Product Responsibility

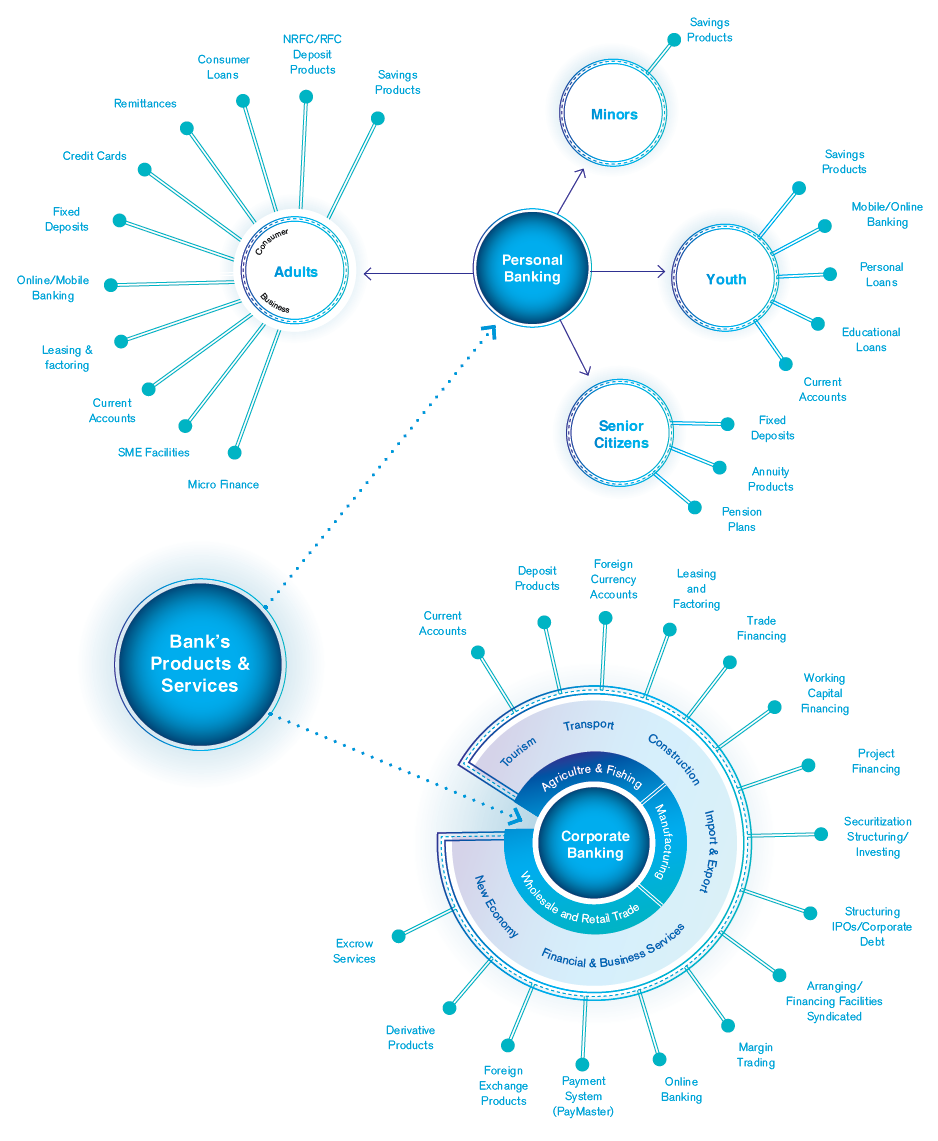

The Bank offers a wide range of products and services designed to meet a spectrum of customer needs. We constantly refine our existing products and develop new products and services addressing the evolving requirements of our customers, as well as technological change, market competition and economic and demographic developments. Flexible options within our offering enable customers to tailor products and services to their exact needs.

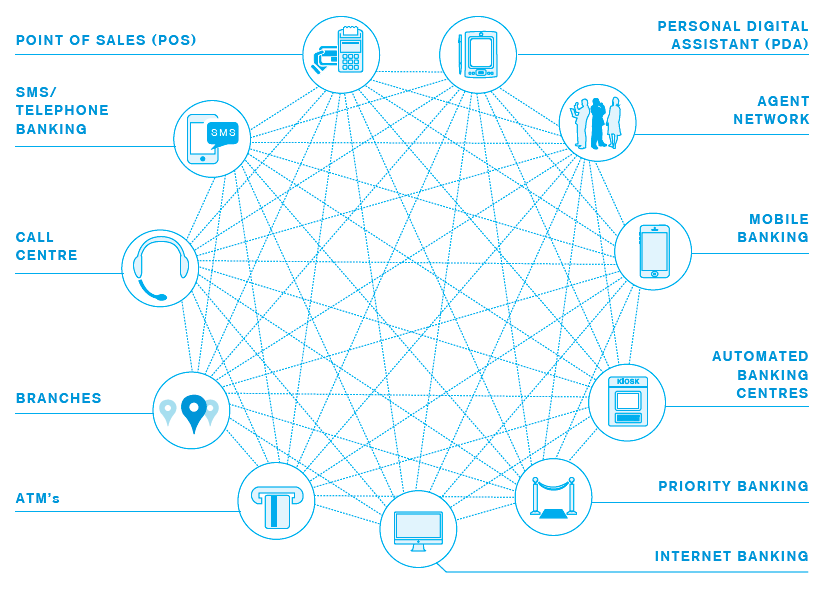

The Bank’s mix of delivery channels has been a strong factor in our growth and success, strengthening customer loyalty. By offering an array of channels, we ensure that our products and services are readily and easily accessible. Customers can conveniently connect with us in a variety of ways, at any time of the day and from wherever they are.

The Bank serves customers’ banking needs 365 days a year, through special holiday banking services at selected branches. Our supermarket banking outlets further extend banking services for added convenience. Refer Operational Review By Division for details on banking hours.

We are proactive in making service improvements, introducing state-of-the-art technology into our processes and channels to enhance our reach and efficiency in delivery. We opened our first 24-hour automated banking centre at Ward Place in 2014 and intend to open five more centres in the coming year as we pursue our target of 15 centres by the end of 2017. We launched a new mobile application (App) for Smartphone users to access ‘Combank Online’ facility conveniently through their hand phone devices.

With our robust product portfolio and island-wide network of branches and ATMs, Commercial Bank supports the Sri Lankan economy and fosters inclusiveness by providing financial solutions and infrastructure across the country. It is essential that we sustain our business operations, products and services in order to play our part in the country’s long-term economic growth and help improve the living standards of our people, especially in low-population and economically disadvantaged areas.

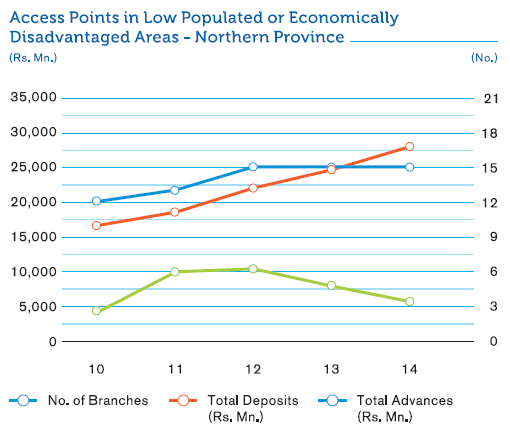

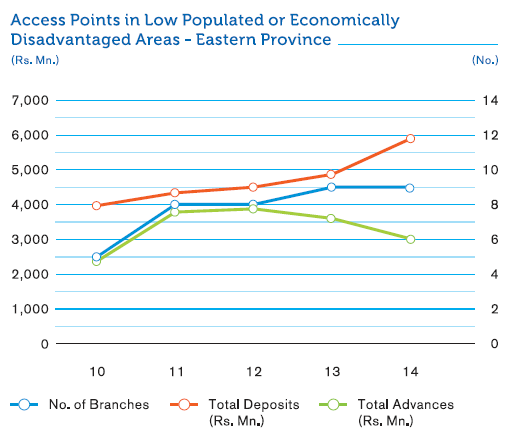

Access Points in Low-Populated or Economically Disadvantaged Areas

Sri Lanka’s 30-year civil war deprived a significant part of the country of vital economic activity. The Northern and the Eastern provinces in particular were not able to benefit from opportunities available to the rest of the country. Since the end of the war in 2009, we have expanded our operations in the two provinces by opening new branches and installing ATMs, revitalising communities and helping the disadvantaged to revive their prospects. The following table summarises the number of branches and ATMs in operation as of December 31, 2014 and related business volumes, underlining the Bank’s contribution to these recovering communities:

Access Points in Low-Populated or Economically Disadvantaged Areas - Northern Province

Access Points in Low-Populated or Economically Disadvantaged Areas - Eastern Province

| As at December 31, | 2014 | 2013 | 2012 |

| Northern Province | |||

| No. of Branches | 15 | 15 | 15 |

| No. of ATMs | 35 | 34 | 33 |

| Deposits (Rs. Mn.) | 27,857 | 24,573 | 21,907 |

| Advances (Rs. Mn.) | 5,705 | 7,914 | 10,459 |

| Eastern Province | |||

| No. of Branches | 9 | 9 | 8 |

| No. of ATMs | 19 | 18 | 17 |

| Deposits (Rs. Mn.) | 5,898 | 4,870 | 4,501 |

| Advances (Rs. Mn.) | 3,010 | 3,596 | 3,873 |

Initiatives to Improve Access to Financial Services for Disadvantaged People

Commercial Bank has undertaken several initiatives to make financial services more readily available to disadvantaged customers, including:

- Executing advertising materials in three languages – Sinhala, Tamil and English.

- Deploying staff in the Northern and in the Eastern provinces who can communicate in all three languages.

- Providing access for wheelchairs in branches where such facilities can be accommodated. Wheelchair accessibility will be a key consideration as we open new branches and relocate existing ones. Currently, 118 branches have wheelchair access (up from 66 in 2013) and all branches have lower counters.

Products Designed to Benefit Society

During 2014, the Bank arranged financial facilities through our development lending arm, using a group lending model for micro-entrepreneurs and agriculturists who were unable to secure conventional loans due to a lack of acceptable collateral. Financial assistance was provided through both Bank-funded and refinance loan schemes.

We granted loans amounting to Rs. 39 Mn., drawn from the Bank’s own funds, to customers in the timber-milling industry. This financing was used to purchase equipment that will yield environmental benefits, including reductions in natural resource consumption, energy use and waste.

The table below provides details of loans and lease facilities granted to the agricultural and microfinance sector during 2014:

| Funded by the Bank | Funded through Refinance Schemes | |||

| Sector/Type | No. of Loans | Amount Rs. Mn. |

No. of Loans | Amount Rs. Mn. |

| Agriculture | 805 | 3,160 | 3,094 | 762 |

| Agriculture - Leasing | 35 | 73 | – | – |

| Microfinance | 701 | 282 | 570 | 95 |

| Total | 1,541 | 3,515 | 3,664 | 857 |

Product/Service Labelling and Marketing Communications

At Commercial Bank, we believe in ethical marketing practices and ensure that our products and services are clearly explained, consistently branded and directed to all sectors of the public. We disseminate clear, accurate, timely and relevant information about interest rates – both nominal and annual effective – as well as fees, commissions, charges, tariffs, terms and conditions.

Up-to-date information on products and services is available through our website, as well as through our information centre, which operates from 8.30 a.m. to 5.00 p.m. on all business days. In the countries where the Bank has a significant presence, we ensure that all forms of communications are offered in languages that are widely used.

The Marketing Department, headed by the Deputy General Manager – Marketing, ensures that marketing communications materials meet the following criteria:

- Comply with corporate and information security policies.

- Reflect and support the corporate image of the Bank.

- Avoid exposing the Bank to potential litigation.

- Avoid racial content or inappropriate imagery and information.

- Are transparent and do not mislead customers.

- Present clear and consistent messaging.

- Use suitable language/s reflective of cultural awareness.

- Include information required and mandated by the Customer Charter of the CBSL.

- Avoid infringing intellectual property rights.

- Have product logos that are registered with National Intellectual Properties of Sri Lanka, in order to maintain the rights of such properties with the Bank.

- Are open to feedback from the media, as well as key media target groups.

In addition, the Bank respects the following requirements:

- Approvals by both external and internal parties prior to the launch and communication of any customer or employee related promotional activity.

- Rules and regulations concerning displays, public-address systems, branding signage and similar materials.

- Approval from the relevant Heads of departments for communications materials and website changes.

- Assurance from a designated department that information posted on the Bank’s website is current, accurate and appropriate.

Sale of Banned or Disputed Products

As a matter of strict policy, the Bank does not sell or market products or services that are banned in any market or are the subject of stakeholder queries or public debate. Neither do we finance any project that is deemed illegal or that involves production of, or trade in, the following items: weapons and ammunition; radioactive material; unbounded asbestos fibre (i.e., with more than 20% asbestos content); gambling, casino or equivalent enterprises; and drift-net fishing using nets in excess of 2.5 km in length.

We also work to ensure that the Bank’s total lending to industries engaged in tobacco and alcohol production, as well as wood-based and forestry operations, will remain below 3% of our overall loans portfolio.

The Bank provides a set of products and services that are highly regularised, duly registered and operate in strict compliance with the CBSL Customer Charter, especially with regard to labelling and dissemination of marketing information. Although we operate in certain overseas markets through fully-fledged banking operations, as well as via Business Promotions Officers, the products and services on offer – including features, pricing, rates and tariffs – are likewise strictly monitored and duly approved by the governing laws of each country.

Customer Privacy

Safeguarding customer privacy is of paramount concern to Commercial Bank as we handle large volumes of sensitive information arising from a wide range of transactions. We have therefore put in place systems and procedures designed to protect customers’ private information and ensure confidentiality. Key measures include:

- An oath of secrecy sworn by all employees.

- Restrictions on the disclosure of account information to any third party.

- Continuous improvements in the protection of online privacy.

- Assurance of email privacy.

- Maintenance of accurate customer information.

- Preventing access to banking transactions for underage children unless a parent has given consent.

- Limitations and controls on employees’ access to personal information of customers.

The Bank remains vigilant about possible threats to security of information communicated through potentially vulnerable electronic media. We are constantly strengthening the security of products and services that rely on digital transmission of data, including Internet banking, mobile banking and point-of-sales transactions. The Bank’s Integrated Risk Management Department, Inspection Department and the Information Technology Department play pivotal roles in this respect through constant monitoring and applying new security precautionary measures where necessary. There were no substantiated complaints regarding breaches of customer privacy and losses of data during the reporting period.

Market Surveys on Customer Satisfaction

The Bank carries out a customer satisfaction survey annually with the following objectives:

- Assessing the needs and expectations of customers.

- Determining current satisfaction levels in relation to set customer service requirements.

- Evaluating the relative impact of specific responses on overall customer loyalty.

- Providing strategic direction for improvement in critical areas.

- Identifying opportunities that can be leveraged for competitive advantage.

The annual survey reveals current loyalty scores while also measuring year-over-year shifts in loyalty, customer satisfaction, future potential and much more. The data collected helps us improve quality standards, process efficiency and our communications outlook.

Though this survey results revealed a shift from the ‘Truly Loyal’ segment to the ‘Trapped’ segment in comparison with the previous year’s results, a significant proportion as high as 74% (81% in 2013) of customers continued to be ‘Truly Loyal’. The ‘Trapped’ segment scored 19% as against 16% in 2013. The survey also showed a similar trend in the comparable banks too. We exceeded the established norms for customer commitment and continuity, while scores related to discontinuing relationships and customer ‘inertia’ remained significantly low. The survey also revealed very good scores in operational/process areas, including rankings related to account openings and loan acquisition, as well as the availability of new banking channels and communication effectiveness.

Product Development Committee

The Bank’s Product Development Committee is responsible for assuring that our products and services conform to applicable laws and regulations, and reflect ethical practices. The committee, headed by the Chief Operating Officer, includes those officers holding the highest positions in the Bank’s main business lines, as well as in the divisions responsible for internal audit, information technology, marketing, compliance, legal and finance. They have the expertise and authority to conduct thorough evaluations of all new development, along with any changes to our current offering, ensuring that products and services meet the following criteria:

- Properly designed to capture and deliver expected benefits to their target market.

- Financially and technically viable.

- Compliant with industry and legal requirements.

- Avoid infringement of any intellectual property rights.

- Supported with proper process instructions, procedures, controls and monitoring frameworks.

- Free of any negative impact on society and the environment when used by customers.

Managing the Social and Environmental Impacts of Products and Services

Activities undertaken directly by the Bank conform to effective social and environmental management practices. In addition, the potential impacts of activities and businesses that we assist to finance are also considered during credit evaluation. Lending decisions must be aligned with Social and Environmental Management System (SEMS), as well as applicable national laws and regulations on environmental and social issues. We make every effort to assist our customers to be in compliance with regulations, rather than simply rejecting outright proposals that do not meet current standards.

Procedures implemented under the Bank’s SEMS enable us to review and manage the social and environmental issues and risks associated with investments. These procedures are applicable to any form of finance extended by the Bank; however, we do allow a certain degree of leniency when it comes to short-term financing, including working capital and trade finance facilities in which financing is provided for a year or less.

We strive constantly to ensure that effective social and environmental management practices are adopted in the Bank’s activities, products and services, with a special focus on the following:

- Ensuring that projects and activities are reviewed against the applicable requirements of the Bank’s Social and Environmental Policy.

- Only financing projects that will be designed, built, operated and maintained in a manner consistent with the applicable requirements of our policy.

- Making our best effort to ensure that projects are operated in compliance with the applicable requirements on an ongoing basis, during the currency of Bank’s financing.

- Maintaining transparency in activities of the Bank.

- Ensuring that customers understand the policy commitments we uphold in the area of social and environmental management.

The SEMS Co-ordinator, under the purview of the Chief Manager - Risk, enables the Integrated Risk Management function to validate SEMS compliance on credit proposals of Rs. 100 Mn. or more that require a risk evaluation. The SEMS Co-ordinator is required to submit periodic confirmations – subject to audit by the Inspection Department – that the relevant financing deals comply with the terms and conditions established by the International Finance Corporation.

The Bank’s lending officers also undertake desk reviews on an ongoing basis and visit financed projects sites to evaluate their environmental and social impacts, as well as how well our clients are fulfilling their related and agreed objectives. As a result of these reviews, borrowers may be obliged to take mitigating actions aligning projects in a timely manner with sustainability standards. The Bank’s lending officers are required to record a summary of discussions and interactions in face-to-face encounters during client project visits.

The mandate of Commercial Bank’s SEMS Co-ordinator is to ensure compliance with relevant procedures on every project. The Co-ordinator receives ongoing training to continuously update required skills. We also leverage the Co-ordinator’s expertise – augmented by external support as needed – to instruct and mobilise Bank staff on environmental and other sustainability issues. As well, we take every possible step to ensure that our employees, along with the decision-makers at client firms, understand and agree to the principles outlined in the SEMS. Given below is a summary of the SEMS evaluations carried out during the reporting period.

| Number of Credit Proposals Evaluated | 3,063 |

| Number of Credit Proposals Rejected | None |

| Number of Credit Proposals Approved Subject to Conditions | None |

| Number of Non-Compliance Incidents Observed | None |