Environmental Responsibility

Commercial Bank’s environmental management strategies focus on three aspects:

- Our direct environmental footprint related to energy consumption and the sourcing and disposal of goods.

- The indirect impact from the operations of our customers and supply-chain partners.

- CSR Trust Fund projects and initiatives designed to create an enhanced environmental footprint.

Managing our Direct Environmental Impact

Compared to many industries, banking has a negligible direct environmental footprint. Our day-to-day business activities consume minimal natural resources and do not generate high volumes of emissions or waste. In the case of Commercial Bank, our consumption of natural resources is primarily focused on energy and paper. We are conscious of the negative effects of waste on the environment, including from the disposal of IT equipment.

Reduction of Paper Usage

In 2014, we continued our efforts to minimise paper use and its negative environmental impacts by expanding the automation and centralisation of our business processes:

- The Bank’s email system was made more robust through the implementation of a parallel system connecting more than 2,000 Junior Executive Assistants, which has streamlined internal communication and reduced paper use.

- To improve accuracy and efficiency while reducing paper-based administrative work, we also began rolling out a biometrics attendance system during the Reporting period. However, the existing paper-based system will continue to be used until the new technology has been fully implemented, and is expected to be completed by the end of the first quarter of 2015.

- Wherever possible, we continued to replace existing paper-based manual processes with digital media and tools.

- We continued to raise employee awareness of the paperless office concept, discouraging any unnecessary printing of documents.

Reduction of Energy Consumption

While the Bank’s efforts to reduce paper use have succeeded, we’re aware that they may have led to increased power consumption. However, we assume the net impact on the environment is positive - especially in light of the following steps taken to reduce energy consumption:

- Procurement of ATMs and IT equipment that have Energy Star 5 ratings and are compliant with the RoHS standards.

- Investing in energy-efficient lighting and air conditioning equipment, conserving energy over the long term.

- Completed the server virtualisation and consolidation project to further reduce energy use.

- Designing new branches to use more natural lighting.

- Giving procurement preference to ATMs that can function without an air-conditioned environment.

The following table indicate the electricity consumption pattern over the last three years.

| For the year ended December 31, Measurement Unit |

2014 Gigajoule |

2013 Gigajoule |

2012 Gigajoule |

| Location | |||

| Sri Lanka | 52.866 | 51.592 | 54.241 |

| Bangladesh | 3.078 | 3.488 | 4.205 |

Waste Management

Because most of the Bank business processes are driven by information technology, we recognise our duty to minimise the hazardous environmental impacts from using and disposing of computer equipment and peripherals. The Bank has a programme to returns used IT equipment to vendors that follow internationally recognised disposal practices.

The heads of the Bank’s Logistics/Procurement and Information Technology Departments monitor compliance to ensure these activities are carried out diligently. We have also taken steps to confirm that employees responsible for procuring and disposing of assets carry out their roles in an environmentally sensitive manner.

The Bank has introduced several other initiatives to minimise the environmental impact of water usage, emissions, effluents and waste disposal. And our Staff Development Centre, when designing and conducting training programmes, ensures that employees are up to speed on the latest environmental initiatives affecting areas such as credit, operations, housekeeping and compliance.

We are determined to carry on expanding Commercial Bank’s steadfast commitment to protecting the environment.

Waste Disposals by Type

| For the year ended December 31, | 2014 in Kg |

2013 in Kg |

2012 in Kg |

| e-waste | Nil | Nil | 13,200 |

| Paper* | 130,335 | Unavailable | Unavailable |

*Bank started measuring disposal of paper only since 2014.

Managing Our Indirect Environmental Impacts

While the business operations of the Bank do not have a significant negative impact on the environment, the activities of our customers and suppliers may. We have therefore implemented procedures to mitigate the indirect impact caused by business and industrial activities that we help to finance, as well as by our supply-chain partners.

Managing Impacts in Our Customer Business Activities

Through our Social and Environmental Management System (SEMS), we work to ensure that any financing we extend to customers is used to support operations that are environmentally sustainable. Refer to the section ‘Managing the Social and Environmental Impacts of Products and Service’ for more details on how the SEMS helps us manage the Bank’s indirect environmental impact.

Supporting Environment Through Our Products

Our Investment Banking Unit and the Development Credit Department provide financial support and technical expertise for projects and business activities that create environmental benefits through reducing the use of natural resources and minimising waste. These funding were largely aimed at renewable energy generation projects and installation of modern machinery in the timber milling industry. The efficiency of these machines enables to reduce the electricity consumption by 60% and wastage by 30% respectively. This will decelerate deforestation and minimise the pollution caused by disposal of sawdust.

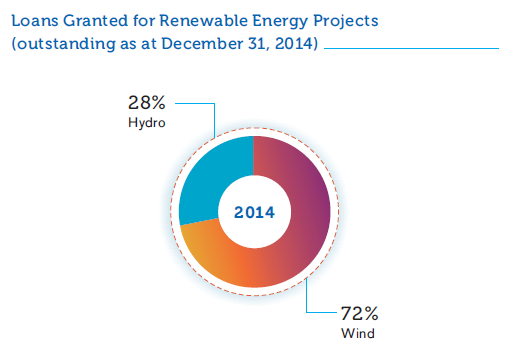

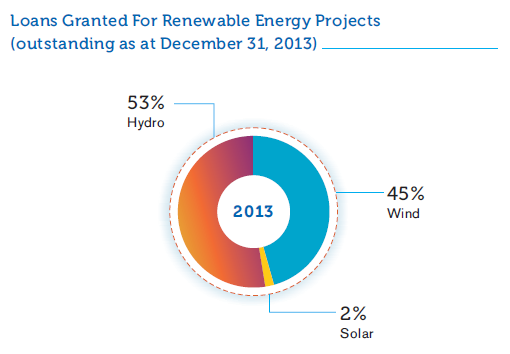

Loans Granted for Renewable Energy Projects by Source of Energy

| For the year ended December 31, | 2014 | 2013 | ||

| Amount Disbursed Rs. Mn |

Amount Outstanding Rs. Mn |

Amount Disbursed Rs. Mn |

Amount Outstanding Rs. Mn |

|

| Source of Energy | ||||

| Wind | 1,543 | 2,101 | 634 | 1,091 |

| Solar | – | – | – | 46 |

| Hydro | 11 | 819 | – | 1,263 |

| Total | 1,554 | 2,920 | 634 | 2,400 |

Apart from above we have extended banking facilities to many other business entities, who are engaged in providing renewable energy- generating solutions.

Loans Granted for Renewable Energy Projects

(outstanding as at December 31, 2014)

Loans Granted for Renewable Energy Projects

(outstanding as at December 31, 2013)

Managing Impacts in Our Supply Chain

All of the Bank’s preferred product and service providers are subject to a stringent evaluation process before being included on our approved list. Assessing the commitment of these supply chain partners to eliminate or mitigate negative impacts on the environment is an essential part of our sustainability process. Refer to the section ‘Supply Chain’ for more information on how we promote sustainability at every step in the Bank’s supply chain.

CSR Trust Fund Initiatives

As described earlier in this Report, the CSR Trust Fund is focused on environmental protection and conservation and the initiatives taken in this regard are detailed under Social Responsibility.