Financial Highlights

| GROUP | BANK | |||||

| 2014 | 2013 | Change

% |

2014 | 2013 | Change % |

|

| Results for the year (Rs. Mn.) | ||||||

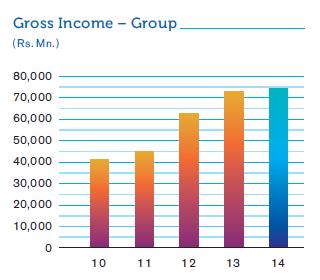

| Income | 74,537.814 | 73,704.516 | 1.13 | 74,441.840 | 73,736.267 | 0.96 |

| Profit before Financial VAT and Taxation | 18,541.905 | 16,654.587 | 11.33 | 18,425.207 | 16,479.473 | 11.81 |

| Profit Before Taxation (PBT) | 15,859.917 | 14,690.918 | 7.96 | 15,736.216 | 14,510.519 | 8.45 |

| Provision for Taxation | 4,617.124 | 4,117.461 | 12.14 | 4,556.035 | 4,065.008 | 12.08 |

| Profit After Taxation (PAT) | 11,242.793 | 10,573.457 | 6.33 | 11,180.181 | 10,445.511 | 7.03 |

| Revenue to the Governments | 7,295,545 | 5,957,636 | 22.45 | 7,234.562 | 5,905.636 | 22.50 |

| Gross Dividends | 5,627.869 | 5,522.473 | 1.91 | 5,627.869 | 5,522.473 | 1.91 |

| At the year-end | ||||||

| Shareholders’ Funds (Capital and Reserves) | 71,205.835 | 61,446.228 | 15.88 | 70,511.730 | 60,943.999 | 15.70 |

| Deposits | 529,266.588 | 451,098.946 | 17.33 | 529,361.484 | 451,152.923 | 17.34 |

| Gross Loans and Advances | 464,899.378 | 379,237.437 | 22.59 | 463,586.297 | 379,252.897 | 22.24 |

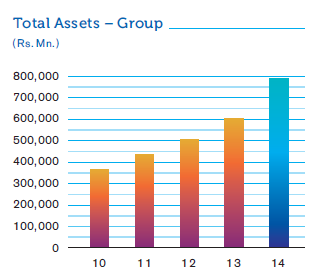

| Total Assets | 797,257.713 | 606,564.507 | 31.44 | 795,609.630 | 605,987.592 | 31.29 |

| Information per Ordinary Share (Rs.) | ||||||

| Earnings (Basic) | 13.01 | 12.24 | 6.29 | 12.94 | 12.10 | 6.94 |

| Earnings (Diluted) | 12.95 | 12.22 | 5.97 | 12.88 | 12.09 | 6.53 |

| Dividends - Cash | – | – | – | 4.50 | 4.50 | – |

| Dividends - Shares | – | – | – | 2.00 | 2.00 | – |

| Net Assets Value | 82.24 | 72.37 | 13.54 | 81.44 | 71.78 | 13.46 |

| Market Value at the year-end - Voting | N/A | N/A | – | 171.00 | 120.40 | 42.03 |

| Market Value at the year-end - Non-Voting | N/A | N/A | – | 125.10 | 93.00 | 34.52 |

| Ratios | ||||||

| Return on Average Shareholders’ Funds (%) | 16.95 | 18.48 | (1.53) | 17.01 | 18.40 | (1.39) |

| Return on Average Assets (%) | 1.60 | 1.89 | (0.29) | 1.60 | 1.87 | (0.27) |

| Price Earnings (times) - Ordinary Voting Shares | N/A | N/A | 13.24 | 9.79 | 35.24 | |

| Price Earnings (times) - Ordinary Non-Voting Shares | N/A | N/A | 9.69 | 7.56 | 28.17 | |

| Year-on-year growth in Earnings (%) | 6.33 | 4.88 | 1.45 | 7.03 | 3.44 | 3.59 |

| Dividend Yield (%) - Ordinary Voting Shares | N/A | N/A | 3.80 | 5.40 | (1.60) | |

| Dividend Yield (%) - Ordinary Non-Voting Shares | N/A | N/A | 5.20 | 6.99 | (1.79) | |

| Dividend Cover on Ordinary Shares (times) | N/A | N/A | 1.99 | 1.89 | 5.29 | |

| Statutory Ratios: | ||||||

| Liquid Assets (%) | N/A | N/A | – | 33.11 | 34.05 | (0.94) |

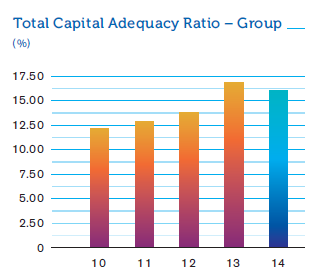

| Capital Adequacy Ratios: | ||||||

| Tier I (%) - Minimum Requirement 5% | 13.07 | 13.30 | (0.23) | 12.93 | 13.27 | (0.34) |

| Tier I & II (%) - Minimum Requirement 10% | 16.22 | 16.93 | (0.71) | 15.97 | 16.91 | (0.94) |

Financial Goals and Achievements - Bank

| Goal | Achievement |

|||||

| Financial Indicator | 2014 |

2013 |

2012 |

2011 |

2010 |

|

| Return on Average Assets (ROA) (%) | Over 2% | 1.60 |

1.87 |

2.12 |

1.94 |

1.60 |

| Return on Average Shareholders’ Funds (%) | Over 20% | 17.01 |

18.40 |

20.96 |

20.28 |

17.87 |

| Growth in Income (%) | Over 20% | 0.96 |

15.40 |

38.25 |

10.45 |

(5.07) |

| Growth in Profit After Taxation (%) | Over 20% | 7.03 |

3.44 |

28.10 |

42.72 |

28.30 |

| Growth in Total Assets (%) | Over 20% | 31.29 |

18.54 |

15.95 |

18.95 |

14.81 |

| Dividend Per Share (DPS) (Rs.) | Over Rs. 5.00 | 6.50 |

6.50 |

6.50 |

6.00 |

7.00 |

| Capital Adequacy Ratios: | ||||||

| Tier I (%) - Minimum Requirement 5% | Over 8% | 12.93 |

13.27 |

12.64 |

12.11 |

10.87 |

| Tier I & II (%) - Minimum Requirement 10% | Over 13% | 15.97 |

16.91 |

13.85 |

13.01 |

12.27 |

Non-Financial Indicators

| 2014 | 2013 | 2012 | 2011 | 2010 | ||

| Customers | Growth in No. of Deposits & Advances Accounts (%) | 2.14 |

7.26 |

12.19 |

8.93 |

7.55 |

| No. of Customer Touch Points | ||||||

| Branches - In Sri Lanka | 239 |

235 |

227 |

213 |

187 |

|

| Branches - In Bangladesh | 18 |

18 |

17 |

17 |

17 |

|

| ATMs - In Sri Lanka | 606 |

585 |

555 |

497 |

401 |

|

| ATMs - In Bangladesh | 19 |

19 |

17 |

17 |

13 |

|

| Employees | Total No. of employees | 4,852 |

4,730 |

4,602 |

4,524 |

4,321 |

| Average hours of training per employee per year | 27.24 |

32.54 |

22.59 |

25.48 |

22.22 |

|

| Employee turnover ratio (%) | 4.26 |

4.29 |

3.28 |

3.82 |

3.36 |

|

| Business Partners | Assets purchased (other than investments) (Rs. Mn.) | 1,164 |

1,077 |

997 |

1,150 |

831 |

| No. of Correspondent Banks | 48 |

48 |

47 |

47 |

47 |

|

| Government Institutions | Taxes to Governments (Rs. Mn.) | 7,355 |

6,110 |

6,184 |

4,542 |

6,515 |

| Taxes collected on behalf of Governments (Rs. Mn.) | 1,382 |

978 |

621 |

499 |

473 |

|

| Community | Donations (Rs. Mn.) | 55 |

51 |

51 |

110 |

57 |

Total Capital Adequacy Ratio - Group

Operating Highlights