Our Business Model

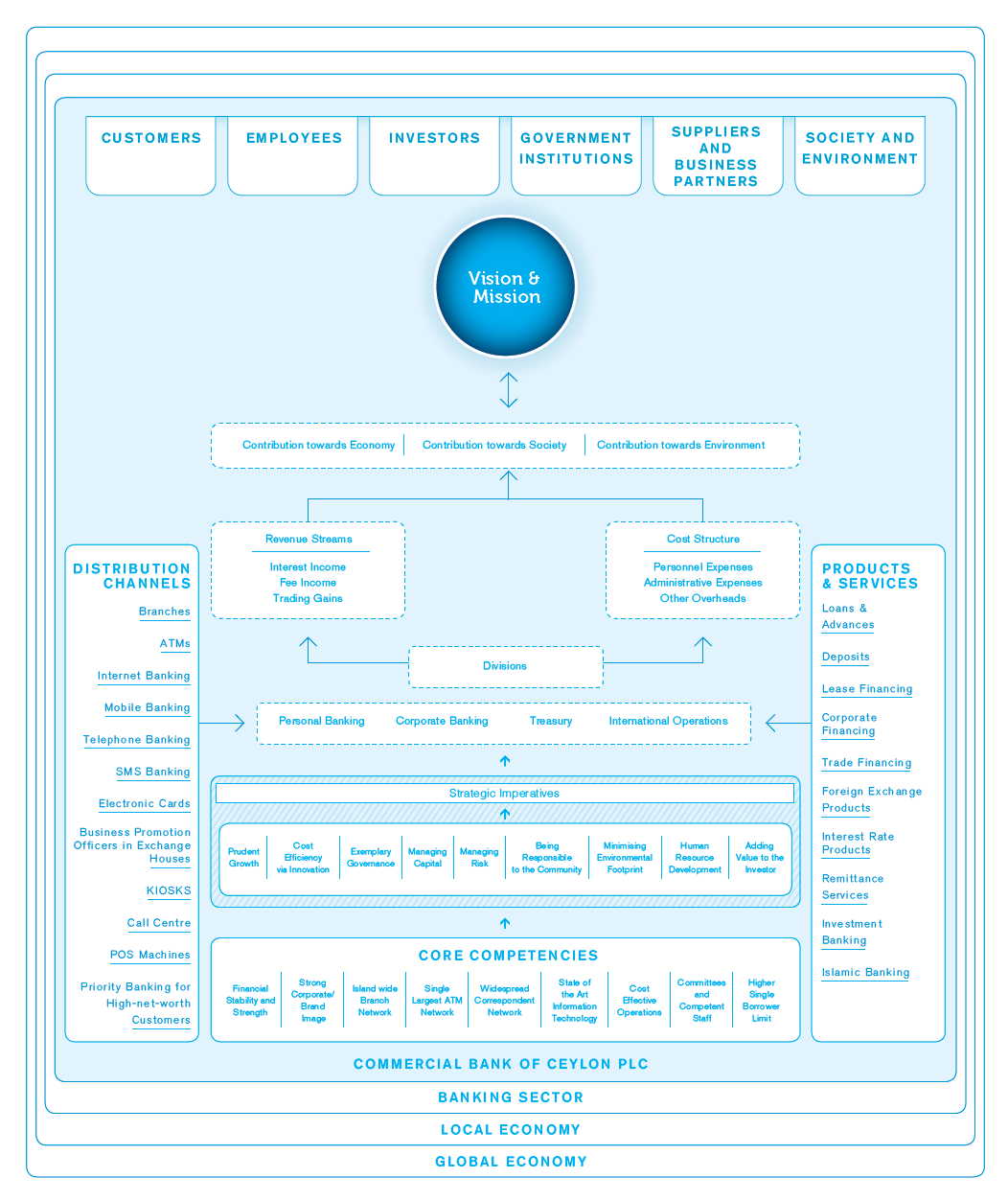

Commercial Bank is primarily a retail-funded financial institution, with 77% of our funding mix comprised of deposits and 76% of those deposits provided by individual customers. Focused mainly on traditional banking activities, we leverage our strengths and core competencies through a proven business model - the mechanism by which we deliver value to our stakeholders, derive value in return and capture it for the benefit of our shareholders.

The Bank’s business model has been evolving over time in response to significant changes in the operating environment - notably a steadily tightening of regulatory oversight, the rapid development of new information and communication technologies, and constantly changing customer behaviour. As a result, we have been reshaping our operations to become more customer-centric, developing a deeper understanding of individual customers’ financial goals and needs. We have segmented the market accordingly and refined our value proposition to meet the expectations of retail and corporate customers that we understand better than ever before. The diverse products and services Commercial Bank offers today, and the range of channels by which we deliver them, reflect this drive to create a more integrated, relevant and valued customer experience.

At the same time, our business model remains simple and clearly aligned with the Bank’s strategic objectives. Consciously avoiding complex, structured products, we have achieved consistently steady performance as we advance against our own record (refer the ‘Decade at a Glance’) and in relation to our peers in Sri Lanka’s competitive banking sector. Commercial Bank’s success reflects the aptness of our underlying business model.

A Model of Uniqueness

Banks are in the business of financial intermediation - between depositors and borrowers, between importers and exporters, between remitters and beneficiaries, and also between investors and commercial ventures. The business model of a bank therefore differs significantly from that of any other enterprise.

The principal differentiator is that the Return on Assets (ROA) achieved by a financial institution is far lower than for other businesses; a bank’s ROA tends to hover around 2%, in contrast to returns as high as 20% in most other sectors. However, in order to remain attractive to investors, financial institutions must nevertheless generate a ROE comparable to that of other publicly traded entities. They meet this challenge by applying a greater degree of gearing: banks’ ability to accept public deposits makes it possible to gear the ROA higher in relation to shareholders’ equity.

The effectiveness of the Bank’s business model has enabled us to report acceptable levels of profitability at optimum levels of gearing over the years, as shown in the following table:

| 2014 | 2013 | 2012 | 2011 | 2010 | |

| ROA (%) | 1.60 | 1.87 | 2.12 | 1.94 | 1.60 |

| Gearing (times) | 10.63 | 9.84 | 9.89 | 10.45 | 11.17 |

| ROE (%) | 17.01 | 18.40 | 20.96 | 20.28 | 17.87 |

Gearing in this context is essentially a matter of growing new business by attracting customer deposits and then lending those funds to prospective borrowers. As such, the ability to expand the Bank’s operation, deriving sustainable value through growth, invariably depends on our success in subsequently delivering value and/or creating opportunities to do so in the future.

In addition to the organic growth that the Bank has sustained over many years, we are always alert to opportunities for inorganic growth. Recent history provides two such examples: our acquisition of the Bangladesh operation of Credit Agricole Indosuez in 2003, and our pending launch of banking operations in Myanmar - through a representative office - after recently being awarded a banking license by that Nation’s Government.

We Know Our Customers

Commercial Bank serves two broad categories of customers: regular and walk-in. Regular customers include depositors and borrowers who maintain an ongoing relationship with the Bank. They enable us to generate revenue from fund-based operations in the form of net interest income - the differential between interest charged and interest paid - as well as from fees and commissions. For walk-in customers, on the other hand, we simply provide over-the-counter services that generate fee-based income.

We have segmented the Bank’s regular customer base with a view to better understand their preferences and attitudes in order to offer tailor-made combinations of products and services, delivery channels, benchmarked service standards and streamlined internal processes. This individualised approach has enabled us to maximise customer fulfillment and engagement.

Customer Segmentation and Target Market

| Criteria | Corporates | SMEs | Micro Customers | Mass Market | High net-worth Individuals |

| Income/Size of Relationship/Business Turnover/Exposure | Either Annual Business Turnover > Rs. 600 Mn. or Exposure > Rs. 200 Mn. |

Annual Business Turnover < Rs. 600 Mn. and Exposure < Rs. 200 Mn. |

Exposure < Rs. 200,000 and availing dedicated products | Individuals not falling into other categories | Individuals with banking relationships above set thresholds |

| Price sensitivity | High | Moderate | Low | Low | High |

| Products of interest | Transactional and Trade Finance | Factoring, Leasing and Project Financing | Transactional | Transactional | Investment |

| No. of transactions | High | Moderate | Low | Low | Low |

| Level of engagement | High | Moderate | Low | Low | High |

| Objective | Funding and Growth | Funding and Growth | Funding and Advice | Personal Financial Needs | Wealth Maximisation |

| Background | Rated, Large Corporates | Medium Business | Self Employed | Salaried Employees | Businessmen/Professionals |

| No. of banking relationships | Many | Many | A few | A few | Many |

| Level of competition from banks | High | Moderate | Low | Moderate | High |

Structured for Success

Functionally, the Bank operates four distinct business units. Corporate Banking Division meets the constantly evolving needs of corporations and SMEs. Personal Banking Division serves the full range of micro-level, mass-consumer and high-net-worth customers; it is organised along regional lines to ensure prompt and efficient service. A third unit, Treasury, plays a critical role by managing the Bank’s interest rate risk, trading in foreign exchange, facilitating liquidity and funding needs, and investing excess funds. And lastly, our Off-shore Banking Centre and Bangladesh operations come under the purview of International Operations.

We understand that each customer has one or more preferred channels to interact with the Bank. Commercial Bank has deployed multiple channels to connect with our customers. These range from conveniently located bricks-and-mortar branches to alternative distribution channels that increasingly leverage information and communication technologies - including ATM networks, call centre services and Internet Banking and mobile banking. The chart below shows the Bank’s channels mix and their primary target segments:

Channel Mix and Target Market

| Customer Segment | Branches | Internet Banking |

ATMs | Call Centre | Mobile Banking |

Relationship Managers |

Business Promotion Officers |

Premier Banking Units |

| Corporates | Yes | Yes | No | Yes | No | Yes | No | No |

| SMEs | Yes | Yes | No | Yes | No | No | No | No |

| Micro | Yes | Yes | Yes | Yes | Yes | No | No | No |

| Mass | Yes | Yes | Yes | Yes | Yes | No | Yes | No |

| High-net-worth | Yes | Yes | Yes | Yes | Yes | Yes | No | Yes |

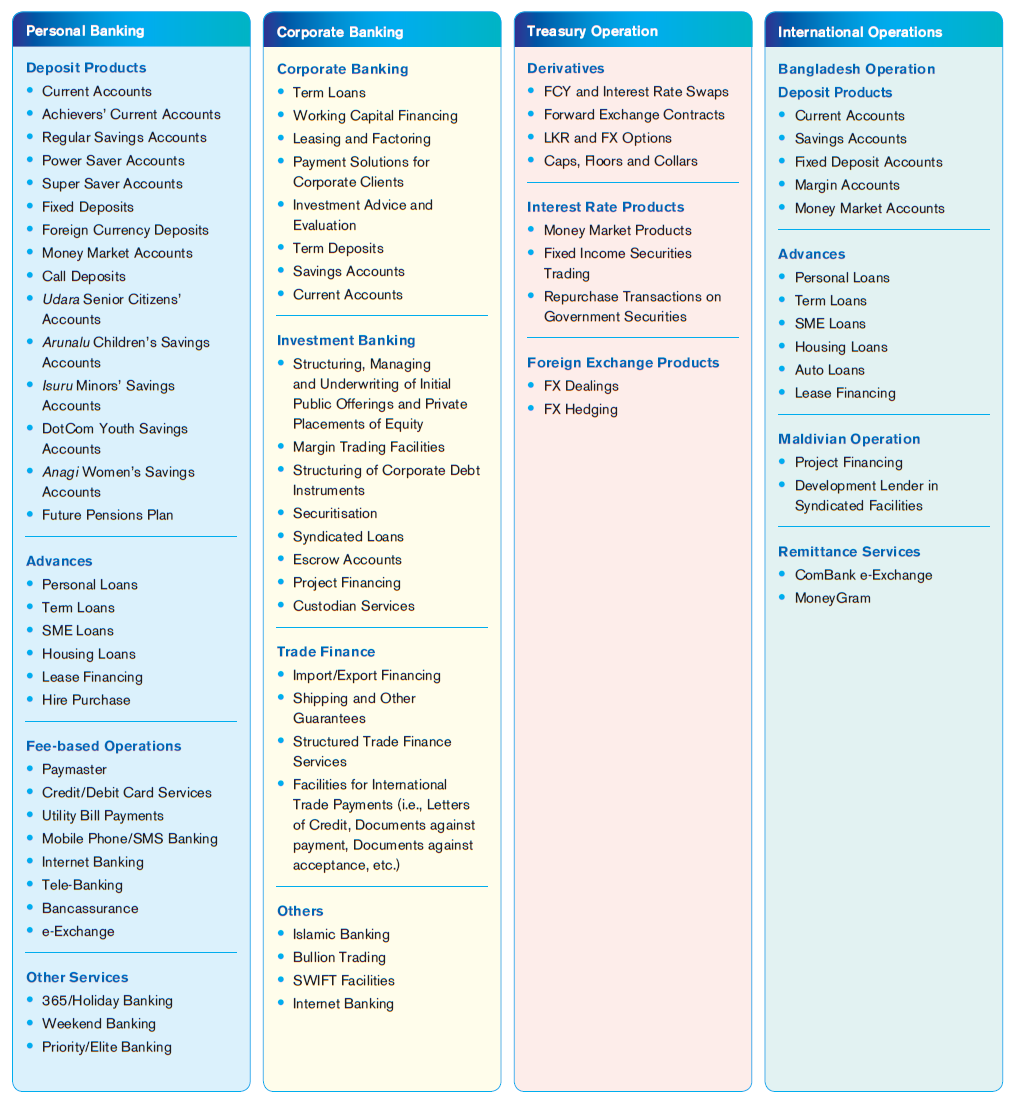

Drawing from a broad spectrum of market-sensitive products and services, we can tailor Commercial Bank’s value proposition to reflect the priorities and expectations of specific customer segments. The products and services on offer include corporate banking to retail banking and from investment banking to treasury. A detailed list of products and services is given below.

To support the delivery of targeted services cost-effectively, we have been moving increasingly towards a shared-services model for the Bank’s central functions. This enables us to take advantage of synergies across the organisation, as various cross-functional working groups share ideas, refine processes and collaborate on joint initiatives.

In addition to our permanent workforce of full-time and part-time employees, we contract the services of outsourced staff for non-core activities. The Bank also operates four subsidiary companies, of which two are primarily engaged in providing support services to our regular operations.

Our business has become increasingly technology-intensive over the past decade, requiring us to work closely with a number of leading-edge IT vendors. These companies partner with us to develop innovative solutions in customer relationship management, multi-channel integration, business process improvement, loans origination and processing, risk management, business intelligence and much more.

As we maintain and enhance a large network of branches and alternative channels, our cost structure consists primarily of human resources expenditure (56%) and administrative and real estate expenses (37%). In addition, we must make adequate provisions for impairment on loans and advances.

With a cost to income ratio of 47.13%, Commercial Bank is one of the most efficient and productive banks in our peer group. That key measure of success is a testament to the soundness of our value proposition, the effectiveness with which we deliver it and, above all, the time-tested business model that provides the foundation for all of our efforts.

Bank’s Products and Services Portfolio