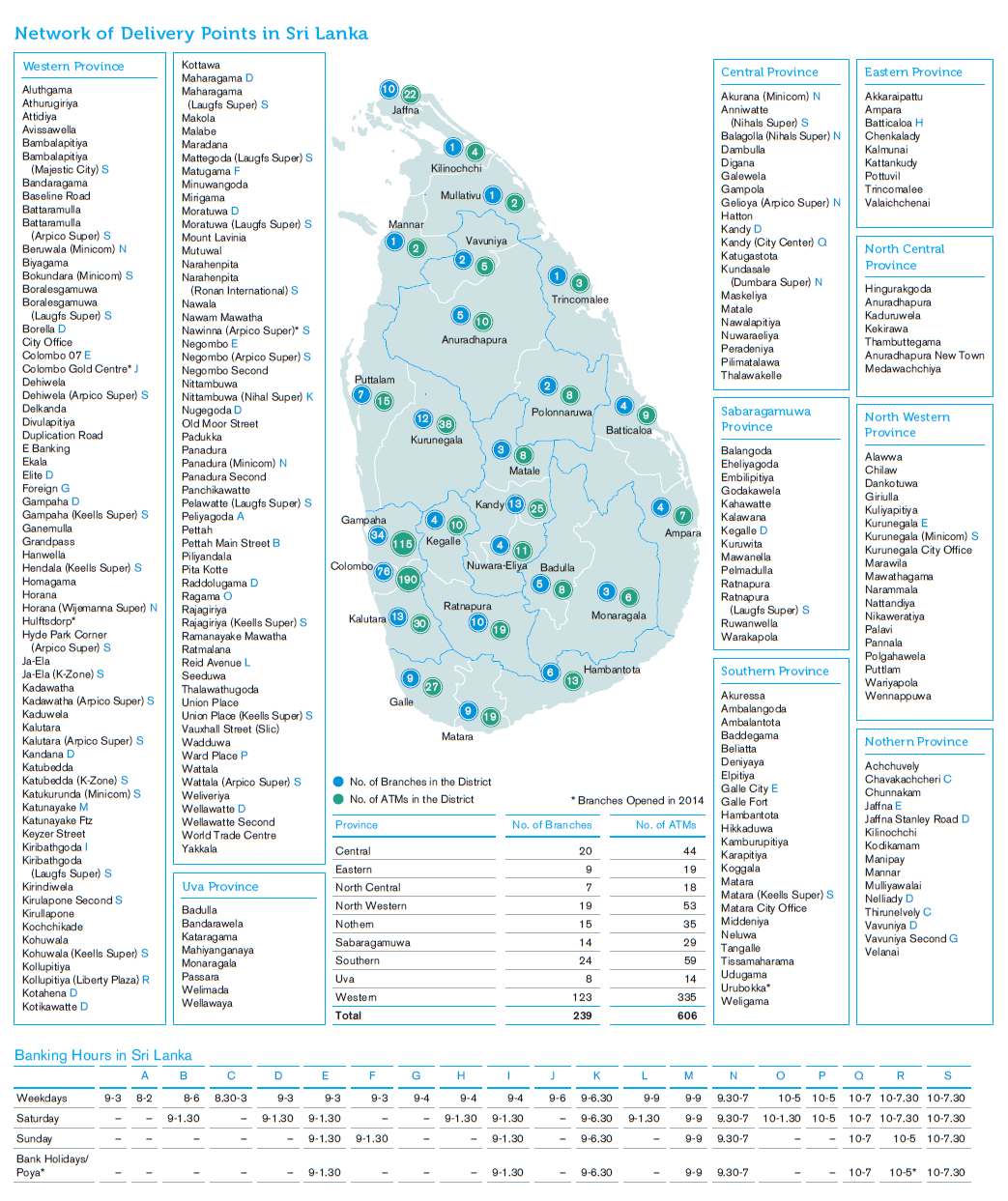

Refer the ‘Network of Delivery Points in Sri Lanka’ given below for an overview of the branch network of the Bank.

Delivery Points

We added four new branches to the Bank’s national network in 2014, while nine branches were relocated to deliver more services to a larger number of current and potential customers. The branch expansion is gradually slowing down as a result of our presence in every nook and corner of the country. The total delivery points across Sri Lanka was 239 branches at the end of 2014.

In the present context, expansion of service delivery also extends beyond bricks-and-mortar branches, taking advantage of expanding digital connectivity and consumers’ embrace of mobile technologies. More and more Commercial Bank customers are taking advantage of the fast, convenient access of mobile banking, online banking and other services supported by the rapid growth of telecommunication and Internet infrastructure in Sri Lanka.

The Bank’s national network is organised into 14 administrative regions and supports decentralised decision-making on credit transactions, as well as day-to-day branch operations. To make access to services even more convenient for customers, the Personal Banking Division provides 365-day banking, weekend banking and priority banking services. High-net-worth and priority banking customers are specially served through an ‘Elite’ branch of the Bank in Colombo 07.

Personal Banking Division – Delivery Points

| Delivery Points | No. |

| Total Branches | 239 |

| 365-day/Holiday Banking Centres - Branches | 19 |

| 365-day/Holiday Banking Centres - Super Market Branches | 28 |

| Weekend Banking Centres | 22 |

| Priority Banking Centres | 2 |

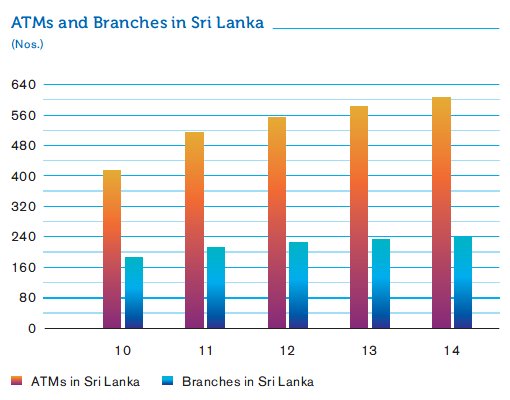

ATMs and Branches in Sri Lanka

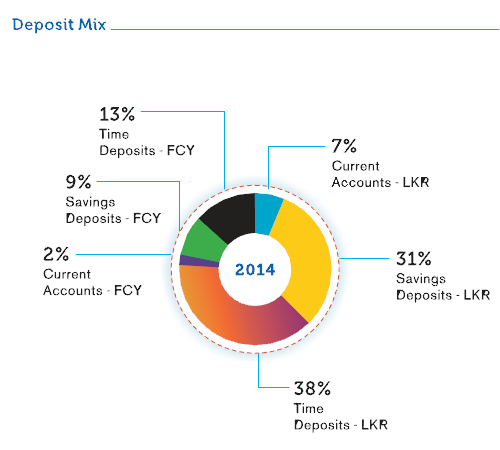

Deposit Mobilisation

Commercial Bank’s diversified branch network, stable capitalisation, good governance and strong corporate image have contributed in building a solid deposit base despite the unfavourable environment for mobilisation of deposits due to the low interest rate scenario. The Bank was able to improve its savings deposits substantially during the year, thereby improving its CASA ratio.

While deposit rates across the Sri Lankan banking sector have shown a general decline in recent years, the Bank has identified new avenues of opportunity. For example, we have introduced new business lines to support a national initiative focusing on the benefits of retirement funds, now that the average Sri Lankan consumer has more investment options. In the third quarter of 2014, we launched the Future Pensions Plan – a pioneering programme with five deposit schemes that can be opened by anyone between the ages of 18 and 65. Customers can also take advantage of valuable added features such as an annual bonus scheme and insurance coverage.

In order to retain Commercial Bank’s existing deposits clientele, over the past year we launched continuous awareness and promotional campaigns for our specialised deposits schemes, showcasing our ability to offer better value than our direct competitors.

ATM Network

In the highly competitive retail banking environment, Commercial Bank’s diversified ATM network – the single largest in Sri Lanka – provides a distinct edge, acting as a catalyst for mobilising deposits. We promote ATMs as a convenient way to conduct financial transactions, making customers’ lives easier while significantly reducing counter traffic at branches and boosting staff productivity.

Providing reliable and readily accessible service to millions of people across the country, the Bank’s ATM network has regularly set records for the volume of cash dispensed and number of transactions processed during peak shopping periods. On April 11, 2014, we established an all-time high for distribution of cash via ATMs in a single day, recording withdrawals of Rs. 2.05 Bn.

In the same note, we continue to grow and improve our ATM network. In September 2014, we reached the 600-machine milestone at the Gold Centre Branch (our 238th retail location in Sri Lanka). Throughout the year, a total of 21 new ATMs were installed – 50% in branches and the rest in convenient off-site locations – including three drive-through ATMs in high-traffic areas.

In 2014, we also installed our first Forex ATM at Crescat Boulevard, one of Colombo’s leading shopping malls. This specially designed machine accepts US Dollar and Euro notes and issues their equivalent in Sri Lanka Rupees – a useful and time saving service for customers, particularly tourists, requiring quick foreign exchange transactions.

Automated Deposit Machines have provided another solution for reducing congestion in our branches, allowing customers to quickly and conveniently deposit both cash and cheques. Sixteen such machines were installed in 2014.

Commercial Bank joined the LankaPay network – the largest common ATM network in the country, connecting more than 2,500 machines operated by nine member banks in 2014. In the past, Commercial Bank customers were often reluctant to use their ATM or debit cards at other banks’ machines, wary of both the surcharges effected on cash withdrawals and potential security concerns. Now our customers enjoy secure, island-wide access to all LankaPay ATMs at affordable rates.

Personal Loans

The steady expansion of Sri Lanka’s middle class population in recent years has provided many opportunities for banks to expand their service offerings. Commercial Bank has benefitted from this demographic shift, tailoring products and services to the needs of an increasingly affluent consumer base. In particular, we have focused on promoting personal loans to professionals and executives of leading companies, maintaining the high quality of our portfolio while achieving unprecedented growth.

During the year 2014, the Bank had granted 15,505 new loans totalling Rs. 14.5 Bn., an increase of 169% over the previous year. The overall personal loans portfolio surpassed the Rs. 20 Bn. mark at the end of the year.

Despite this substantial growth in the portfolio, the non-performing loans (NPL) increased only marginally, by Rs. 0.81 Mn., reducing the NPL ratio from 4.37% to 3.27% as at end of December 2014. Building on our success in extending personal loans to a larger potential market, we plan to focus more on moderate income earners in the coming year.

Leasing

The slow rise in credit demand from the private sector that characterised 2013, continued into the subsequent year. This trend was clearly visible from the decline in the number of registrations of new vehicles, which resulted in a very low demand for leasing facilities in 2014. Even so, the Bank had granted 3,075 new leases (including hire purchase facilities and loans granted to import vehicles under permits) with a total value of Rs. 10.6 Bn.

From the end of the third quarter, we saw a positive growth in leasing business driven by three key factors:

- Strategic partnerships with reputed vendors.

- Island-wide marketing campaigns conducted through local branches.

- A branch competition conducted with special interest rates.

In the past, the Value Added Tax (VAT) on vehicle leases hindered business growth. However, the decision, made in Government Budget proposals to exempt such transactions from VAT gave an immediate boost to the number of leases granted for registered motor vehicles during the latter part of the year.

Domestic Factoring

The Bank has adopted a restrained approach to promoting our factoring business. The Bank took measures to reduce the exposure levels of several existing facilities. Given the prevailing low interest rates regime, there has also been a tendency to move factoring customers to other, more cost-effective working capital facilities.

Even with the reduced activity in this segment during the year, the Bank recorded a factoring turnover of Rs. 12.83 Bn., with substantial volumes been brought in by new businesses. Despite low interest rates, we achieved a high rate of return, mainly from the high fee-based income earned on such products.

In the future, we expect that factoring will continue to gain traction as a means of providing effective financing for small and medium sized enterprises. We therefore intend to focus more in this area, which promises both high returns and good future prospects.

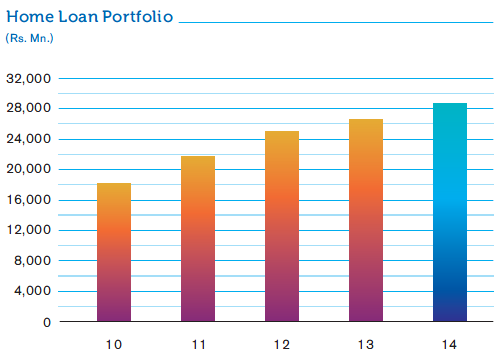

Home Loans

Since the end of the civil war in 2009, Sri Lanka’s construction industry recorded a healthy growth, which in turn spurred economic growth throughout the country. Interest rates applicable on home loans came down substantially during the year. The fixed rate loans were reduced by 4.5%, the floating rate by 5% and the Privilege Home Loans rate by 4.5%. These rate reductions contributed in growing Bank’s housing loan portfolio.

Since 2013, demand from high-net-worth customers has driven a boom in condominium construction projects. Taking advantage of our strategic connections with developers, the Bank extended sizeable home loan facilities, especially to Sri Lankans employed abroad.

The Bank also introduced home loans for professionals during the latter part of the year. Bank passes on the tax benefit accruing through this product to professionals by granting loans at discounted rates.

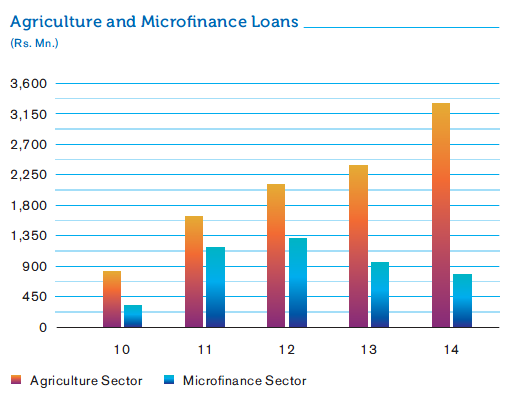

Agriculture and Microfinance Loans

Lending to the agriculture sector continued to grow in 2014, recording a net increase - in contrast to the Bank’s microfinance business, which recorded a negative growth over the year. The net infection ratio of our microfinance portfolio was also marginally higher due to a rise in non-performing loans in the Northern and the Eastern province branches. Notwithstanding these mixed results, the Bank provides a strong support for the agriculture and microfinance sectors, extending services to customers across our national branch network.

The Agriculture and Microfinance Unit, which provides supply chain financing to agriculture and livestock producers, has proven to be one of our most effective credit-delivery mechanisms; it is especially popular in the tea and dairy industries. As well, a wide array of credit schemes – both refinanced and also funded by the Bank have helped in increasing lending to small and medium-sized agricultural businesses, as well as micro enterprises.

Bank continued to participate in five refinance credit schemes and two interest-subsidised credit schemes. All of them were designed to support the agriculture and livestock sectors. Across the country, our microfinance programme is designed to be inclusive of customers in vulnerable groups, providing them with a means of financing their livelihoods.

Agriculture and Microfinance Loans

After analysing performance in the agriculture and microfinance areas, we have identified a growing demand for advances from entrepreneurs who are engaged in commercial-scale agricultural and livestock projects. Considering this market development, we observe a tremendous opportunity to promote larger agricultural and livestock project facilities, which in turn will drive national agricultural production in the country. To that end, our new Leasing-Agri product should help to meet rising demand from existing and prospective customers.

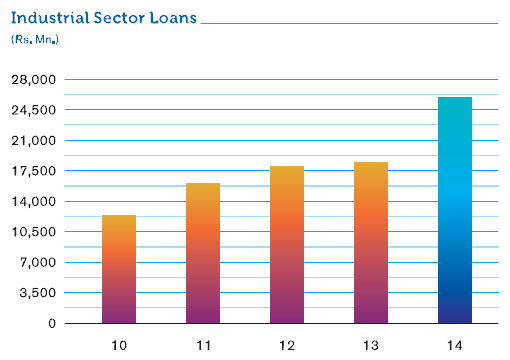

Industrial Loans

In the past year, the Bank operated five credit lines, as well as our own development lending product, the Diribala Loan Scheme. Diribala is aimed at Small and Medium sized Enterprises (SMEs) and offers flexible terms to facilitate loan repayment. It is the only dedicated credit line offered by a private bank in Sri Lanka designed specifically to benefit SMEs.

Our focus on the SME sector reflects its huge contribution to Sri Lanka’s GDP, employment creation and export earnings. During 2014, in line with global trends, we gave priority to developing SMEs, placing special emphasis on extending financing to manufacturing and service oriented businesses through flexible terms.

As of the end of December 2014, the value of the Bank’s development lending products portfolio was Rs. 25.95 Bn., with 1,192 new loans granted amounting to Rs. 15.74 Bn.

Moving forward, planned industrial lending activities include:

- Setting up branches to serve as knowledge centres for the SME sector.

- Conducting capacity building programmes for existing and prospective borrowers with the goal of retaining and building businesses.

- Promoting the Bank’s development loan products to SMEs via external organisations.

We have also launched a series of awareness programmes to improve financial literacy and entrepreneurship among operators of SMEs and micro enterprises. The programmes are designed to raise general awareness of development lending opportunities provided by the Bank. To date, they have been conducted by a number of branches, providing guidance to approximately 800 aspiring entrepreneurs. Commercial Bank is the first private bank to initiate this type of programme, collaborating with the Central Bank of Sri Lanka.

Pawning

Pawning is a popular loan product among the rural community. This is due to the ease of obtaining funds, by surrendering the gold articles. However, the pawning industry was affected by the sharp drop in global gold prices during 2013 – a trend that continued at a slower pace in 2014. As gold prices continued to fluctuate widely in the market, Loan To Value (LTV) ratio was reduced as a precaution, which led to decline in pawning advances. Responding to the difficult market conditions, several of the Bank’s pawning units ceased operations in 2014.

The Central Bank of Sri Lanka (CBSL) recognising the importance of pawning – which mainly serves the rural economy – introduced the Credit Guarantee Scheme of Pawning Advances in a bid to increase disbursements. Under this programme, the LTV ratio has been increased to 80%; the CBSL compensates losses due to falling gold prices up to 65% of LTV. Commercial Bank has entered into an agreement with the CBSL to participate in the new Credit Guarantee Scheme.

Payment Cards

In 2014, the Bank further consolidated its position as the Sri Lankan market leader in debit card spending, achieving 35% growth in transactions compared to 2013, and also driving up interchange income. The EMV Debit Card, launched in 2010, has now been extended to all of our cardholders, protecting them better against counterfeit and fraudulent transactions.

Credit card purchase volumes also saw a double-digit growth in 2014, even as the market overall experienced a lull in spending growth. The Bank’s promotional activities throughout the year, as well as our partnerships with various merchants, contributed significantly to increase in credit card use.

Over the past year, we upgraded our cards systems, processing switch, international network gateway applications and ATM systems to conform with the security requirements set out in the Payment Card Industry Data Security Standards Guidelines. We further upgraded our ATM system to allow ‘cardless transactions’, paving the way to opening up the country’s largest ATM network to third parties offering cardless banking services.

eBanking

As more and more millennials and other customers focused on convenience, banking embrace all digital and mobile technologies, the Bank continues to invest in these channels. More than 5% of the Bank customers now conduct their banking via our online or mobile platforms. Our online banking customer base increased by 28% from 2013, attracted by an array of capabilities and benefits, including augmented safety features, now offered via our secure web portal.

In September 2014, we launched a new Corporate Online Banking solution, developed on the Microsoft .NET platform, that is similar in its functionality to our existing Personal Online Banking solution. This new solution incorporates a range of helpful features demanded by corporate users, including multi-level authorisation, administrator users and single-user IDs for multiple company accounts. The new system allows single, dual or multi-level authorisation for fund transfers, bill payments and letters of credit, helping large companies to automate all single-entry payments. The system can also apply payment limits according to the signature rules of each corporate customer.

Our Bank is the only Sri Lankan bank to offer online cheque-imaging, which allows customers to view digital images of deposited cheques. The system also allows corporate customers to schedule bill payments effective on a future date (typically the due date). In addition, it is now possible to register regular payment beneficiaries and execute instant payments to them (via Commercial Bank accounts), 365 days a year. The system also enables customers to submit letter of credit applications with uploaded supporting documents. And it provides a ‘Corporate Administrator’ facility, allowing companies to manage internal user authorisations as required.

Android App for Online Banking Customers

The Bank introduced a mobile banking app for Android smartphone users in early 2014, offering similar functionality and features as the iOS application launched for Apple iPhone users in the fourth quarter of 2013, the new app is compatible with Android version 4.2.2 upwards. Users who are already registered with our online banking facility can adopt the new app with their existing login information.

As this Annual Report goes to press, there have been 20,000 downloads of this Android app, drawing highly favourable customer comments and ratings.

Enhancements to Personal Online Banking

The Bank’s Online Banking Platform now allows personal banking customers to make loan requests and invest in fixed deposits via the Bank’s website (where the relevant secure applications are hosted). The loan request is submitted electronically to the appropriate branch for evaluation and processing. A fixed deposit request submitted online is similarly communicated to the appropriate branch. Customers can also monitor the details and progress of their applications online.

| Growth over 2013 | ||

| Transactions % |

Volume % |

|

| Internet banking | 37.06 | 7.67 |

| Mobile banking | 93.99 | 56.11 |

PayMaster

Commercial Bank has been the market leader in facilitating and promoting online payments. ComBank PayMaster is the industry’s first comprehensive online payment solution, enabling large corporate clients to make bulk payments using a single mechanism. Our web-based system is now used by more than 2,000 corporate clients, assisting them to quickly and efficiently handle payroll processing, bonuses, agent commissions, interest payments and many other transactions.

The Bank has successfully introduced many other innovative online payment solutions. After a pioneering collaborative effort with Employees Provident Fund (EPF), we now process EPF payments via our web-based banking platform – an innovation that has been welcomed by the corporate sector.

| Paymaster Growth | Growth over 2013 % |

| Customer | 11.7 |

| Income | 14.7 |

| Transactions | 10.2 |

| Volume | 8.6 |

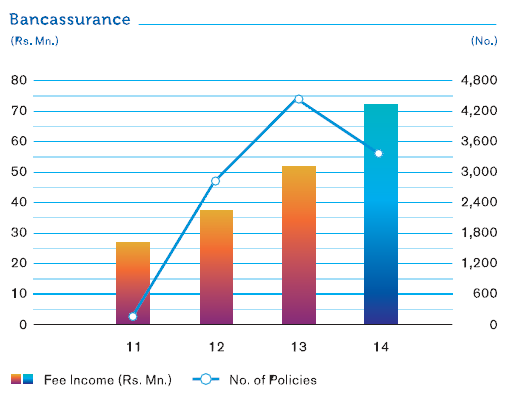

Bancassurance

Commercial Bank partners with ten leading insurance companies to offer life and general insurance. Launched mid-2010, Bancassurance has achieved significant growth over the past four years.

Fee income showed a steady growth rate of more than 40% year over year. In 2014, however, the number of policies issued fell, largely because of an increase in monthly insurance premium. Also, under Bancassurance’s revised mandate, life policies can only be issued to account holders of the Bank.

In 2014 the Bank centralised the insurance renewal process and now premiums are recovered from customers as soon as their policy renewals are confirmed at the branch level. And as a further improvement in both customer service and branch efficiency, Bancassurance now offers web-based quotations for new insurance coverage.

Supermarket Banking

Commercial Bank has led the way in supermarket banking in Sri Lanka, implementing unique, customer-centric operating models that vary by branch type and location. Among the innovations that differentiate our approach is the decision to move some supermarket branches to standalone locations outside the retail environment, which increases customer traffic and banking transactions, and improves business volumes overall. We now operate 28 supermarket outlets across the country, including four new locations opened in 2014. In addition the Bank operates 11 standalone minicom branches.

Commercial Bank Elite

The Bank’s exclusive priority banking service, Commercial Bank Elite, caters to high-net-worth individuals who appreciate an added level of convenience and personalised service. Located in a private residence at No. 7, R.G. Senanayake Mawatha (Gregory’s Road), Colombo 07, the business unit has specially trained relationship officers who help customers with the full range of financial products and premium services provided by other partners of the Bank. Commercial Bank Elite also operates an Elite Banking Centre at our Peradeniya branch.

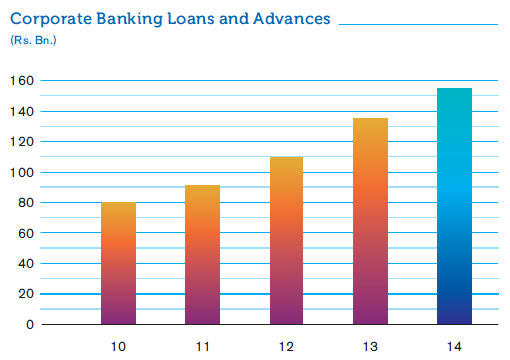

Corporate Banking

| Key Performance Indicators (*) | Actual 2014 Rs. Mn. |

Budget 2014 Rs. Mn. |

Actual 2013 Rs. Mn. |

Achievement (Actual Over Budget) % |

| Advances as at December 31, | 155,314.7 | 151,415.0 | 135,282.5 | 102.6 |

| Profit before Tax | 5,027.4 | 5,638.8 | 5,102.1 | 89.2 |

| Import turnover | 208,103.6 | 158,270.0 | 180,729.8 | 131.5 |

| Export turnover | 272,229.0 | 255,561.4 | 240,053.8 | 106.5 |

| Cost to Income Ratio (%) | 19.9 | 22.3 | 18.8 | |

| NPA Ratio as at December 31, (%) | 0.7 | 1.9 | 0.9 |

(*) Based on Management Accounts

Through our Foreign Branch, Investment Banking Unit, Off-shore Banking Centre and Islamic Banking Unit, the Corporate Banking Division of Commercial Bank offers customers a wide range of business-oriented financial services. These include working capital financing, leasing and factoring facilities, project financing and Islamic banking products. To help corporate customers conduct business internationally with their global counterparts, we have a worldwide network of well-established and trusted correspondents.

Over the years, the Foreign Branch has established a reputation for expertise in trade finance, catering to a clientele across wide and varied business spectrum, including large and medium sized Sri Lankan enterprises, blue-chip companies and multinationals operating in the country.

The Corporate Banking Division also oversees our credit operations in Bangladesh and conducts selective lending in the Maldives.

Private sector demand for bank credit was low during the first half of the year. Further, large companies were able to raise funds through debt instruments locally and overseas, taking advantage of low interest rates. These factors caused high excess liquidity among banks, sparking an intense lending competition – which in turn contributed to the decline in the AWPLR.

Since the end of the civil disturbances in 2009, Sri Lanka’s economy has been buoyed by two major drivers of growth: mega-infrastructure projects undertaken by the Government and a boom in the tourism sector. Over the past year, the Corporate Banking Division continued lending aimed at the development of the country’s road network and water projects, as well as financing a range of factory modernisation and hotel projects.

Most large scale government sector projects have been funded through overseas loans which have to be repaid with the country’s foreign exchange reserves. To reduce the outflow of foreign exchange in 2014, Commercial Bank collaborated for the first time with a state bank to facilitate the construction of a new building complex for a state university. The Bank is to fund the entire project, on a guarantee issued by a state bank which will be repaid by the National Treasury.

During the past year, the Corporate Banking Division implemented a fully-automated solution – Kalypto Loan Origination System, to evaluate credit proposals, making the process faster and more efficient.

Corporate Banking Loans and Advances

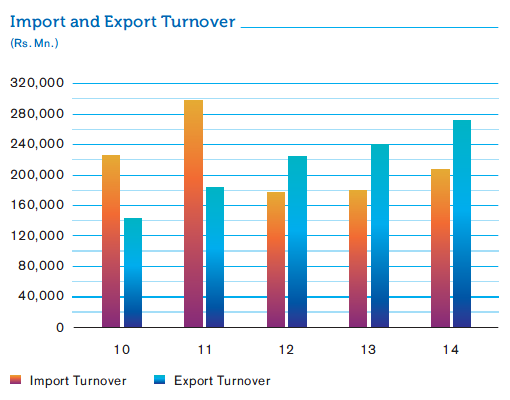

Import Business

In its 2014 budget, the Sri Lankan Government introduced customs tariff reductions for certain categories of vehicles, stimulating growth in automobile imports in the latter part of the year. In the last quarter, favourable exchange rates, especially for the Japanese Yen, spurred large scale motor vehicle imports from Japan.

Ongoing tourist development, along with various Government infrastructure and private sector construction projects, led to an increase in imports of heavy-duty machinery. And demand for materials driven by rapid growth among small and medium size businesses also had an indirect effect on imports.

| Import Turnover | 2014 US $ Mn. |

2013 US $ Mn. |

Growth % |

| Bank | 1,575 | 1,379 | 14.1 |

| Country | 19,400 | 17,996 | 7.0 |

| Bank’s market share (%) | 8.1 |

Export Business

Sri Lanka had a strong year in exports, with year-over-year earnings increasing by 7% during the year 2014. Industrial products led the way, accounting for 74% of exports during this period. The balance was mainly contributed through agricultural exports.

The top five leading markets for Sri Lankan exports were the US (the largest single overseas market), UK, Italy, India and Germany. Garment exports to the European Union and US markets, a longtime staple of the national economy, increased by 21% and 16% respectively (January to October 2014). Rubber products, the second leading contributor to exports, grew by 10% in the same period.

Tea exports were hampered by the stringent UN-backed sanctions imposed on certain Middle Eastern countries. As well, volatility in EU markets in the third quarter of 2014 dampened fisheries exports.

| Export Turnover | 2014 US $ Mn. |

2013 US $ Mn. |

Growth % |

| Bank | 2,060 | 1,832 | 12.4 |

| Country | 11,118 | 10,394 | 7.0 |

| Bank’s market share (%) | 18.5 |

Investment Banking

To strengthen our growing investment banking business, and to reflect our expanded scope of related activities and services, in 2014 we re-launched our corporate finance unit as Commercial Bank Investment Banking.

In 2014, investment banking generally benefited from credit growth fuelled by low interest rates. Excellent stock market performance, following three relatively subdued years, also helped to stimulate activity. Substantial market demand for debenture issues was fuelled by a large number of companies that locked in longer-term debt issued at relatively modest rates.

Margin trading operations improved substantially in 2014, with an increase in average portfolio size stemming from substantially improved market performance throughout the year, as well as low interest rates. Customer trading activity levels were also more buoyant, and several new accounts were added during the year.

The equity funds of the Bank recorded noteworthy growth in 2014, capitalising on favourable market movements and timely investments and divestments made during the year. The Bank also initiated several structuring assignments for equity and debt issuances during the year.

Overall, the unit showed a substantial improvement in performance over the previous year, buoyed by our new focus on investment banking and favourable market conditions.

Islamic Banking

Islamic Sharia law prohibits the charging of interest. Commercial Bank’s Islamic Banking service therefore operates on the concept of ‘profit and loss sharing’ as an alternative to conventional interest-based financial transactions.

Our Islamic banking window, Al Adalah, has been in operation since June 2011. This step has since been followed by other Sri Lankan financial institutions: two private banks introduced Islamic banking offerings in 2014, and other institutions and finance companies will soon be venturing into the field.

The Bank’s Islamic Banking operations are supervised by the Central Bank of Sri Lanka and also by a Sharia Supervisory Board, to ensure that all transactions conform to traditional law. The Sharia scholars appointed to the Board help to carry out periodic reviews and audits.

The Islamic banking products we offer throughout Sri Lanka include Mudaraba savings accounts and investment accounts, as well as asset products such as Murabaha, Musharaka, Diminishing Musharaka, Wakala, and Ijara leasing and import financing. Several other Islamic-targeted products are available at select branches.

During 2014, our Islamic banking unit for the first time began providing financing through our offshore banking facility. Moreover, Islamic Banking Unit is in the process of developing a product that supports Islamic export bill discounting.

After less than five years in this sector, Commercial Bank has about a 6% share of the Islamic banking market – a number that we expect will continue to grow as we pursue new initiatives.

Treasury

| Key Performance Indicators(*) | Actual 2014 Rs. Mn. |

Budget 2014 Rs. Mn. |

Actual 2013 Rs. Mn. |

Achievement (Actual Over Budget) % |

| Foreign exchange profit | 672.9 | 1,618.6 | 1,070.1 | 41.8 |

| Profit before tax | 842.9 | 714.0 | 460.9 | 118.1 |

| Interest earning assets as at December 31, | 270,384.2 | 174,779.5 | 173,716.7 | 154.7 |

| Interest bearing liabilities as at December 31, | 120,998.5 | 37,232.2 | 44,454.9 | 325.0 |

| Cost to Income Ratio (%) | 25.7 | 39.0 | 38.9 | _ |

(*) Based on Management Accounts

The Bank’s Treasury Department manages interest risk, liquidity risk and foreign exchange risk. Its operations are divided into three specialised areas – Forex and Corporate Sales, Fixed Income Securities and ALM Operations – each headed by a chief dealer.

The Central Bank of Sri Lanka (CBSL) policy rates were steady throughout the year; only the reverse repurchase rates were revised downward – by 50 basis points, from 8.5% to 8%, in January 2014. However, even though there were no major changes to the policy rates, the CBSL’s Monetary Board made significant changes to its policy-related tools. The traditional open market operations repurchase window, where commercial banks could park their excess liquidity was replaced by the Standing Deposit Facility (SDF) and the Reverse Repurchase Window through which the Central Bank injected overnight liquidity was renamed as Standing Lending Facility (SLF) in January 2014. The Standing Deposit Facility of the CBSL is uncollateralised.

Further, the CBSL restricted banks from depositing excess liquidity with CBSL to a maximum of three times per calendar month at the currently applicable SDF rate of 6.5%, and any deposits at the SDF window exceeding three times by a participant bank was accepted at a reduced interest rate of 5% per annum.

These measures were taken to enhance private sector credit growth at reasonable rates, which in turn would help to sustain the momentum of economic growth, given the low inflationary environment. Private sector credit growth was subdued during the first half of the year, then picked up considerably as a result of low interest rates and substantial excess liquidity in the banking system.

Although the economic conditions were good in 2014, the lack of demand and a low appetite for borrowing in the private sector hampered expansion of the loan book. As a result, Treasury had to manage the Bank’s substantial excess liquidity position, primarily by investing in Government Securities. Returns on Government Securities eroded with declining interest rates, resulting in a re-pricing risk at maturity.

AWPLR of commercial banks fell from 10.13% at the beginning of the year to 6.33% in December 2014. During the same period, the Average Weighted Deposit Rate declined from 9.37% to 6.20%.

The Bank’s Assets and Liabilities Committee (ALCO) was compelled to revise downward the deposit rates on liabilities several times during the year. This, along with faster downward revision of interest rates of our asset base, resulted in diminishing interest margins. Still, even with continuing low interest rates, our deposit base grew at a healthy pace. A significant increase in the current account and savings account base, compared to the growth in time deposits, helped the Bank to manage the cost of funds more efficiently.

The Sri Lankan Rupee was under pressure to appreciate during the early part of 2014 with healthy foreign currency inflows coming into the stock market and Government Securities. Further overseas borrowings by corporate and financial institutions added to this pressure. However, the CBSL absorbed the major part of these inflows in order to prevent any sharp appreciation and volatility in the currency. The value of the Rupee therefore remained flat for most of the year, then depreciated slightly in the last quarter due to a renewed demand for imports driven by private sector credit growth, reduced vehicle import tariffs and the sharp depreciation of the Japanese Yen.

In this context, the growth in foreign exchange income was not impressive; most of the Bank’s exchange profit was earned from trade-related transactions and remittances. Corporate sales income also remained flat, mainly because of decreased trade volumes and low margins.

Treasury was again the market leader in Interbank FX operations, providing liquidity in spot, forward and swap transactions. The unit led as well in cross-currency operations and played an integral role, working closely with the Fixed Income Securities Desk, in efficiently managing excess liquidity as low interest rates prevailed. In 2014, Treasury maintained its supporting role to our Personal and Corporate Banking units, meeting their Sri Lanka Rupee funding requirements while managing the foreign currency flows that are vital to their day-to-day business.

Treasury also acts as the funding centre of the Bank, supporting transfer-pricing for all assets and liabilities from other business units. In 2014, Treasury’s transfer-pricing income was Rs. 27.6 Bn. and the relevant expense was posted as Rs. 42.2 Bn. The transfer-pricing mechanism is set up to centralise interest rate risk, protecting other business units against market risk on interest rates.

By correctly anticipating interest rate direction and the decline in long-term interest rates for Government Securities, Treasury increased trading gains during the year. The Bank held Rs. 188.3 Bn. in Sri Lankan Rupee-denominated Government Securities and Rs. 46.2 Bn. in US Dollar-denominated government securities as of December 31, 2014.

Treasury provides ALCO with interest and exchange rate updates, as well as data on other macroeconomic developments that support the Bank’s asset and liability management process. Based on this information, ALCO sets parameters for the management of maturity mismatch risks in the balance sheet. Treasury also provides direction to the ALCO Sub-Committee on fixing funds transfer-pricing rates based on prevailing market conditions.

International Operations

Bangladesh Operation

| Key Performance Indicators(*) | Actual 2014 Rs. Mn. |

Budget 2014 Rs. Mn. |

Actual 2013 Rs. Mn. |

Achievement (Actual Over Budget) % |

| Deposits as at December 31, | 44,092.0 | 43,371.8 | 41,819.5 | 101.7 |

| Advances as at December 31, | 40,175.3 | 39,727.6 | 36,138.0 | 101.1 |

| Profit before Tax | 2,580.4 | 2,828.6 | 2,012.3 | 91.2 |

| Cost to Income Ratio (%) | 28.1 | 35.2 | 30.9 | |

| NPA Ratio as at December 31, (%) | 2.1 | 1.4 | 1.5 |

(*) Based on Management Accounts

Activities discussed under this section encompass Bangladesh operation, e-remittance business of e-banking unit and off-shore operations of the Off-Shore Banking Centre.

Bangladesh Economy

One of the world’s most densely populated countries, Bangladesh has a rapidly developing market-based economy. Per capita income, on a population base of 160 Mn. rose to US $1,190 in the 2013 -14 fiscal year. Bangladeshi economy has grown at a rate of 5.75% to 6.75% per annum over the past several years.

Bangladesh is a nation with enormous unrealised potential. Macroeconomic growth has been driven by exports and remittance; both have increased at a compounded annual growth rate of more than 15% over the past decade, accounting for more than a third of GDP.

More than half of national GDP comes from the services sector. Nearly 50% of Bangladeshis are employed in the agriculture sector; other important products include garments, textiles, pharmaceuticals, jute, leather and leather goods and ceramics. There is also a significant fishing industry.

Remittances from Bangladeshis working overseas, mainly in the Middle East, provide the major source of foreign exchange earnings. Garment and textile exports, jute cultivation, pharmaceuticals and shipbuilding have also been major drivers of economic growth.

Country has not fully recovered from the disruption of economic activities in 2013, during which the ready-made garment industry suffered heavy losses. New investment was at very low levels throughout 2014, and all financial institutions, faced with excess market liquidity and a lack of demand for substantial borrowing, struggled to maintain growth and profitability.

In 2014, Bangladesh achieved a Ba3 stable rating from Moody’s Bond Credit Rating Agency for the fifth consecutive year. Standard & Poor’s gave the country a BB- sovereign rating with stable outlook for the same period. However, the US $133 Bn. economy was hurt by election-related issues during the year. As a result, the Bangladeshi economy achieved 5.8% annual GDP growth, falling shy of the 7.5% target set at the beginning of the previous fiscal year. If the country is to reach its goal of achieving middle-income status by 2021, the economy will need to grow at a steady pace of 7.5% to 8% over the next several years.

The 2014 inflation rate is expected to hover around 6.5% to 7% as the result of wage increases and disruptions to food supplies caused by political protests – both factors in driving consumer prices higher. In the aftermath of the worldwide recession and unprecedented capital market volatility, the country suffered political violence throughout 2013, which hurt the Bangladeshi banking industry across the board. These problems continue, exacerbated by a political situation in which the main opposition representatives remain out of Parliament, despite calls from the caretaker Government for a collaborative effort.

During the past year, Bangladesh managed to achieve significant growth in its international reserves, which topped US $20 Bn. for the first time in history. This was well supported by continued expansion of exports and a decline in imports, coupled with a healthy flow of remittances.

In the course of 2014, the Bangladeshi currency, the Taka, depreciated 0.26% against the US Dollar, towards the latter part of the year due to some large import settlements. However, currency was stable throughout the year 2014. The interbank call money rate was stable during 2014, with sufficient liquidity in the market. Rates ranged from 5.25% to 8.50%, with the peak recorded in October 2014.

Performance of Bangladesh Operation

The financial system of Bangladesh consists of the Bangladesh Bank; 4 nationalised commercial banks; 4 Government-owned specialised banks; 39 domestic private banks; 9 foreign banks; and 31 non-bank financial institutions. Out of nine foreign banks, three are global – SCB, HSBC and CITI – and the rest operate regionally within South Asia.

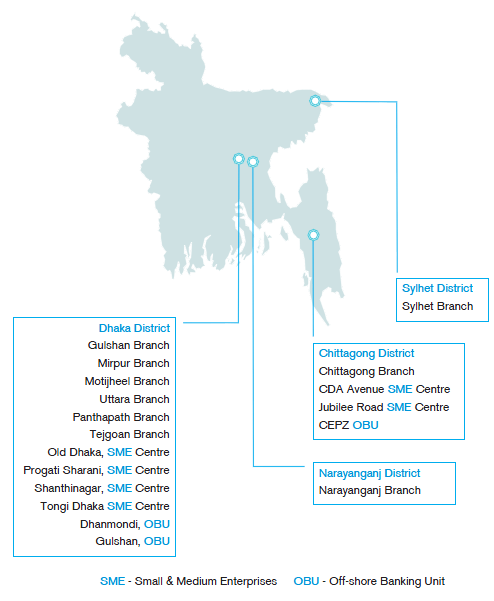

Commercial Bank first entered the Bangladesh market in 2003 by acquiring the operations of Credit Agricole Indosuez, a French bank with two branches and two retail booths. In the past 11 years, we have expanded to 10 branches, 6 SME centres and 2 off-shore banking units. We have also built a network of 19 ATMs, including 3 in off-site locations. Commercial Bank has established a leadership position among other regional banks operating in Bangladesh. Our Bangladesh operation caters to a wide-ranging clientele, including a healthy mix of corporate and retail customers.

Commercial Bank has a presence in three main geographical areas - Dhaka, Chittagong, Sylhet and Narayangonj in Bangladesh. Map of the Branch network in Bangladesh is given below:

As a foreign bank, we have a large corporate clientele. But with the expansion of our branch network, we have been able to attract more retail customers, as well as small and medium sized enterprises (SMEs). This has improved our low cost deposit base, resulting in lower cost of funds and improved profitability.

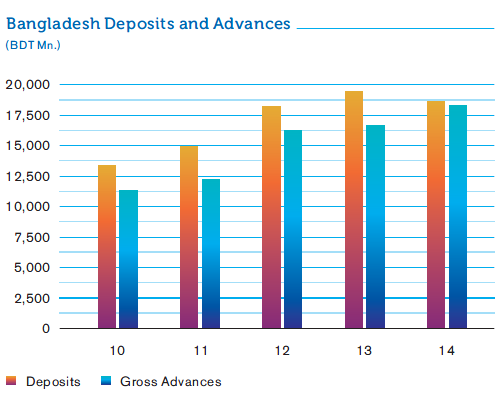

Past Performance of Bangladesh Operation

Through 11 years of sustained effort in Bangladesh, Commercial Bank has established a position well above other regional banks. While others have reported moderate or lower performance levels, ours have been consistently good. The Bank did well even in the difficult period of recessionary impacts, unprecedented market volatility and countrywide political violence that affected the entire sector in 2013.

Business Volumes

| Growth Over 2013 | ||||

| As at December 31, | 2014 BDT Mn. |

2013 BDT Mn. |

BDT Mn. | % |

| Deposits | 18,633.8 | 19,526.6 | (892.8) | (4.57) |

| Advances | 18,328.4 | 16,705.1 | 1,623.3 | 9.72 |

BDT - Bangladeshi Taka

Up to December 2014, Bangladeshi deposits decreased by 4.57% compared to December 2013. The market experienced very high surplus liquidity throughout the year, as lending opportunities were very low. This was the result of uncertainty in the market following the general election in January, 2014. Call money rates, as well as Treasury Bill/Bond rates, also dropped substantially, and very low credit growth forced all of the country’s banks to reduce deposit rates substantially.

Similarly demand for borrowing reduced throughout the year, though our Bangladesh Operation was managed to show a positive growth of around 10% in advances. The situation was further aggravated by large local corporations borrowing from foreign sources, with the permission of regulators, to take advantage of lower costs.

Bangladesh Deposits and Advances

Bangladesh Treasury

During 2014, the Treasury of our Bangladesh operation was able to maintain a stable balance sheet and revenue targets. However, reduced trade volumes resulting from sluggish market conditions, combined with severe competition, compelled us to operate on thin margins that yielded lower income. We maintained the market dominance in fixed-income securities throughout the year with sound forecasts and an aggressive trading strategy.

Operating Costs

Bangladesh operation continued with optimum resources during the year and thereby was able to sustain the high profitability standards we have set. Despite increase in network of branches and SME centres from four locations in 2003 to 18 in 2014 with a corresponding increase in human resources, we were able to effectively maintain a consistent cost to income ratio around 30% during this period. Nevertheless, operating costs continue to be strained by the shortage of skilled talent in the Bangladeshi banking industry, especially in foreign and local private-sector banks.

The performance of our Bangladesh operation during the last 5 years is tabulated below:

| For the Year Ended/as at December 31, | |||||

| Key performance indicators(*) | 2014 | 2013 | 2012 | 2011 | 2010 |

| Deposits (BDT Mn.) | 18,633.81 | 19,526.65 | 18,245.95 | 14,969.97 | 13,369.43 |

| Gross advances (BDT Mn.) | 18,328.43 | 16,705.12 | 16,344.90 | 12,338.19 | 11,403.94 |

| Total assets (BDT Mn.) | 32,063.52 | 27,451.21 | 25,682.73 | 21,655.37 | 18,819.10 |

| Net interest income (BDT Mn.) | 1,738.99 | 1,456.74 | 1,325.47 | 893.82 | 892.35 |

| Profit before tax (BDT Mn.) | 1,630.56 | 1,371.00 | 1,151.02 | 1,041.51 | 808.40 |

| Profit after tax (BDT Mn.) | 947.49 | 833.41 | 648.02 | 611.51 | 464.41 |

| Non performing advances ratio (%) | 2.11 | 1.52 | 0.79 | 0.68 | 0.07 |

| Cost to income ratio (%) | 28.15 | 30.91 | 33.04 | 32.83 | 34.89 |

| Return on Assets (%) | 5.09 | 4.99 | 4.31 | 4.81 | 4.3 |

| Return on Capital (%) | 14.86 | 15.21 | 13.02 | 15.69 | 15.22 |

* Based on Management Accounts

Awards and Recognition

In 2014, the Credit Rating Information and Services Ltd. awarded Commercial Bank’s Bangladesh Operation an AAA rating for the fourth successive year, based on the previous year’s financial performance. In addition, the Institute of Cost and Management Accountants of Bangladesh recognised our bank for the fourth time with a Best Corporate Performance Award in the Foreign Bank Category.

eRemittances

Sri Lanka’s overseas workforce continues to be a leading source of foreign exchange earnings for the country, as well as a major source of employment. Commercial Bank is aligned with the national Government’s strategy in targeting expatriate workers around the globe and making them aware of our secure and time-tested electronic channels for inward remittances.

As the nation’s economy saw its highest-ever revenue stream from overseas workers in 2014, recording more than an 8% growth, Commercial Bank’s eExchange inward remittance services also grew significantly.

Remittances were promoted through a range of communication campaigns in new markets such as Malaysia, Israel and Korea. Promotional efforts in established markets included special welcoming ceremonies for Sri Lankan workers in Kuwait and Qatar, sponsorship of cultural events across all overseas markets, and joint campaigns promoting a broad range of events throughout the 15 exchange corridors that the Bank represents. The Bank conducted local seasonal promotions – tied into the Sinhala and Tamil New Year celebrations, as well as Ramadan – aimed at key customer segments of eExchange services.

The Bank also partnered with the four main banks in Korea early in the year, placing our own representatives in their branches to promote remittances to Sri Lanka. As well, we introduced a new Cash to Account product created by MoneyGram, which enables expatriates based in Europe and Canada to route their remittances to any bank account in Sri Lanka.

The Bank’s network of overseas business partners expanded from 85 to 99 during the year, increasing coverage of key growth markets such as Israel, Korea, Australia and the UK. We now have 12 Business Promotion Officers, who aggressively promote the Commercial Bank eExchange brand and also cross-sell our other products and services.

| ComBank eExchange | Growth over 2013% |

| Income | 10.11 |

| Transactions | 11.94 |

| Volume | 12.34 |

Initiatives Taken to Enhance Regional Presence

Maldivian Operation

At present Commercial Bank conducts selective lending in Maldives under the supervision of Bank’s Corporate Banking Unit. Our exposure is mostly concentrated on the tourism sector which is the leading industry in Maldives. Major clients in the portfolio consist of well-established leading entities in the industry.

Myanmar Operation

The Commercial Bank became the first Sri Lankan bank to be granted a license by the Central Bank of Myanmar to operate a Representative Office in the South East Asian republic of more than 50 Mn. people.

This representative office is expected to assist in increasing bi-lateral trade between Myanmar and Sri Lanka and also to facilitate some of Sri Lanka’s leading apparel exporters and other industries who are expecting to set up operations in Myanmar. The Bank is in the process of planning the timelines for setting up its representative office as well as the services it will offer initially in Myanmar. The Bank envisages that this representative office will offer advisory services to Sri Lankan and Bangladeshi businessmen wishing to enter the Myanmar market and to arrange banking and advisory facilities and funds transfer and encashment services, subject to approval of the Central Bank of Myanmar.

The Bank is also exploring the feasibility of setting up its operations in a few other selected regional locations.

Support Services

Effective delivery of our banking products and services in a competitive marketplace depends heavily on the support of various specialised departments across Commercial Bank. Many have become business units in their own right, offering a growing array of invaluable services.

Our Information Technology Department, for example, has helped the Bank fully embrace emerging technologies that will advance both quality of service and operational efficiency. At the same time, our bricks-and-mortar locations remain vital to establishing a strong presence in communities across Sri Lanka. We have made substantial investments to improve our physical infrastructure in recent years.

The following sections review the operating highlights of a few key support services departments:

Human Capital

At Commercial Bank, we understand that our people are our most valuable asset. Human Resources play a vital role in achieving the objectives of the Bank. Their professionalism and proficiency, along with their diverse backgrounds, experience and points of view, have contributed significantly to our success. The detailed analysis of the full spectrum of Human Resource function including compensation and benefits, staff welfare, HR development and labor relations is discussed under the section of ‘Human Resources Management’ in the Sustainability Report.

Marketing

Marketing Department plays a key role building the brand Commercial Bank, building its corporate image, strengthening its corporate positioning platform ‘For a Better Future’, maintaining the presence of the Bank through visual media and promoting the products and services offered by the Bank.

Over the past year, the Bank’s Marketing Division had to address the challenge of attracting new clientele and retaining the valuable existing customers in a climate of declining interest rates.

We took the opportunity to enhance our brand image further, launching a refreshing new strategic direction. The goal was to position Commercial Bank as a forward-looking, consumer-focused Bank that caters to customers from all walks of life. A new brand slogan, ‘For a Better Future,’ conveys the core message that we are dedicated to helping fulfill customers’ needs today and tomorrow. And the accompanying integrated communication campaign emphasises our role as a provider of personalised services, with a disciplined focus on ensuring superior quality.

This longstanding commitment to helping create a better future for our customers paved the way for the Bank to becoming the No. 1 Bank in Sri Lanka and sets us squarely on the path to achieving our longer term strategic agenda towards Vision 2020.

Information Technology

The Bank’s Information Technology Department worked diligently over the past year to provide customers with innovative and engaging in-branch banking experience – most notably by leveraging growing familiarity with touchscreen technology to provide self-service information and transaction Kiosks at selected retail locations.

Our mobile banking channel experienced a high rate of growth, supported by the broad spectrum of mobile technologies introduced at the beginning of the year. In particular, customers embraced anytime anywhere banking allowing for ‘Queue Busting’ mobile option that allowed faster transactions and standing in line at branches.

Commercial Bank’s mobile strategy is set against the broader changes that have been unfolding recently in the Sri Lankan marketplace, as a growing number of non-bank providers support person-to-person mobile payment systems. While these providers have been instrumental in creating consumer interest and building a mobile-payments ecosystem, banks are nevertheless expected to continue playing a central role in this area.

Other highlights of the Bank’s efforts to improve the customer experience with technology over the past year include:

- ‘Banking at your fingertips’: we launched an acclaimed Android mobile banking app to complement the iOS app introduced in the previous year.

- ‘Queue Busting’: our cheque and cash deposit machines handled on average more than 3,000 transactions per month, with some locations exceeding 8,000 transactions.

- Anytime, anywhere banking: we increased our mobile banking customer base by more than 200% to 200,000.

- Corporate Internet banking: our new system, arguably the best in Sri Lanka, helped to grow our total number of online banking customers by 50%.

- Online applications for loans and fixed deposits: transactions totalling approximately Rs. 750 Mn. in each category were handled through the 24-Hour Automated Branch.

- Consolidated account opening: the single application form launched online in 2013 was extended last year to conventional branches as well.

- ATM network: we offer greater access than any other financial institution, with 606 machines by the end of 2014.

- Cash withdrawals from mobile wallets: customers can now withdraw cash from Mobitel mCash digital wallets using our cardless ATMs – a unique service in Sri Lanka.

In the past year, 217 Commercial Bank branches, as well as a few key departments at Head Office, installed digital signage systems that continuously broadcast interest rates, exchange rates, product updates (with relevant marketing campaign material), branch operating hours, special services and other valuable information. Installed near waiting areas or behind branch teller counters, the cost-effective electronic signs provide customers with real-time information that attracts interest, sparks dialogue and builds loyalty.

Recoveries

Across the Sri Lankan banking sector in 2014, financial institutions coped with an overall rise in non-performing loans (NPLs) resulting from problems with pawning advances in the first seven months of the year. However, NPLs began to decline after August as interest rates fell and financial institutions adopted appropriate measures to improve their asset quality.

Commercial Bank has a well-defined and rigorously documented process for recoveries that clearly defines the functions of the branches and our Central Recoveries Department. The branch recovery function is activated upon disbursement of the advance. The Branch Credit Monitoring Unit focuses on minimising new additions to the non-performing advances portfolio, constantly monitoring arrears, taking prompt action when required and liaising with the relevant branches.

During 3 to 6 months that an account is in arrears, branch staff co-ordinate with Regional Recovery Officers to follow the account closely and attend everything possible to recover the instalments owing, regularise payments and bring back the advance to the performing category.

The Central Recoveries Department assists the branches in trying to achieve prompt recovery of non-performing advances (NPAs), thereby maintaining our target NPA ratio. The department also monitors loan-loss provisions and all rescheduling/restructuring of advances carried out across the Bank.

When borrowers’ business ventures fail, it strains their cash flows and affects the timely repayment of credit facilities. We are often able to resolve such situations by restructuring facilities to suit borrowers’ revised payment capabilities, and in some cases by encouraging them to compromise on renegotiated settlement terms.

In 2014, we were able to reduce the NPA ratio of the Bank by recovering several large-scale advances, auctioning unredeemed pawned articles, closely monitoring non-performing accounts and undertaking effective recovery actions. Further, we have automated the entire process of classifying and declassifying NPAs to achieve increased efficiency. As a result, we were able to reallocate and saved resources into monitoring of advances, which will help to ensure an even healthier loan portfolio.

NPA and Provision Cover

| As at December 31, | ||

| 2014 % |

2013 % |

|

| Gross NPA Ratio (Net of Interest in Suspense) | 3.47 | 3.88 |

| Net NPA Ratio (Net of Interest in Suspense and Specific Provisions) | 1.86 | 2.12 |

| Provision Cover | 46.34 | 45.41 |

The Bank adopts a flexible approach in initiating recovery proceedings, evaluating each case on its merits and opting for negotiated settlement of NPAs rather than resorting to legal recourse, as this saves time, money and inconvenience for both parties.

By combining post-sanction monitoring with effective follow-up on large scale non-performing loans, we expect to maintain a low NPA ratio. And as we expand our repertoire of recovery strategies, these efforts should continue to contribute to the Bank’s bottom-line growth.

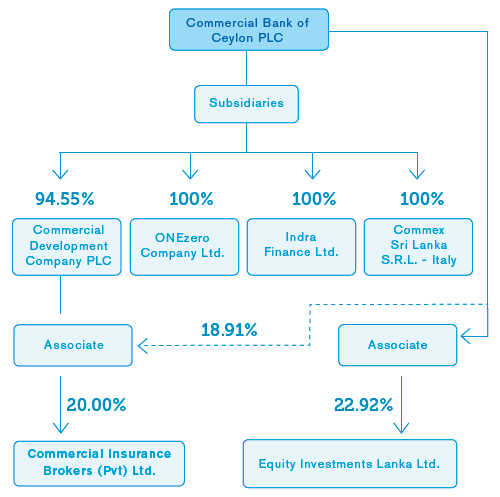

Subsidiaries and Associates

Commercial Development Company PLC

Commercial Development Company PLC (CDC) was formed in 1980 to build the present Head Office building of Commercial Bank. At present, the Bank holds 94.55% of stake of the CDC. Today CDC is one of the principal utility service providers to the Bank. The company derives most of its income from renting space in the Commercial House building, outsourcing staff and hiring vehicles to the Bank.

In 2014, CDC expanded its staff-outsourcing business, realising a significant increase in revenue and profits. The company earned an after-tax profit of Rs. 275.4 Mn. in 2014, 81.92% increase over the last year, arising largely from the fair-value gain on its investment property and increased income from its staff-outsourcing business.

ONEzero Company Ltd.

ONEzero Company Ltd., a wholly owned subsidiary of Commercial Bank, provides information technology services and solutions to the Bank.

ONEzero has three main lines of business: outsourcing workforce services to the Bank; providing support services from skilled IT professionals and maintenance technicians; and supplying hardware and pre-developed software. This last area of focus has so far contributed minimally to ONEzero’s bottom line, as the technology market is highly competitive. However, maintenance of hardware and software services to the Bank expanded further to another region during the year. Moving forward, ONEzero will continue to enhance the breadth and depth of its offering to match the Bank’s evolving requirements – while also coping with the high employee turnover that is characteristic of the IT industry generally.

In 2014, ONEzero recorded a post-tax profit of Rs. 30.29 Mn. an increase of 77.85% compared to 2013 mainly due to expanded support service business to new geographical areas of the Bank.

Commex Sri Lanka S.R.L. - Italy

Commex Sri Lanka, a fully owned subsidiary of the Bank, incorporated in Rome to serve the funds transfer needs of Sri Lankan expatriates in Italy.

During 2014, Commex tied up with Ria Financial Services offering Sri Lankan expatriates additional ways of remitting their earnings to Sri Lanka, supplementing the services already offered through MoneyGram. The tie up with MoneyGram and Ria permits remittances to all parts of the world through Commex.

In order to meet Italian Regulatory requirements, an Italian National having special expertise in the areas of Anti Money Laundering (AML) and Internal Audit was appointed to the Board of Commex. These steps are also expected to expedite the process of obtaining the Money Transfer License from the Bank of Italy, enabling Commex to undertake funds transfers on its own account.

Indra Finance Ltd.

In 2014, Commercial Bank acquired the 100% stake in Indra Finance Ltd. (IFL) in one of the first deals to be finalised under the Financial Sector Consolidation Road Map mandated by the Central Bank of Sri Lanka.

Located at No.182, Katugastota Road, Kandy, IFL was incorporated in 1987, licensed as a Specialised Leasing Company in 2007 and became a Licensed Finance Company in 2013. It is principally focused on granting lease facilities, hire purchase, mortgage loans and other credit facilities.

IFL benefits from close affiliation with the Indra Group, as most of its business comes from financing passenger and commercial vehicles sold and distributed by Indra Traders (Pvt) Ltd. IFL currently has offices in 11 locations.

This acquisition of IFL will significantly strengthen the Bank’s leasing operations. It enables us to offer lower-priced finance options for customers of Indra Traders, which has a significant share of the motor vehicles import and leasing market.

During the four months period up to December 31, 2014 from the date of acquisition on September 1, 2014, IFL recorded a post-tax profit of Rs. 26.68 Mn.

Commercial Insurance Brokers (Pvt) Ltd.

The Bank has an indirect stake of 18.91% in Commercial Insurance Brokers (Pvt) Ltd. (CIBL), through its subsidiary company, Commercial Development Company PLC. The Company is one of the country’s premier brokering firms for both life and general insurance policies. CIBL has built strong partnerships with US-based CA Technologies, as well as Pronto XI ERP of Australia, making it one of the most tech-savvy firms in the Sri Lankan insurance industry. By leveraging this technology leadership, CIBL ensures that its customers benefit from timely, responsive insurance solutions that reflect global standards.

In 2014, CIBL recorded a post-tax profit of Rs. 7.69 Mn. a decrease of 56.76% compared to 2013.

Equity Investments Lanka Ltd. (EQUILL)

Commercial Bank holds a 22.92% stake in EQUILL, a pioneering venture capital firm with more than 24 years of experience in the Sri Lankan market.

EQUILL’s performance in 2014 was negatively affected by the decline in interest rates offered on Money-Market instruments such as fixed deposits, commercial paper, treasury bills and trust certificates. Even so, the company was able to earn capital gains through the sale of shares in the equity market, taking advantage of favourable conditions on the Colombo Stock Exchange – and, more generally, recent economic developments in Sri Lanka that had a positive impact on publicly traded companies.

Venture capital is a comparatively high-risk business, because of the longer-term maturity periods for investments (typically four years or more), and also no collateral or security offered for funding. Even so, in 2014, EQUILL recorded a post-tax profit of Rs. 22.29 Mn., recording a growth of 179% compared to 2013. The company was able to minimise risk by diversifying its portfolio and structuring some of its instruments so that cash flows were more predictable.

Moving forward, EQUILL aims to increase its profits and funding base by seeking new investment opportunities. Its future performance will be driven by the overall performance of the money market, the share market and the economy as a whole.