Human Resources Management

At Commercial Bank, we understand that our people are our most valuable asset. Their professionalism and proficiency, along with their diverse backgrounds, experience and points of view, have contributed significantly to our success. We in turn, encourage our employees by providing equal opportunity and remuneration, and by guiding them towards their personal and professional goals through training and skills development.

We also strive to help our people achieve work-life balance. While staff relations are governed by the Shop and Office Employees Act, the Bank goes beyond these regulations in what we offer employees. Their welfare, progress and contentment are among our core priorities. We strongly believe that an effective collective bargaining process covering employee compensation and human rights concerns helps to foster strong bonds with trade unions and the executive association, which in turn ensures the long-term viability of our enterprise.

Employment

The Bank’s employment policy dictates that we must recruit the candidates best suited for open positions, applying fair, objective and internationally accepted evaluation methods. We provide equal opportunity to all those who meet minimum educational and age requirements to join our organisation. New employees are recruited as either banking or management trainees. Some specialised jobs call for mid-career recruitment, although we endeavour wherever possible to fill such vacancies from our internal talent pool. New employees are made aware of the Bank’s philosophy, goals, policies, procedures, rules, regulations and day-to-day business practices through orientation programmes designed to help them integrate smoothly into their roles.

Total Number and Rates of New Employee Hires by Age Group and Gender – Sri Lanka

| For the year ended December 31, | 2014 | 2013 | 2012 | |||||||||

| New Employee Hired | Rate of New Employee Hired % |

New Employee Hired | Rate of New Employee Hired % |

New Employee Hired | Rate of New Employee Hired % |

|||||||

| Category/Age Group | Male | Female | Male | Female | Male | Female | Male | Female | Male | Female | Male | Female |

| Corporate Management | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Executive Officers | ||||||||||||

| Below 30 Years | 3 | 3 | 0.22 | 0.67 | 1 | 2 | 0.08 | 0.46 | – | 1 | – | 0.23 |

| 30 - 50 Years | 5 | 3 | 0.36 | 0.67 | 1 | 1 | 0.08 | 0.23 | 2 | – | 0.16 | – |

| 51 - 60 Years | 1 | – | 0.07 | – | – | – | – | – | – | – | – | – |

| Junior Executive Assistant and Allied | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | 1 | 1 | 0.06 | 0.21 | – | – | – | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Banking Trainees | ||||||||||||

| Below 30 Years | 216 | 84 | 60.34 | 51.22 | 206 | 95 | 67.76 | 43.58 | 106 | 101 | 22.70 | 61.96 |

| 30 - 50 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Office Assistants and Others | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Total | 225 | 90 | 6.52 | 7.56 | 209 | 99 | 6.20 | 8.63 | 108 | 102 | 3.26 | 9.38 |

Total Number and Rates of New Employee Hires by Age Group and Gender – Bangladesh

| For the year ended December 31, | 2014 | 2013 | 2012 | |||||||||

| New Employee Hired | Rate of New Employee Hired % |

New Employee Hired | Rate of New Employee Hired % |

New Employee Hired | Rate of New Employee Hired % |

|||||||

| Category/Age Group | Male | Female | Male | Female | Male | Female | Male | Female | Male | Female | Male | Female |

| Corporate Management | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Executive Officers | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | 1 | – | 0.98 | – |

| 30 - 50 Years | – | – | – | – | 1 | – | 0.98 | – | 2 | – | 1.96 | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Junior Executive Assistance and Allied | ||||||||||||

| Below 30 Years | 10 | 3 | 12.82 | 3.85 | 18 | 4 | 32.14 | 21.05 | 9 | 6 | 16.07 | 31.58 |

| 30 - 50 Years | 1 | – | 1.28 | – | – | – | – | – | 2 | – | 3.57 | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Banking Trainees | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Office Assistants and Others | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Total | 11 | 3 | 14.10 | 1.42 | 19 | 4 | 11.38 | 9.09 | 14 | 6 | 8.86 | 13.64 |

The Bank employs more than 4,800 permanent and full-time employees, along with nearly 500 people on fixed-term contracts. Certain non-core functions are outsourced, based on business imperatives, with a view towards enhancing productivity and remaining competitive. In this regard, security and janitorial staff, stenographers, typists, telephone operators, multi-task assistants, drivers and office assistants are outsourced. As a policy, the Bank does not recruit employees on a part-time basis.

Total Number of Employees by Employment Contract, Gender and by Significant Location

| No. of Employees | Composition of Employees | |||||

| As at December 31, | 2014 | 2013 | 2012 | 2014 | 2013 | 2012 |

| Sri Lanka | ||||||

| Full-time employees - Male | 3,449 | 3,372 | 3,312 | 74.35 | 74.62 | 75.27 |

| Full-time employees - Female | 1,191 | 1,147 | 1,088 | 25.65 | 25.38 | 24.73 |

| Total | 4,640 | 4,519 | 4,400 | 100.00 | 100.00 | 100.00 |

| Outsourced employees - Male | 352 | 358 | 344 | 61.00 | 60.58 | 56.39 |

| Outsourced employees - Female | 225 | 233 | 266 | 39.00 | 39.42 | 43.61 |

| Total | 577 | 591 | 610 | 100.00 | 100.00 | 100.00 |

| Bangladesh | ||||||

| Full-time employees - Male | 168 | 167 | 158 | 79.25 | 79.15 | 78.22 |

| Full-time employees - Female | 44 | 44 | 44 | 20.75 | 20.85 | 21.78 |

| Total | 212 | 211 | 202 | 100.00 | 100.00 | 100.00 |

| Outsourced employees - Male | – | – | – | – | – | – |

| Outsourced employees - Female | – | – | – | – | – | – |

| Total | – | – | – | – | – | – |

Proportion of Senior Management Hired from the Local Community

All recruits to the Bank’s corporate management and senior management roles are citizens of the countries in which we operate. The sole exception is in our Bangladesh operation, where two of total nine members of the corporate management team are seconded from Sri Lanka. Therefore, 100% of our Sri Lankan corporate and senior management ranks are drawn from the local community, while in Bangladesh corporate management is comprised of 22% Sri Lankans and 78% Bangladeshis – with 100% of senior management drawn from Bangladesh.

Return to Work and Retention Rate After Maternity Leave

| Country and Description | 2014 | 2013 | 2012 |

| Sri Lanka | |||

| No. of employees entitled to maternity leave | 1,191 | 1,147 | 1,088 |

| No. of employees who took maternity leave | 51 | 60 | 58 |

| No. of employees who returned to work after maternity leave | 39 | 58 | 60 |

| No. of employees who are still employed for the 12-months after they return from maternity leave | 58 | 60 | 70 |

| Return to work rate (%) | 100 | 98 | 100 |

| Retention rate (%) | 100 | 100 | 100 |

| Bangladesh | |||

| No. of employees entitled for maternity leave | 35 | 33 | 30 |

| No. of employees who took maternity leave | 3 | 5 | 4 |

| No. of employees who returned to work after maternity leave | 1 | 5 | 4 |

| No. of employees who are still employed for the 12-months after they return from maternity leave | 5 | 4 | 3 |

| Return to work rate (%) | 100 | 100 | 100 |

| Retention rate (%) | 100 | 100 | 100 |

Human Resources Development

Performance Evaluation

We consider the performance review to be a critical tool in effective employee development. The Bank’s current performance appraisal system, which was established several years ago, helps us to build and maintain a target-driven culture – a key factor shaping our success as an industry leader. All permanent employees of the Bank are subject to an annual performance evaluation that has been carefully designed to yield a fair and balanced assessment of their performance. The performance measurement mechanism assesses the following factors:

- Achievement of key performance indicators (for executive grades).

- Job knowledge and expertise, measured by both quality and quantity of work.

- Customer orientation.

- Communications and interpersonal skills.

- Planning, administration and organisation.

- Creative thinking.

- Self-development and growth.

- Emotional dimensions of workplace performance.

- Areas for improvement and further training.

- Potential for growth.

- Special contributions towards the betterment of the Bank.

Training and Education

Commercial Bank is fully committed to training and developing our employees so they can achieve their full potential and face future challenges effectively. We provide a nurturing work environment that is conducive to learning and development, encouraging our people to acquire knowledge, competencies and attitudes that will add value to their working experience.

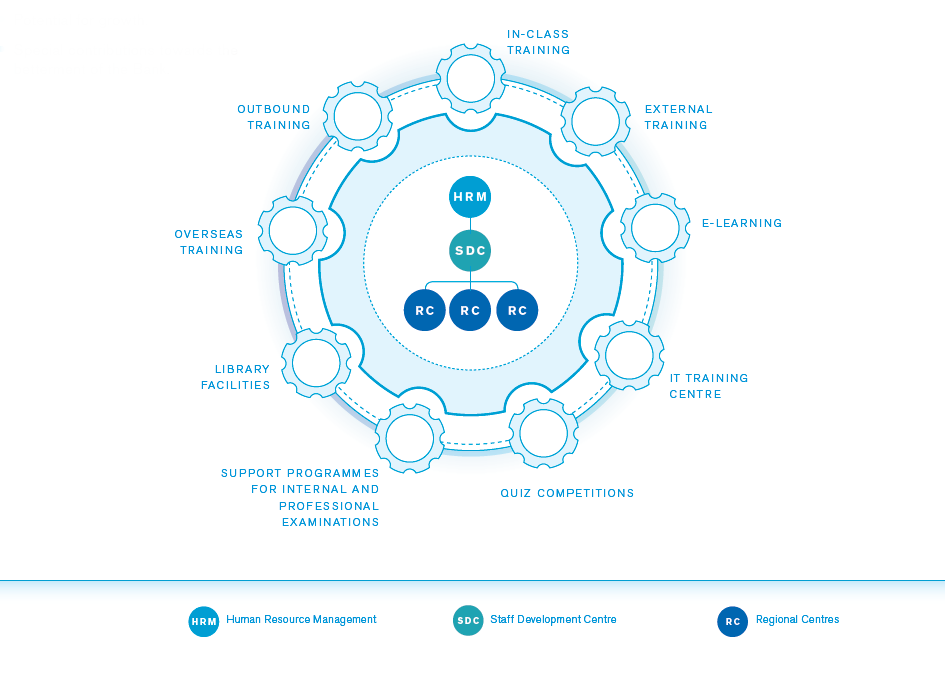

Our Staff Development Centre (SDC) provides the Bank’s workforce with essential information, training opportunities and resources, helping them to enhance their productivity and achieve new levels of professional success. The SDC helps employees realise their potential by linking learning to practice, fostering a cycle of continuous development that extends individual horizons and boosts overall morale.

The following diagram depicts the reporting structure of the SDC, including its tools and methodologies. To fulfill its responsibilities in developing the workforce, the SDC each year conducts a comprehensive needs assessment and then prepares a training calendar for employees at all levels.

The following table provides a snapshot of the various types of training the Bank provides in Sri Lanka, by employee category and gender.

| For the year ended December 31, | 2014 Training Hours |

2013 Training Hours |

2012 Training Hours |

|||||||||

| Employee Category and Type of Programme | Male | Female | Total | Per Employee | Male | Female | Total | Per Employee | Male | Female | Total | Per Employee |

| Corporate Management | 970 | 34 | 1,004 | 43.65 | 1,312 | 78 | 1,390 | 42.12 | 1,454 | 38 | 1,491 | 43.85 |

| Technical | 418 | 20 | 438 | 19.04 | 782 | 66 | 848 | 25.20 | 825 | 38 | 863 | 25.38 |

| Soft Skills | 208 | 14 | 222 | 9.65 | 234 | 12 | 246 | 7.45 | 156 | – | 156 | 4.59 |

| Overseas | 344 | – | 344 | 14.96 | 296 | – | 296 | 8.97 | 472 | – | 472 | 13.88 |

| Executive Officers | 23,926 | 8,608 | 32,534 | 17.78 | 32,275 | 9,037 | 41,311 | 21.99 | 29,489 | 8,527 | 38,016 | 20.58 |

| Technical | 13,586 | 4,198 | 17,784 | 9.72 | 24,887 | 6,641 | 31,527 | 16.78 | 25,891 | 6,793 | 32,684 | 17.70 |

| Soft Skills | 9,284 | 3,946 | 13,230 | 7.23 | 6,716 | 2,204 | 8,920 | 4.75 | 2,654 | 1,454 | 4,108 | 2.22 |

| Overseas | 1,056 | 464 | 1,520 | 0.83 | 672 | 192 | 864 | 0.46 | 944 | 280 | 1,224 | 0.66 |

| Junior Executive Assistants and Allied Grades | 41,392 | 12,998 | 54,390 | 25.01 | 59,588 | 9,846 | 69,074 | 31.45 | 19,423 | 3,014 | 22,437 | 11.33 |

| Technical | 37,860 | 11,990 | 49,850 | 22.92 | 55,388 | 8,418 | 63,806 | 29.06 | 18,295 | 2,596 | 20,891 | 10.55 |

| Soft Skills | 3,532 | 1,008 | 4,540 | 2.09 | 4,072 | 1,068 | 5,140 | 2.34 | 1,128 | 418 | 1,546 | 0.78 |

| Overseas | – | – | – | – | 128 | – | 128 | 0.06 | – | – | – | – |

| Banking Trainees | 26,606 | 11,880 | 38,486 | 73.73 | 30,169 | 11,984 | 42,153 | 80.75 | 29,360 | 12,652 | 42,012 | 66.69 |

| Technical | 26,070 | 11,592 | 37,662 | 72.15 | 28,381 | 11,392 | 39,773 | 76.19 | 28,104 | 12,336 | 40,440 | 64.19 |

| Soft Skills | 536 | 288 | 824 | 1.58 | 1,788 | 592 | 2,380 | 4.56 | 1,256 | 316 | 1,572 | 2.50 |

| Total | 92,894 | 33,520 | 126,414 | 27.24 | 123,344 | 30,584 | 153,928 | 32.54 | 79,726 | 24,231 | 103,956 | 22.59 |

Reward Management

Commercial Bank is committed to maintaining an equitable and consistent reward structure to ensure that employees’ contributions to the business are recognised in different ways. This helps us to attract and retain staff while encouraging their efforts towards the achievement of the Bank’s strategic goals.

There is no regulation under Sri Lanka’s Shop & Office Employees Act governing the minimum wage for covered employees. However, through collective bargaining and ongoing dialogue with employee organisations, as well as discussions with labour authorities and our corporate peers, the Bank stays abreast of current trends relating to wage practices in the banking industry and in the mercantile sector generally. Our wage policy is based mainly on collective agreements – which cover specific employee categories – as well as periodic market surveys examining wage ranges in the current marketplace.

For executive officers, salaries and perks are largely decided by considering the market rates applicable for similar categories and roles. The Bank has a well-established, target-driven culture focused on achieving the goals set out in our corporate plan. Executive Directors of the Board, along with key management personnel and other executive officers, are offered incentives and receive recognition for promotions based on how well they achieve mutually agreed targets. Our approach to performance evaluation is fully aligned with the Bank’s business goals and supported by a reward mechanism that recognises multiple levels of performance keyed to an incentive matrix.

Remuneration, incentives and other perks for non-executive grades are decided based on the collective bargaining process between the Bank and the Ceylon Bank Employees Union. Promotions within non-executive and executive grades are awarded through a process involving written and oral examinations, as well as individual performance evaluations.

The Bank’s two employee associations – the Executive Association and the Ceylon Bank Employees Union – maintain a regular dialogue on remuneration with the Board and management, and their views are given due consideration in the formulation of relevant policies and proposals.

The wages and perks of employees who serve as Business Promotion Officers in Italy, South Korea and the Middle East are the same as for comparable roles in Sri Lanka, although these officers also receive a special allowance to cover extraordinary expenses incurred abroad.

The wages and perks of Bangladeshi staff are determined based on market practices and, as in Sri Lanka, these employees receive increments, incentives and promotions based on the results of their annual performance evaluations.

Commercial Bank’s governance structure requires that any changes made to remuneration policies and procedures must be passed through the Human Resources and Remuneration Committee of the Board, which is responsible for evaluating proposals and recommending any changes to the full Board.

Benefits Provided to Full-Time Employees

As a matter of policy, the Bank does not recruit part-time employees. Our permanent employees of Sri Lanka as well as Bangladesh operations receive the following benefits:

- Bonuses reflective of performance or decided under the collective bargaining agreement.

- Fuel allowance for executives and transportation allowance for non-executive roles.

- Holiday bungalows.

- Staff loans at below-market interest rates.

- Medical benefits, including special health insurance coverage for critical illnesses.

- A death gratuity scheme extending to the legitimate dependants of a confirmed employee.

- A personal accident insurance scheme.

- Provision of free accommodation and/or subsidised transportation, or house rent or other special allowances, for employees working at locations that pose logistical, housing and cost-of-living challenges.

- Retirement benefits.

The Bank also helps branches and departments to organise annual staff get-togethers or excursions by providing an annual allowance for such events to every employee.

Although employees hired by the Bank through outsourcing are not entitled to the above benefits, the Human Resources Department ensures that they are paid at least the minimum wage under applicable statutes. We also ensure that mandatory contributions are made to defined contribution plans such as the Employees’ Provident Fund and the Employees’ Trust Fund, in addition to providing remuneration governed by the Payment of Gratuities Act.

Diversity, Equal Opportunity and Equal Remuneration

Commercial Bank is dedicated to upholding the principle of equality in offering our employees both career opportunities and competitive remuneration. We seek the most qualified, educated and talented candidates and do not discriminate with regard to race, language, religious beliefs, gender or age. We only consider employees’ relevant skills and competencies, as those are the attributes that create sustainable value. By advancing employees according to merit, we improve their overall personal and professional satisfaction – key components of stakeholder value.

Sri Lankan operations being the largest of our operations employs staff from various ethnicities. In certain instances, in order to serve our customers with a homely atmosphere, preference is given when hiring and deploying staff at branches based on composition of the community and the language widely used in such locality.

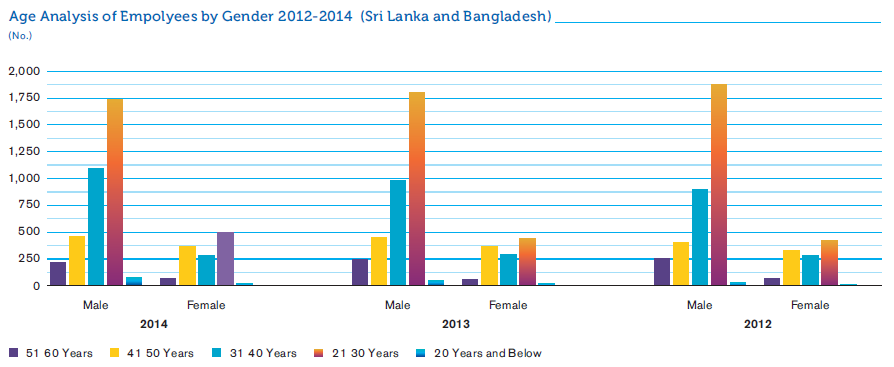

Age Analysis of Employees by Gender 2012-2014 (Sri Lanka and Bangladesh)

Composition of the Board and Employees by Category

| As at December 31, | 2014 | 2013 | |||||||||

| Gender (%) | Age Group (%) | Gender (%) | Age Group (%) | ||||||||

| Male | Female | Below 30 Years | 30 - 50 Years |

Over 50 Years |

Male | Female | Below 30 Years | 30 - 50 Years |

Over 50 Years |

||

| Board of Directors | 100.00 | – | – | – | 100.00 | 100.00 | – | – | – | 100.00 | |

| Corporate Management | 91.30 | 8.70 | – | 43.47 | 56.53 | 87.50 | 12.50 | – | 33.33 | 66.67 | |

| Executive Officers | 75.40 | 24.60 | 15.54 | 75.13 | 9.33 | 74.66 | 25.34 | 16.39 | 73.44 | 10.17 | |

| Junior Executive Assistants and Allied Grades | 73.65 | 26.35 | 68.83 | 29.65 | 1.52 | 77.27 | 22.73 | 69.35 | 28.64 | 2.01 | |

| Banking Trainees | 68.58 | 31.42 | 100.00 | – | – | 58.24 | 41.76 | 100.00 | – | – | |

| Office Assistants and Others | 100.00 | – | – | 53.33 | 46.67 | 100.00 | – | – | 58.00 | 42.00 | |

Equal Remuneration for Women and Men: Basic Salary Ratio by Employee Category

| Ratio for Basic Salary Women to Men |

|||

| As at December 31, | 2014 | 2013 | 2012 |

| Corporate Management | 1:0.84 | 1:0.87 | 1:0.97 |

| Executive Officers | 1:0.93 | 1:0.98 | 1:0.96 |

| Junior Executive Assistants and Allied Grades | 1:0.91 | 1:0.85 | 1:0.88 |

| Banking Trainees | 1:1.00 | 1:0.98 | 1:1.06 |

Staff Welfare

Because we consider Commercial Bank’s employees to be our most valuable asset, we are committed to maintaining and boosting staff morale – the springboard, in our view, of operational efficiency.

Commercial Bank Sports and Recreation Club

We believe that sports, recreation and physical fitness programmes help employees better meet the heavy demands of serving our customers well. Promoting sportsmanship and disciplined self-improvement also helps to build character. The Bank provides employees with encouragement and, in some cases, material assistance to participate in different sports. In the gym and on the playing field, they develop their personal strength, courage and dedication.

We also give an annual grant to the Commercial Bank Sports & Recreation Club and provide facilities for the Club’s activities. And we provide another grant for an annual get-together of employees’ children, usually held in December.

Employee and Labour Relationship Management

We strive always to cultivate a sense of belonging and shared purpose among the Bank’s employees, maintaining harmonious relations based on trust, common values and mutual understanding. We encourage open and frank dialogue throughout the organisation, garnering constructive suggestions that help to promote both individual and organisation-wide well-being. As our business grows, we will continue to provide the vital mechanisms, support and guidance that foster self-development, team building, grievance resolution and camaraderie among our dedicated people.

Employee Changes

Activities related to employees’ career advancement, transfers, termination, dismissal or retirement are enacted according to the policies and current requirements of the Bank. For example, it is our policy to identify suitable employees to fill any vacancies that arise, provided such vacancies can be filled directly.

Promotions

We are mindful of the need to keep employees at all levels of the organisation motivated, providing them with opportunities to progress in their careers and receive promotions. The potential for advancement depends on employees’ growth in their current roles and a demonstrated ability to perform their duties at a level commensurate with the grade they aspire to.

Promotions for the non-executive cadre, including junior executive assistant and allied grades, are made in accordance with procedures set out in the collective agreement. All vacancies in the first tier of executive grades are filled internally by way of promotions – following a written test and two interviews. Candidates reach the second executive tier by achieving consistently strong performance reports and successfully completing two interviews. Promotions to higher executive tiers are governed by a formal performance appraisal process extending over three years, during which time a candidate must demonstrate that he or she has developed the specialised knowledge and skills required for the position in question.

Transfers

Transfers provide employees with valuable exposure to the full spectrum of the Bank’s operations – and in some cases are used to limit the time spent in difficult postings. We do all that we can to reduce the inconvenience caused when employees must be transferred, because of business imperatives, to locations at a significant distance from their home stations.

Other than in some specialised positions, five years is the maximum length for a posting to a particular location. This helps to keep employees stimulated by new opportunities, free of the potential for complacency that can arise when a job becomes too familiar. As well, the Bank’s transfer policy ensures that employees receive horizon-broadening exposure to various aspects of banking, enabling them to explore their full potential.

Separation

The Bank executes any employment separations in full compliance with applicable labour laws. Considerations of race, gender, religion or the nature of the position do not play into such decisions.

Reasons for separation include:

- Resignation/Retirement

- Termination of contract

- Violation of contract

- Dismissal due to unsatisfactory performance or misconduct

- Redundancy

- Poor health/Death

Employee Turnover by Reason for Separation

| Sri Lanka | Bangladesh | |||||

| Male | Female | Total | Male | Female | Total | |

| Resignations | 106 | 35 | 141 | 8 | 3 | 11 |

| Retirements | 33 | 8 | 41 | 2 | 2 | |

| Deceased | 1 | 1 | 2 | – | – | – |

| Terminations | 5 | 1 | 6 | – | – | – |

| Premature Retirement on Medical Grounds | 3 | 1 | 4 | – | – | – |

| Total | 148 | 46 | 194 | 10 | 3 | 13 |

Total Number and Percentage of Employee Attrition by Age Group and Gender – Sri Lanka

| For the year ended December 31, | 2014 | 2013 | 2012 | |||||||||

| Employee Attrition | Rate of Attrition (%) | Employee Attrition | Rate of Attrition (%) | Employee Attrition | Rate of Attrition (%) | |||||||

| Category/Age Group | Male | Female | Male | Female | Male | Female | Male | Female | Male | Female | Male | Female |

| Corporate Management | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 51 - 60 Years | 4 | 1 | 19.05 | 50.00 | 3 | – | 13.64 | – | 3 | – | 13.64 | – |

| Executive Officers | ||||||||||||

| Below 30 Years | 1 | 3 | 0.07 | 0.67 | 5 | 1 | 0.38 | 0.23 | 4 | 5 | 0.31 | 1.14 |

| 30 - 50 Years | 5 | 8 | 0.36 | 1.77 | 20 | 4 | 1.53 | 0.90 | 16 | 5 | 1.25 | 1.14 |

| 51 - 60 Years | 24 | 4 | 1.74 | 0.89 | 21 | 5 | 1.61 | 1.13 | 17 | 3 | 1.33 | 0.69 |

| Junior Executive Assistant and Allied | ||||||||||||

| Below 30 Years | 38 | 5 | 2.37 | 0.87 | 34 | 9 | 2.07 | 1.87 | 19 | 9 | 1.33 | 1.86 |

| 30 - 50 Years | 9 | 5 | 0.56 | 0.87 | 5 | 3 | 0.31 | 0.62 | 2 | 5 | 0.14 | 1.03 |

| 51 - 60 Years | 5 | 5 | 0.31 | 0.87 | 4 | 4 | 0.24 | 0.83 | 1 | 3 | 0.07 | 0.62 |

| Banking Trainees | ||||||||||||

| Below 30 Years | 52 | 15 | 14.53 | 9.15 | 49 | 14 | 16.12 | 6.42 | 23 | 9 | 4.93 | 5.52 |

| 30 - 50 Years | – | – | – | – | – | – | – | – | 1 | – | 0.21 | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Office Assistants and Others | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | 1 | – | 0.90 | – |

| 51 - 60 Years | 10 | – | 11.11 | – | 8 | – | 8.00 | – | 9 | – | 8.11 | – |

| Total | 148 | 46 | 4.23 | 3.90 | 149 | 40 | 4.42 | 3.49 | 96 | 39 | 2.90 | 3.58 |

Total Number and Percentage of Employee Attrition by Age Group and Gender – Bangladesh

| For the year ended December 31, | 2014 | 2013 | 2012 | |||||||||

| Employee Attrition | Rate of Attrition (%) | Employee Attrition | Rate of Attrition (%) | Employee Attrition | Rate of Attrition (%) | |||||||

| Category/Age Group | Male | Female | Male | Female | Male | Female | Male | Female | Male | Female | Male | Female |

| Corporate Management | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Executive Officers | ||||||||||||

| Below 30 Years | – | – | – | – | 9 | 3 | 8.82 | 12.00 | – | – | – | – |

| 30 - 50 Years | 2 | – | 1.96 | – | 1 | 1 | 0.98 | 4.00 | 7 | 5 | 6.86 | 20.00 |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Junior Executive Assistant and Allied | ||||||||||||

| Below 30 Years | 8 | 3 | 13.33 | 16.67 | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | 3 | 1 | 5.36 | 5.26 |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Banking Trainees | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Office Assistants and Others | ||||||||||||

| Below 30 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 30 - 50 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| 51 - 60 Years | – | – | – | – | – | – | – | – | – | – | – | – |

| Total | 10 | 3 | 5.95 | 6.82 | 10 | 4 | 6.33 | 9.09 | 10 | 4 | 6.33 | 13.64 |

The age of retirement is 60 for staff who have joined the Bank since 2003. Those who were employed before this date were given the option to decide and fix the age of retirement to be either 55 or 60. A staff member may also retire within a five-year period before the official retirement age and still receive benefits, provided he or she has 10 years or more of service and has secured the agreement of management.

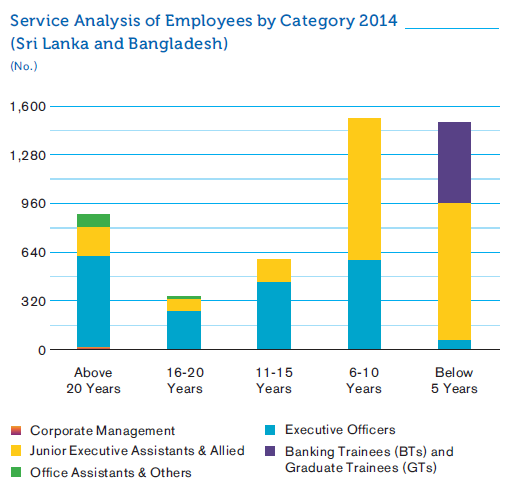

Service Analysis of Employees by Category 2014 (Sri Lanka and Bangladesh)

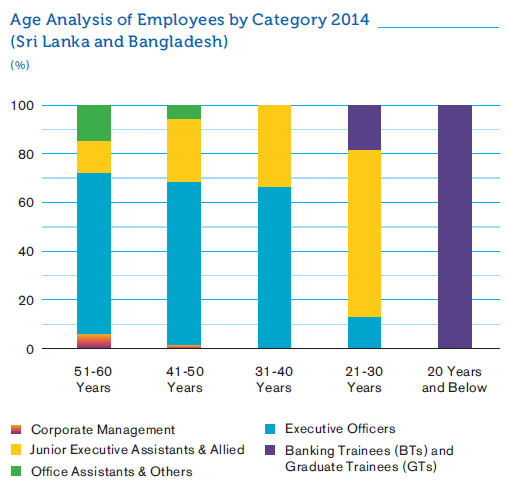

Age Analysis of Employees by Category 2014 (Sri Lanka and Bangladesh)

Minimum Notice Period for Operational Changes

| Type of Change | Minimum Notice Period |

| Collective Bargaining | 36 weeks |

| Transfers | 2 weeks |

| Terminations | 4 - 12 weeks |

| Retirements | 3 - 4 weeks |

| Dismissals | Immediate |

| Voluntarily Resignations Scheme | As specified in the scheme |

Industrial Relations

At Commercial Bank, we appreciate the important and constructive role that employee organisations and trade unions play in acting for the individual and collective good. We work with these bodies respectfully, recognising that by maintaining a meaningful dialogue on material issues, we further the achievement of our overall business goals. We do not engage in any measures that are detrimental to the interests and growth of the Bank, nor would we ever expect these organisations to do so. We take steps to ensure industrial harmony and encourage the resolution of disputes through a constructive process of negotiation, conciliation and consensus building.

More than 80% of our permanent workforce in Sri Lanka is represented by one of the two employee associations. Both the Bank and our employees have benefited from a history of consistent and cordial engagement leading to amicable solutions. Our workforce in Bangladesh does not have any employee associations.

| As at December 31, | 2014 | 2013 | 2012 | |||

| Name of Employee Association | No. | % | No. | % | No. | % |

| Ceylon Bank Employees’ Union | 3,260 | 70.21 | 3,102 | 69.04 | 2,928 | 63.62 |

| Commercial Bank Executive Association | 616 | 13.27 | 590 | 13.13 | 588 | 12.78 |

| Total | 3,876 | 83.48 | 3,692 | 82.17 | 3,516 | 76.40 |

Occupational Health and Safety

People are the focus of the Bank’s Human Capital Policy. We manage employees’ work-life balance issues responsibly, remaining sensitive to specific needs while making accurate assessments of individual capabilities, attitude and potential. We place a high value on the physical and mental health of our staff and are mindful of the stressful effects of a performance-driven culture. For this reason, effective counselling is provided for any employees who need it. Ensuring the well-being of our employees is our most important long term investment.

To maintain a healthy workforce, the Bank offers a comprehensive medical insurance scheme for all permanent employees covering both in-house treatment and reimbursement of outside medical costs. In addition to this insurance scheme, employees covered under the collective agreement who have reached the age of 40 are entitled to claim the expenses incurred during full medical check-ups, without being admitted to a hospital, subject to a maximum threshold.

The Bank’s front-line employees receive training on how to respond to emergencies such as robberies and other aggressive acts. In 2014, a Commercial Bank branch, operating 24x7, was robbed in the late hours of the day, and one staff member working at the counter received a stabbing injury. The employee’s life was spared because he followed proper procedure for such a rare and catastrophic event. Bank management acted immediately to provide medical treatment and paid leave until the employee had made a full recovery, as well as certain other steps to assist the employee and his family to recover from the trauma. In addition, the management decided to restrict the banking hours of the affected branch.

To reduce the likelihood of comparable traumatic situations, we had taken several steps across our branch network, including the deployment of trained security personnel at customer locations, installing alarm systems and CCTV cameras, and ensuring prompt support from specialised departments for branches in need of assistance. The Bank’s Integrated Risk Management Department reports such events to the Executive Integrated Risk Management Committee, along with actions taken to prevent such situations from recurring.

In 2014, the Bank established a procedure for working with law enforcement officials who periodically visit our branches and departments requesting information. If a staff member is asked to appear at the offices of a law enforcement authority to assist with an inquiry or investigation, or to record a statement, we will first determine that the request is relevant to his or her official duties at the Bank. We will further ensure that any such employee has sufficient guidance and necessary professional advice to fulfill the authorities’ request confidently and comfortably.

Employees can easily access the intranet site of the Bank’s Security Department, which clearly spells out procedures to be followed in case of an emergency. The department conducts periodic fire drills at our Head Office and Union Place locations to ensure that employees can respond appropriately in the event of a real threat. After each drill, an email is sent to all staff with feedback, including observed lapses and recommendations to remedy them. The Security Department has also identified dedicated teams within each business/service unit of the Bank to supplement its work, providing them with comprehensive training on how to respond to emergencies such as robberies, fires and earthquakes.

Handling of Grievances

The Bank has an open-door policy when it comes to addressing urgent workplace issues, initiating immediate discussions with the two employee associations. We encourage employees at all levels to bring forward any grievances, so together we can prevent small problems from becoming big issues or possibly formal disputes. If we are unable to reach an amicable resolution with the associations, they have the option of referring matters to the Commissioner of Labour.

Through the ‘Speak Out’ web portal maintained by the Bank’s Human Resources Department, employees can air any concerns regarding workplace conditions and labour practices. They can also bring any potential violation of human rights directly to the attention of the officer responsible for employee relations in the Human Resources Department. Representatives from the Department also make regular branch visits, inviting staff to address issues relating to their welfare. These visits help us to identify risks, uncover potential rights violations and address any other issues of concern.

There were no substantiated grievances lobbied by the employees during the reporting period.