Economic Sustainability

At Commercial Bank, we have always strived to repay the trust shareholders have placed in us by returning maximum value. At the same time, in our quest for sustainable growth we work with a variety stakeholders - including customers, employees and suppliers - to help them achieve their aspirations. We conduct the Bank’s business in a transparent and in an ethical manner, managing risk and pursuing opportunities while adhering to the principles of good governance.

The Board of Directors guides Commercial Bank’s approach to economic sustainability with a comprehensive corporate plan. This plan reflects the inputs of all key strategic business units – Personal Banking, Corporate Banking, Treasury and International Operations – as well as other support service units. The needs of each business unit are addressed in the annual budget, which is prepared according to a rolling five-year plan. Our detailed budgeting includes specific goals for each unit, with resources allocated according to the Bank’s overall strategic objectives.

The sections of this Annual Report devoted to ‘Corporate Governance’ and ‘Managing Risk at Commercial Bank’ discuss in detail how we govern our business and manage risk, respectively.

The Bank’s performance in achieving defined economic targets is discussed in detail in the report section devoted to ‘Operational Review by Division’ within the section ‘Management Discussion and Analysis’ and also the ‘Highlights of the Year’ section.

We have put in place various mechanisms to monitor our progress towards goals set out in the Corporate Plan and Budget:

- Detailed management accounts, including key performance data, are submitted to monthly meetings of the Board of Directors, with explanations of material variances. The Bank prepares interim and annual Financial Statements according to the requirements of the Sri Lanka Accounting Standards (SLFRS/LKAS), which are fully congruent with the International Financial Reporting Standards (IFRS).

- At Board meetings, the Heads of the Bank’s main strategic business units discuss recommended action plans to improve performance.

- The Board has established eight Sub-Committees – four of them mandatory – to support Directors in their efforts and to ensure good governance. These Board Sub-Committees are in turn backed by several other management committees headed by the Managing Director. The proceedings of these Board Sub-Committees are duly communicated to the Board.

The composition of all Board Sub-Committees, their mandates and how each committee functions are disclosed in the reports of each Sub-Committee under Stewardship section. In addition ‘The Investor Relations Supplement’ discusses key information required by the stakeholders, mainly, the shareholders.

- An effective internal audit function covers Commercial Bank’s entire scope of operations in Sri Lanka and in Bangladesh.

- Annual external audits of Financial Statements are conducted by reputable firms of chartered accountants. Other statutory audits are undertaken by regulators such as the Central Bank of Sri Lanka (CBSL), Bangladesh Bank, the Sri Lanka Accounting and Auditing Standards Monitoring Board and the Inland Revenue Department.

Direct Economic Value Generated and Distributed

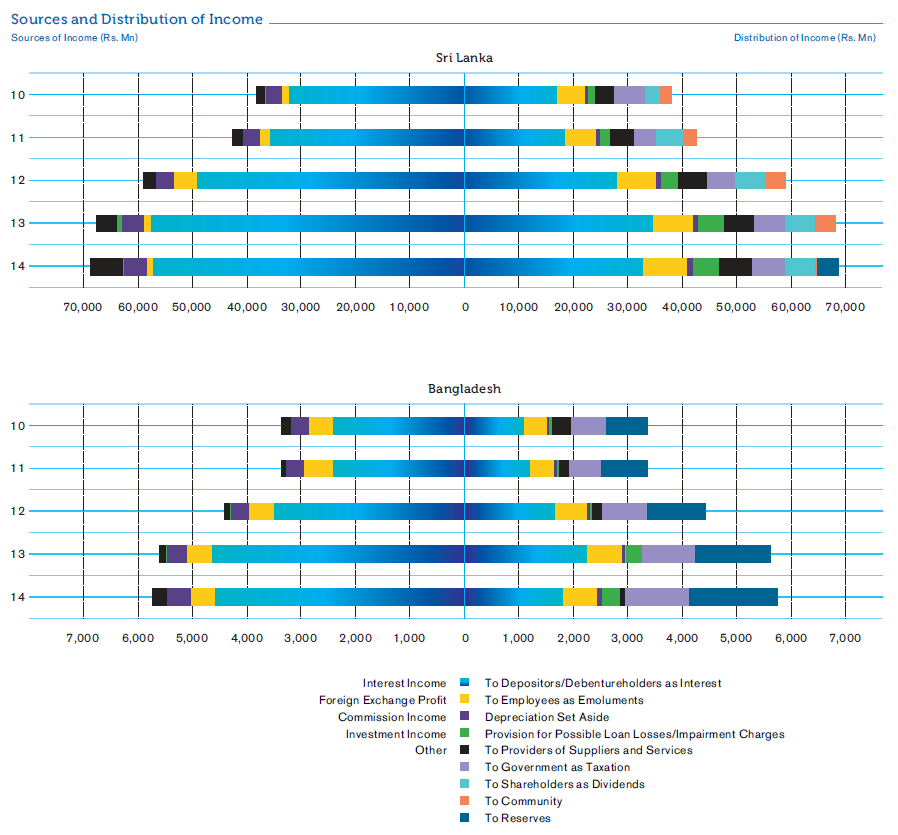

The table below shows the Bank’s contribution to the Sri Lankan and Bangladesh economies in the past five years.

| Sri Lanka Operation | Bangladesh Operation | |||||||||

| For the year ended December 31, | 2014 Rs. Mn. | 2013 Rs. Mn. | 2012 Rs. Mn. | 2011 Rs. Mn. | 2010 Rs. Mn. | 2014 Rs. Mn. | 2013 Rs. Mn. | 2012 Rs. Mn. | 2011 Rs. Mn. | 2010 Rs. Mn. |

| Source of Income | ||||||||||

| Interest Income | 57,244 | 57,534 | 49,169 | 35,914 | 32,293 | 4,588 | 4,653 | 3,516 | 2,442 | 2,447 |

| Foreign Exchange Profit | 1,029 | 1,541 | 4,246 | 1,811 | 1,329 | 452 | 455 | 448 | 510 | 412 |

| Commission Income | 4,405 | 3,876 | 3,253 | 2,977 | 2,886 | 426 | 374 | 345 | 348 | 334 |

| Investment Income | 99 | 873 | 103 | 81 | 188 | 14 | 14 | 16 | – | 19 |

| Other | 5,932 | 3,722 | 2,201 | 1,715 | 1,468 | 253 | 118 | 98 | 61 | 146 |

| 68,709 | 67,546 | 58,972 | 42,498 | 38,164 | 5,733 | 5,614 | 4,423 | 3,361 | 3,358 | |

| Distribution of Income | ||||||||||

| To Depositors/Debenture Holders as Interest | 32,812 | 34,617 | 28,148 | 18,452 | 17,241 | 1,798 | 2,262 | 1,682 | 1,198 | 1,087 |

| To Employees as Emoluments | 8,255 | 7,555 | 7,190 | 5,834 | 5,162 | 648 | 631 | 580 | 456 | 426 |

| Depreciation Set Aside | 1,119 | 881 | 987 | 699 | 485 | 82 | 55 | 48 | 49 | 54 |

| Provision for Possible Loan Losses/ Impairment Charges | 4,571 | 4,606 | 3,155 | 1,763 | 1,163 | 348 | 21 | 42 | 45 | 29 |

| To Providers of Supplies and Services | 6,131 | 5,629 | 5,046 | 4,661 | 3,402 | 88 | 297 | 183 | 167 | 377 |

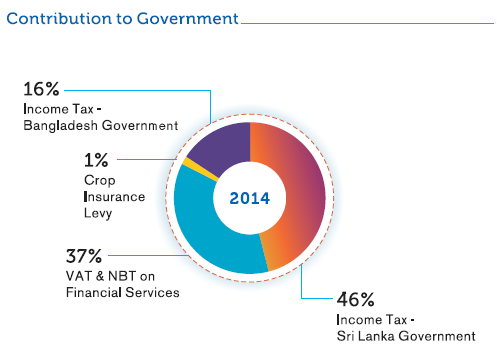

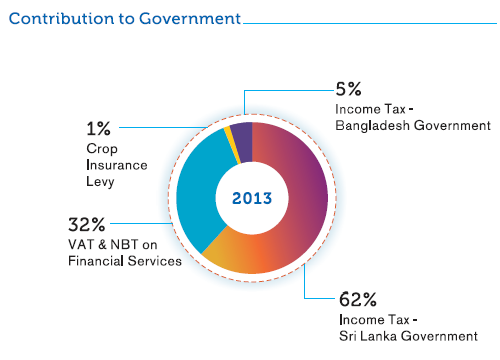

| To Government as Taxation | 6,185 | 5,149 | 5,357 | 3,946 | 5,885 | 1,170 | 961 | 827 | 596 | 630 |

| - Income Tax | 3,386 | 3,104 | 3,370 | 2,418 | 3,164 | 1,170 | 961 | 827 | 596 | 630 |

| - VAT and NBT on Financial Services | 2,689 | 1,969 | 1,987 | 1,523 | 2,709 | – | – | – | – | – |

| - Crop Insurance Levy | 110 | 76 | – | – | – | – | – | – | – | – |

| - Debits Tax | – | – | – | 5 | 12 | – | – | – | – | – |

| To Shareholders as Dividends | 5,628 | 5,519 | 5,418 | 4,905 | 2,642 | – | – | – | – | – |

| To Community | 53 | 51 | 51 | 110 | 57 | 2 | – | 1 | – | 1 |

| To Reserves | 3,955 | 3,539 | 3,620 | 2,128 | 2,127 | 1,597 | 1,387 | 1,060 | 850 | 754 |

| 68,709 | 67,546 | 58,972 | 42,498 | 38,164 | 5,733 | 5,614 | 4,423 | 3,361 | 3,358 | |

Note: Data for 2011–2014 has been derived from the audited Financial Statements that were prepared based on the Sri Lanka Accounting Standards (SLFRS/LKAS), while data for 2010 is from statements based on the Sri Lanka Accounting Standards (SLAS).

Sources and Distribution of Income

Economic Value Added (EVA)

EVA is a measure of profitability based on the cost of total invested equity. It provides an indication of the true economic value created for shareholders, as opposed to accounting profits. The Bank is deeply committed to delivering optimum and consistent value to our shareholders. The EVA created during 2014 amounts to Rs. 8,962 Mn., while cumulative EVA created over the past five years totals Rs. 28,457 Mn. We remain one of the few enterprises in Sri Lanka that has embraced EVA as a measure of performance.

| For the year ended December 31, | 2014 Rs. Mn. |

2013 Rs. Mn. |

2012 Rs. Mn. |

2011 Rs. Mn. |

2010 Rs. Mn. |

| Invested Equity | |||||

| Shareholders’ Funds | 70,512 | 60,944 | 52,577 | 43,766 | 33,302 |

| Add: Cumulative Loan Loss Provision/Provision for Impairment | 16,956 | 15,787 | 13,501 | 11,601 | 4,900 |

| Total | 87,468 | 76,731 | 66,078 | 55,367 | 38,202 |

| Earnings | |||||

| Profit after Tax and Dividends on Preference Shares | 11,180 | 10,446 | 10,098 | 7,883 | 5,523 |

| Add: Loan Losses and Provisions/Impairment Provision | 4,919 | 5,204 | 3,197 | 1,808 | 1,192 |

| Less: Loan Losses Written-Off | (27) | (99) | (5) | (24) | (6) |

| Total | 16,072 | 15,551 | 13,290 | 9,667 | 6,709 |

| Cost of Equity (Based on 12 Months Weighted Average Treasury Bill Rate Plus 2% for the Risk Premium) | 8.66% | 12.63% | 13.97% | 9.53% | 10.49% |

| Cost of Average Equity | 7,110 | 9,018 | 8,483 | 4,459 | 3,761 |

| Economic Value Added | 8,962 | 6,532 | 4,807 | 5,208 | 2,948 |

Our Indirect Economic Impact

At Commercial Bank we are mindful of our responsibilities as one of Sri Lanka’s leading banks, accounting for approximately 10% of the total assets of the banking and finance industry in Sri Lanka. We have a strong obligation to prudently manage risks we face to ensure the continuity of our own business, so as not to send shock waves to the stability of the country’s economy.

Commercial Bank through its Corporate Banking Division finances many large infrastructure projects that help to fuel the country’s economic growth, creating many trickle-down benefits to the society, as well as the environment. Indirect economic impacts are equally important to us as we pursue the goals of sustainable performance. The Bank did not take part in any such new projects during 2014 but only continued with the previous commitments.

Business Continuity Management

Continuity of critical business operations is vital to the Bank’s success and continued growth. Our Business Continuity Management Steering Committee, which includes several representatives of corporate and senior management, provides overall guidance to the Business Continuity Planning (BCP) Committee, which is comprised of senior officers representing key business and service units of the Bank.

The BCP Committee has developed a formal Business Continuity Plan, in-line with the requirements and guidelines provided by the CBSL, which has been formally approved by the Board. In addition, to comply with the CBSL requirements, the plan helps the Bank remain ahead in the industry and reinforces our international presence. It addresses operational risks and strives to minimise any threats posed by shortcomings or failures of internal processes and systems, as well as external events, including natural disasters.

As the Bank rely heavily on information technology, we have put in place disaster recovery sites at remote locations and periodic role-swap exercises are carried out to test the Bank’s ability to withstand any disaster situation. These exercises are aimed at identifying issues in switching machines and minimising the down time and loss of data.