Material Aspects and Boundaries

Our Approach to Defining Report Content and the Aspect Boundaries

We believe it is vital to align the Bank’s business strategy with the expectations of our stakeholders, given the strong connection between our sustainability commitment and our overall goals as an enterprise. The content of this Report therefore considers the full range of the Bank’s business activities, along with our economic, environmental and social impacts and also the views expressed by our stakeholders, as outlined in the section ‘Stakeholder Engagement Process’.

The methodology used to determine report content is based primarily on the strategic imperatives and the GRI G4 guidelines and follows a two-step process:

Step 1 – Identify Relevant Aspects and Their Boundaries

We have identified aspects with broad sustainability significancecollected via the stakeholder engagement process and established ‘boundaries’ to isolate those impacts that are most relevant to Commercial Bank and our stakeholders.

We evaluated aspects according to their impact on, and contribution to, areas of sustainability related to the Bank’s business strategy and operations. They were also assessed in the light of stakeholder expectations – again, as gathered through the engagement process.

Aspects were categorised according to three levels of significance: high, moderate and low. We applied the following criteria to measure impacts and boundaries:

- The level of influence that the Bank has over each aspect.

- The extent to which a resource is used in our operations.

- The degree of various stakeholders’ interactions and their levels of expectation.

- The Bank’s responsibility as a good corporate citizen.

- The impacts of the activities of our customers and suppliers.

- The value that the Bank can potentially deliver in relation to each aspect.

Step 2 – Establishing Material Aspects and Prioritisation

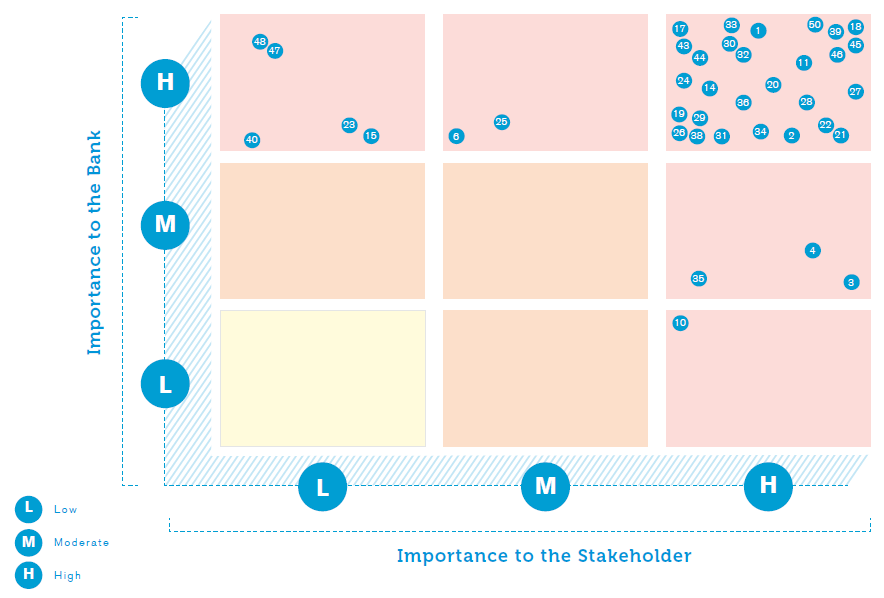

We evaluated and ranked ‘material aspects’ based on their importance to the Bank’s operations, as well as the expectations of our stakeholders and the applicability of relevant local and international laws, regulations and treaties. At the same time, for each material aspect, we identified a boundary encompassing its most significant impacts.

To establish an aspect’s ‘materiality’ or direct importance, we prioritised its relevance (again, with rankings of high, medium and low) from two perspectives:

- The importance of the aspect to our pursuit of the Bank’s strategic objectives (set out in the Corporate Plan) as we fulfill our responsibilities to the economy, the natural environment and society as a whole.

- The importance of the aspect to specific stakeholder groups, and the influence it could have on how they assess their relationship with the Bank.

The following table shows the levels of significance accorded to various aspects relative to the triple bottom lines of sustainability.

| Aspect Boundary | Materiality | ||||||||||

| Internal | External | ||||||||||

| Aspect | Significance to Bank’s Operations | Sri Lanka | Bangladesh | Customers | Communities | Suppliers | To the Bank | To the Stakeholder | |||

| Economic | |||||||||||

| 1. | Economic performance | High | High | High | |||||||

| 2. | Market presence | High | High | High | |||||||

| 3. | Indirect economic impact | Moderate | Moderate | High | |||||||

| 4. | Procurement practices | Moderate | Moderate | High | |||||||

| Environmental | |||||||||||

| 5. | Materials | Low | |||||||||

| 6. | Energy | Moderate | High | Moderate | |||||||

| 7. | Water | Low | |||||||||

| 8. | Biodiversity | Low | |||||||||

| 9. | Emissions | Low | |||||||||

| 10. | Effluents and waste | Moderate | Low | High | |||||||

| 11. | Products and services | Moderate | High | High | |||||||

| 12. | Compliance | Low | |||||||||

| 13. | Transport | Low | |||||||||

| 14. | Overall | Low | |||||||||

| 15. | Supplier environment assessment | Moderate | High | Low | |||||||

| 16. | Environment grievance mechanisms | Low | |||||||||

| Social: Labour Practices and Decent Work | |||||||||||

| 17. | Employment | High | High | High | |||||||

| 18. | Labour/management relations | High | High | High | |||||||

| 19. | Occupational health and safety | Moderate | High | High | |||||||

| 20. | Training and education | High | High | High | |||||||

| 21. | Diversity and equal opportunity | High | High | High | |||||||

| 22. | Equal remuneration for women and men | High | High | High | |||||||

| 23. | Supplier assessment for labour practices | High | High | Low | |||||||

| 24. | Labour practices grievance mechanisms | High | High | High | |||||||

| Social: Human Rights | |||||||||||

| 25. | Investment | Moderate | High | Moderate | |||||||

| 26. | Non-discrimination | High | High | High | |||||||

| 27. | Freedom of association and collective bargaining | High | High | High | |||||||

| 28. | Child labour | High | High | High | |||||||

| 29. | Forced or compulsory labour | High | High | High | |||||||

| 30. | Security practices | Moderate | High | High | |||||||

| 31. | Indigenous rights | Low | |||||||||

| 32. | Human rights assessment | High | High | High | |||||||

| 33. | Supplier human rights assessment | High | High | High | |||||||

| 34. | Human rights grievance mechanisms | High | High | High | |||||||

| Social: Society | |||||||||||

| 35. | Local communities | Moderate | Moderate | High | |||||||

| 36. | Anti-corruption | High | High | High | |||||||

| 37. | Public policy | Low | |||||||||

| 38. | Anti-competitive behaviour | Low | |||||||||

| 39. | Compliance | High | High | High | |||||||

| 40. | Supplier assessment for impacts on society | Moderate | High | Low | |||||||

| 41. | Grievance mechanisms for impacts on society | Low | |||||||||

| Social: Product Responsibility | |||||||||||

| 42. | Customer health and safety | Low | |||||||||

| 43. | Product and service labelling | High | High | High | |||||||

| 44. | Marketing communications | High | High | High | |||||||

| 45. | Customer privacy | High | High | High | |||||||

| 46. | Compliance | High | High | High | |||||||

| 47. | Product portfolio | High | High | Low | |||||||

| 48. | Audit | High | High | Low | |||||||

| 49. | Active ownership | Low | |||||||||

| Other Topics | |||||||||||

| 50. | Bank’s CSR activities | High | High | High | |||||||

There were neither material restatement of information provided in earlier reports nor any material change in the scope nor in the aspect boundaries of the report with regard to reporting on sustainability impacts of the Bank.