Circular to Shareholders on Proposed Employee Share Option Plan – 2015 (ESOP-2015)

Dear Shareholder/s,

1. Business Case

(a) Background and Proposal

Commercial Bank of Ceylon PLC (the ‘Company’) has, with the approval of the Shareholders successfully implemented the two Employee Share Option Plans (‘ESOPs’) which were introduced during the years 2002 [‘ESOP-2002’]and 2008 [‘ESOP-2008’], respectively. The said ESOPs, which had also received the approval of regulatory bodies were operated in accordance with the Guidelines set out by the Securities and Exchange Commission of Sri Lanka (the ‘SEC’) and the Colombo Stock Exchange (the ‘CSE’) and were successfully concluded in 2006 and 2012 respectively.

Given the success of the above two ESOP schemes, which have been of mutual benefit to both employees and Shareholders of the Company, and, in keeping in line with modern international practices, the Company’s Board of Directors propose to introduce an ESOP for the year 2015 [‘ESOP-2015’], subject to regulatory and Shareholder approval being obtained therefor. It is to be noted that in comparison to the previous ESOP schemes, the eligible employee coverage has been improved significantly, in this scheme.

Furthermore, ESOP-2015 has been structured with the professional assistance of NDB Investment Bank [‘NDBIB’] and also Messrs KPMG, Chartered Accountants, who have provided advice regarding the tax and accounting implications pertaining to the scheme. The terms and conditions governing the ESOP-2015 are, as set out herein, subject however to the provisions of applicable Statutes, the Listing Rules of the CSE and other applicable rules and regulations of regulatory bodies and provided that any matter not expressly dealt with herein or which lacks clarity will, for purposes of administrative efficacy and clarity of this scheme, be determined at the discretion of the Company’s Board of Directors [subject to such Board being constituted for this purpose only of the Non-Executive Directors] within the framework of the Report provided by NDB Investment Bank to establish ESOP-2015.

ESOP-2015 will come into effect from April 01, 2016 [subject to all necessary approvals being obtained therefor] and will lapse on September 30, 2018.

(b) Global Trends

ESOPs are increasingly used in the corporate world as an effective tool to align employee interests with Shareholder expectations by enabling employees to take part in the share ownership of the Company.

(c) Benefits to Shareholders and to the Company

As you are aware your Company has been performing remarkably well in the recent past. These recent successes of the Company are largely due to the efforts and contributions made by the staff, in particular the Executive Officers in Grade 1A and above, whose efforts have been highly appreciated by the Shareholders at general meetings of the Company.

The ESOP-2015 is proposed by the Board of Directors in aiming at further motivating the staff, so that they would continue to maintain the growth momentum of the Company and push the Company into new heights in the future with consequential direct and indirect benefits to Shareholders. The Board of Directors are confident that the staff motivation generated through the proposed ESOP-2015 will contribute substantially towards the success of your Company in out-performing the local market, in terms of business growth, profitability and market capitalisation of its shares.

2. Quantum of Share Options to be Issued

Under the proposed ESOP-2015, the Company will allocate up to a maximum of 2% of the total issued and fully-paid ordinary [voting] shares of the Company amounting to 16,210,714 (subject to exercise of existing ESOPs). This equity allocation would be issued to employees in the form of share options in a maximum of three (03) annual tranches spread over a period of three (03) years, commencing from 2015 and after 3 years the ESOP-2015 would lapse.

The first two tranches would amount to a maximum of 0.5% each, whilst the third tranche would amount to a maximum of 1%, of the ordinary [voting] shares in issue as at the grant date [i.e. the date on which the share options are offered/granted to the employee]. The Company’s Board of Directors will, however, have the discretion to decide on the exact size of an annual tranche up to the said limits to be granted in a financial year, depending on the extent of achievement of the qualifying criteria by the Company in the previous year, as detailed in Section 3 below (subject however to the 2nd paragraph of section 4 below). If the quantum of share options offered in a given year is less than the abovementioned maximum amounts of 0.5% or 1%, the remainder which has not been offered in a given year will remain unissued.

In the event of subsequent Bonus Issues [Capitalisation of Reserves], Stock Dividends, Rights Issues and/or Sub-division/Consolidation of Shares by the Company which occur during the vesting period and the exercise period [in the case of unexercised options], the number and the exercise price of the share options to be offered under the affected tranches will be adjusted as per the applicable rules of the ESOP-2015, which have been drafted in accordance with the accepted market practices.

3. Qualifying Criteria that the Company should satisfy to proceed with ESOP-2015

(a) Profitability

- The Bank should achieve the annual budgeted profit after tax for the respective financial year commencing from 2015 for eligible employees to be entitled for share options.

- The Company’s percentage growth of Profit After Tax (PAT) in a financial year should exceed the average of percentage growth of PAT disclosed by the competitor banks in their Annual Reports during the same period. However, PAT of the Company and competitor banks will be adjusted on account of the foreign currency transaction gains/losses, if any, arising from their overseas banking operations, and which are currently recognised in the Statement of Changes in Equity, as per the Accounting Standards.

These competitor banks for 2015 will be Hatton National Bank PLC, Sampath Bank PLC, NDB Bank PLC, Seylan Bank PLC and The Hongkong and Shanghai Banking Corporation Ltd - Sri Lanka Branch. The Board of Directors has the authority to amend the list of comparator banks, depending on the market conditions and other relevant issues.

(b) Return on Equity (ROE)

There are two sub-criteria to be fulfilled in this connection-

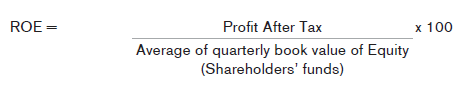

- The Company’s ROE for a financial year measured as per the following formula should exceed the required ROE of the Company, to be decided by the Board of Directors of the Company.

Required ROE = Simple average of the weekly published weighted average rates of interest (after tax) on one (1) year Treasury bills during the applicable financial year (risk free rate) + an equity risk premium to be determined by the Board of Directors between 5% - 7% which will be communicated to the eligible staff annually in advance.

- ROE of the Company, measured as per the formula in 3(b)(i) above for a financial year should exceed the average (pooled) ROE of comparator Banks during the same period, to be calculated using the same formula referred to in 3(b)(i) above.

(c) Compliance

The Company should fulfill all the following compliance requirements:

- To obtain an unqualified audit opinion from the external Auditors;

- To fulfill the Regulatory requirements on Capital Adequacy, Liquid Assets and Statutory Reserve Requirements of the Central Bank of Sri Lanka (the ‘CBSL’), without any material breach;

- To classify the Non Performing Loans properly;

- To make provisions on Non performing Loans accurately;

- To adhere to the rules of the CSE and the Securities and Exchange Commission of Sri Lanka; and

- To adhere to the applicable provisions of the Mandatory Corporate Governance Code of the CBSL.

Fulfillment of the above compliance criteria should be established from the disclosures made in the Directors’ and Auditors’ Reports contained in the Company’s Annual Report.

4. How to be Eligible for ESOP-2015

From 2015 onwards the Company will be required to fulfill any two of the four criteria referred to in 3(a), 3(b)(i) and 3(b)(ii) above in the financial year applicable, in addition to the compulsory fulfillments of the criterion on Compliance, referred to in 3(c)above.

An employee of the Company shall not be entitled to acquire through ESOPs more than one percentum (01%) of the total number of shares issued by the Company at any given time.

Hence, share options under the annual tranches up to a maximum of three (03) will be granted during the period from 2016 to 2018. Any share options not allocated during this period, due to the Company not achieving the above qualifying criteria will be cancelled.

5. Share Option Grant Dates

Share options under the 1st tranche of the ESOP-2015, shall, in respect of the year 2015, be offered on April 01, 2016. Thereafter, options under the remaining tranches will be offered on April 01 each year until the conclusion of the maximum of three (3) tranches of the ESOP-2015, the last being on April 01, 2018.

6. Share Option Allocations to Individual Employees – Eligibility Criteria

For an employee to be eligible for share options under a particular tranche of the ESOP- 2015, he/she:

- should be an Executive Officer in Grade 1A or above working in Sri Lanka operations and includes Executive Directors of the Company and having a performance grading of ‘Very Good’ or above in the annual performance assessment system of the Company for the applicable year.

7. Vesting Period

Once the share options are granted for 2015, 2016 and 2017 the eligible employee should remain in the employment from April 01 to September 30, 2016, 2017 and 2018 respectively for them to be able to exercise each option of ESOP-2015. Hence, every tranche will have the following vesting schedule:

| Tranche |

% of Voting

Shares Issued (maximum) |

Period of

Performance Evaluation |

Option

Grant Date (Assumed) |

Date of Vesting |

Exercise Period |

| 1 | 0.5 | FY 2015 | 01.04.2016 | 30.09.2016 | 1.10.2016 to 30.09.2019 |

| 2 | 0.5 | FY 2016 | 01.04.2017 | 30.09.2017 | 1.10.2017 to 30.09.2020 |

| 3 | 1.0 | FY 2017 | 01.04.2018 | 30.09.2018 | 1.10.2018 to 30.09.2021 |

7.1. Early Vesting

In the event of retirement or death of an eligible employee, there will be an immediate vesting of all the options granted to the respective eligible employee.

8. Exercise Period

This is the period which follows the vesting period, during which an eligible employee could exercise the share options to purchase the ordinary [voting] shares of the Company at the pre-determined exercise price, as detailed in Section 9 below.

The exercise period applicable after each of the vesting periods referred to in Section 7 above would be 3 years. Accordingly, the exercise period schedule of the ESOP-2015 would be as follows, assuming that options under each of the annual tranches will be issued upto the full 0.5% in the first two years and the full 1% in the third year, these being the consecutive years 2016, 2017 and 2018.

| Tranche |

% of Voting

Shares Issued (maximum) |

Period of

Performance Evaluation |

Option

Grant Date (Assumed) |

Date of Vesting |

Exercise Period |

| 1 | 0.5 | FY 2015 | 01.04.2016 | 30.09.2016 | 1.10.2016 to 30.09.2019 |

| 2 | 0.5 | FY 2016 | 01.04.2017 | 30.09.2017 | 1.10.2017 to 30.09.2020 |

| 3 | 1.0 | FY 2017 | 01.04.2018 | 30.09.2018 | 1.10.2018 to 30.09.2021 |

Any options not exercised during the applicable period will be cancelled, subject to the vesting arrangements applicable for eligible employees on retirement and/or death [such vesting arrangements and applicable Exercise Periods shall be determined at the discretion of the Company’s Board of Directors (subject to such Board being constituted for this purpose only of the Non-Executive Directors)].

However, in the event of resignation of an employee prior to vesting (as detailed in Section 7 above), any options offered to him, but not vested will be cancelled, allowing him to exercise only the vested but unexercised options, if any. On the other hand, in the event of dismissal or serious disciplinary action being taken against a particular employee, all vested but unexercised options, if any, as at the date of dismissal/date on which disciplinary action is taken [including where the employee voluntary resigns due to such factors] would be cancelled.

9. Share Option Exercise Price

All share options will be offered at a predetermined price. However, in order to ensure that the Company would receive a fair value, the share options will be priced at a volume-weighted average market price of the Company’s ordinary (voting) shares, during the period of thirty (30) market days, immediately prior to each option grant date.

However, in the event of a Bonus Issues [Capitalisation of Reserves], Stock Dividends, Rights Issues and/or Sub-division/Consolidation of shares by the Company during the applicable vesting periods of the ESOP-2015, the share option exercise price of the affected tranches will be adjusted as per the applicable rules of the ESOP-2015 which have been drafted in accordance with the accepted market practices.

10. Financial Support to Purchase Shares Under the ESOP-2015

Neither the Company nor its subsidiaries will provide any direct or indirect financial support to the Company’s employees to purchase shares under the proposed ESOP-2015.

The employees holding shares issued under any previous ESOPs which were funded by the Company or any of its subsidiaries and an employee share trust, shall not participate in voting at the Extraordinary General Meeting to be held on March 31, 2015.

11. Accounting and Financial Reporting Implications to the Company Under the ESOP-2015

The Company is mindful of the “Sri Lanka Accounting Standard- SLFRS 2 Share-based Payments” which sets out the financial reporting implications to an entity when it undertakes a share-based payment transaction. In particular, it requires an entity to reflect in its profit and loss and financial position the effects of share-based payment transactions, including expenses associated with transactions in which share options are granted to employees. This has been modelled after IFRS 2 - Share Based Payments.

At the grant date of the options, the Company is required to recognise the value of the share options granted to employees through the ESOP-2015. The value of the share options should be calculated using an option valuation model. SLFRS 2 recommends using either Black-Scholes-Merton Model or Binomial Option Valuation Models for this purpose. NDBIB has estimated the value of the options using the Binomial Model of option valuation.

The value of the options should be amortised over the vesting period. Assuming that the impact to the Statement of Comprehensive Income for the first year as per Auditor’s estimates is Rs. 278.7 Mn., which could however be amortised over the vesting period of 3 years. Furthermore there will be no outgoing from the Company in this connection, as the accounting entries to be passed for this purpose will be a debit to the Income Statement, whilst credit is placed in the equity account of the Company.

12. Tax Implications

The profit and loss impact mentioned above in each financial year will not be treated as tax deductible expenses for the Corporate Tax purposes and Financial VAT purposes since the expenses mentioned above will not be made in the form of cash/monetary means in the hands of employees. However, for PAYE tax purposes such expenses will be treated as employment benefits at the point of option exercise by the employees, hence, will warrant tax deduction according to each employee’s effective tax rate.

13. Appointment of Managers to the ESOP - 2015

The Company will arrange to appoint independent Managers with no conflict of interests, to manage and monitor the proposed ESOP-2015.

14. Consideration for the Issue of Shares

As required by Section 52 of the Companies Act No. 07 of 2007, the Board has resolved that in its opinion that the consideration, for which the Company’s ordinary [voting] shares are proposed to be issued, is fair and reasonable to the Company and to all existing Shareholders.

Such consideration will be equivalent to the volume weighted average market price of the Company’s ordinary [voting] shares, during the period of thirty (30) market days, immediately prior to each option grant date.

15. Approvals

(i) Listing Rules of the CSE

The Board of Directors of your Company, having considered the above implications and overall benefits to the Company and its staff arising from the proposed ESOP-2015, are pleased to recommend ESOP-2015, which has been approved by them, to the Shareholders for their formal approval.

As per Listing Rule 5.6 of the Listing Rules of the CSE, the prior approval of the Shareholders, by way of a special resolution at a general meeting must be obtained for the purpose of creating or establishing a scheme such as ESOP-2015. Accordingly, an Extraordinary General Meeting has been convened for March 31, 2015 for this purpose and the proposed resolutions to be passed thereat is set out in the attached Notice of Meeting, for the consideration and due adoption by the Company’s Shareholders thereat.

Subject to the above, your Directors have obtained ‘in principle’ approval of the CSE, for the listing of the ordinary [voting] shares to be allotted and issued under the ESOP-2015.

(ii) Requirements under the Companies Act No. 07 of 2007 and the Articles of Association of the Company

In terms of Article 9 A of the Company’s Articles of Association, the Company’s Shareholders have a pre-emptive right to new issues of shares, unless otherwise resolved to by way of an ordinary resolution. Since new ordinary [voting] shares will be issued under ESOP-2015, the requisite resolution to be passed by Shareholders waiving their pre-emptive rights thereto is set out in the attached Notice of Meeting, for due consideration and adoption by the holders of the Company’s ordinary (voting) shares.

Approval is also sought of the holders of the Company’s ordinary [voting] shares by way of a special resolution, in relation to the allotment and issue of new ordinary [voting] shares under the ESOP-2015, in pursuance of Section 99 of the Companies Act No. 07 of 2007 and Article 10 of the Company’s Articles of Association. The requisite resolution to be passed in this regard is set out in the attached Notice of Meeting, for due consideration and adoption by the holders of the Company’s ordinary (voting) shares.

By Order of the Board of Commercial Bank of Ceylon PLC

(Sgd.)

Ms. Ranjani Gamage

Company Secretary

March 09, 2015